- FedEx announced fourth quarter and full-year earnings with fourth quarter net income rising to US$1.65 billion, confirmed a flat to 2% revenue growth outlook for the upcoming quarter, provided updated guidance, and named a new Chairman following the founder’s passing.

- Ongoing fleet modernization and buyback activity highlight FedEx’s focus on strengthening capital allocation and network efficiency as it transitions leadership.

- We’ll examine how FedEx’s new earnings guidance and board changes may influence its long-term investment outlook and efficiency efforts.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

FedEx Investment Narrative Recap

To be a FedEx shareholder today, you need to believe in the company’s ability to deliver network efficiency gains and manage costs despite a muted revenue outlook and ongoing market headwinds. The recent earnings announcement demonstrates steady profitability amid leadership transition, but near-term catalysts like network optimization and buyback activity remain far more significant to the stock’s direction than the reported aircraft impairments and board changes, which are not materially altering FedEx’s risk-reward profile right now.

Among the recent developments, the Q1 2026 earnings guidance stands out: FedEx forecasts flat to 2% revenue growth and EPS of US$2.90 to US$3.50, or up to US$4.00 when excluding optimization and spin-off costs. This aligns closely with expectations around ongoing structural initiatives, which remain a key factor as investors consider the company’s ability to drive margin improvement against economic and contract risks.

Yet, while new cost savings initiatives hold promise, investors should be aware that growing execution risks around the planned FedEx Freight spin-off could…

Read the full narrative on FedEx (it’s free!)

FedEx’s narrative projects $96.5 billion in revenue and $5.9 billion in earnings by 2028. This requires a 3.2% yearly revenue growth and a 51.3% increase in earnings from $3.9 billion.

Uncover how FedEx’s forecasts yield a $277.75 fair value, a 21% upside to its current price.

Exploring Other Perspectives

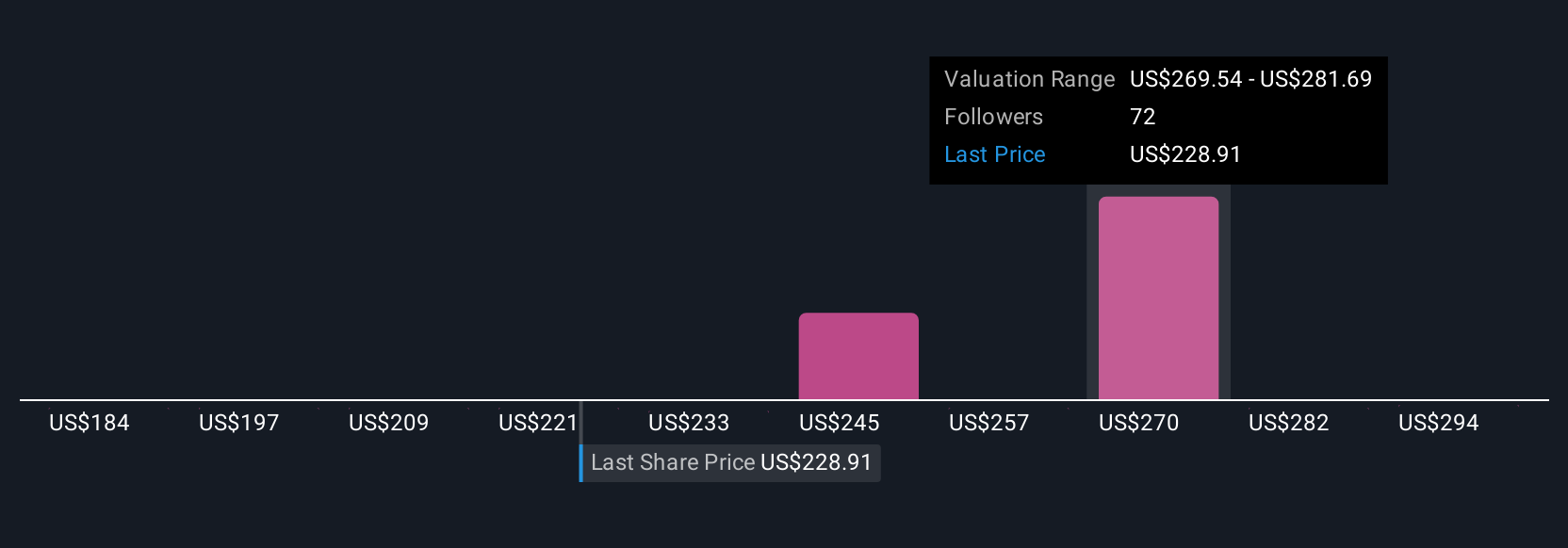

The Simply Wall St Community includes 11 unique fair value estimates for FedEx, ranging from US$184.46 to US$306 per share. With execution risks tied to segment restructuring, your outlook on profitability may look very different from others, explore all the available viewpoints.

Build Your Own FedEx Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your FedEx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FedEx research…

Read More: What FedEx’s (FDX) Earnings, New Chair And Guidance Update Mean for