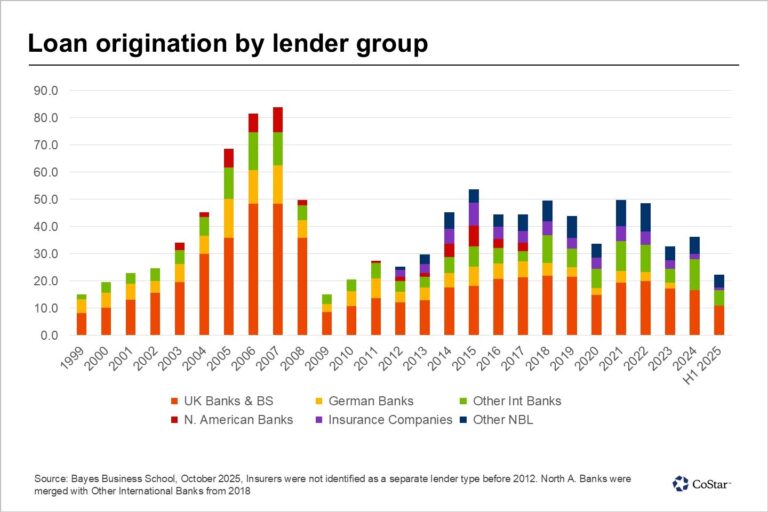

New lending for commercial real estate in the first half of 2025 was 33% up on the same period last year, according to the latest six-monthly report from Bayes Business School.

Total new lending reached £22.3 billion, while secondary loan market syndication surpassed £10 billion, almost matching the full-year total for 2024. The investment market is still lagging, with 74% of new lending recorded to refinancing. However, there is hope that the rest of the year will improve further, Bayes writes.

The report finds that banks have made significant progress in reducing their defaulted loan books, achieving a 10 to 20% decline through 70% of loan refinancing and increased loan syndication.

An active secondary market is a good sign of financial health and Bayes reports that the market is finally providing more pricing stability for the syndication market to grow. In total 23 lenders were active in syndication (18 in 2024) and 22 lenders (14 in 2024) recorded club deals and participations.

The report’s author Nicole Lux said in a statement: “Those steps renewed banks’ appetite for new lending, with loans now offered at highly competitive rates. Lender sentiment has turned increasingly bullish, with 39 lenders indicating a preference for issuing loans exceeding £100 million.”

There is particular enthusiasm for financing office and logistics assets, the report finds, followed by student housing and residential properties.

Prime office and industrial/logistics (88%) had the highest numbers of lenders willing to lend, despite the fact the lenders are very selective with office deals, and overall lending volumes to the sector are declining. A total of 60 lenders are offering finance for prime office deals, but this number drops to only 19 (28%) for secondary office properties, but 26 lenders would provide office development finance. Student housing and residential properties are ranking in fourth and fifth place in financing popularity.

Among secondary properties, logistic properties are most likely to be financed (54% of lenders), ranking in overall 10th place, followed by prime data centre and secondary residential. The final 12 ranks are all taken by secondary asset types, with secondary health care and secondary senior living schemes ranking last. When it comes to secondary assets or locations, financing options drop quickly to fewer than 20 lenders or 10 -15% of lenders.

Development financing is a key growth area, accounting for 22% of new lending and 19% of total outstanding commercial real estate debt. The report finds £31 billion in development loans are on lenders’ loan books – approaching the previous peak of £43 billion in 2007 – with an additional £24 billion in undrawn commitments.

Despite progress in managing non-performing loans, the overall default rate has risen to 6.3%, primarily driven by debt funds, which reported a significantly higher default rate of 20.3% (from 15.2% in December 2024). This sharp increase highlights…

Read More: Bayes: UK commercial real estate lending surges driven by banks and