Geojit Financial Services Limited’s (NSE:GEOJITFSL) investors are due to receive a payment of ₹1.50 per share on 24th of August. This makes the dividend yield 1.7%, which will augment investor returns quite nicely.

Our free stock report includes 2 warning signs investors should be aware of before investing in Geojit Financial Services. Read for free now.

Geojit Financial Services’ Payment Could Potentially Have Solid Earnings Coverage

Impressive dividend yields are good, but this doesn’t matter much if the payments can’t be sustained. However, prior to this announcement, Geojit Financial Services’ dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share could rise by 24.9% over the next year if the trend from the last few years continues. Assuming the dividend continues along recent trends, we think the payout ratio could be 21% by next year, which is in a pretty sustainable range.

See our latest analysis for Geojit Financial Services

Dividend Volatility

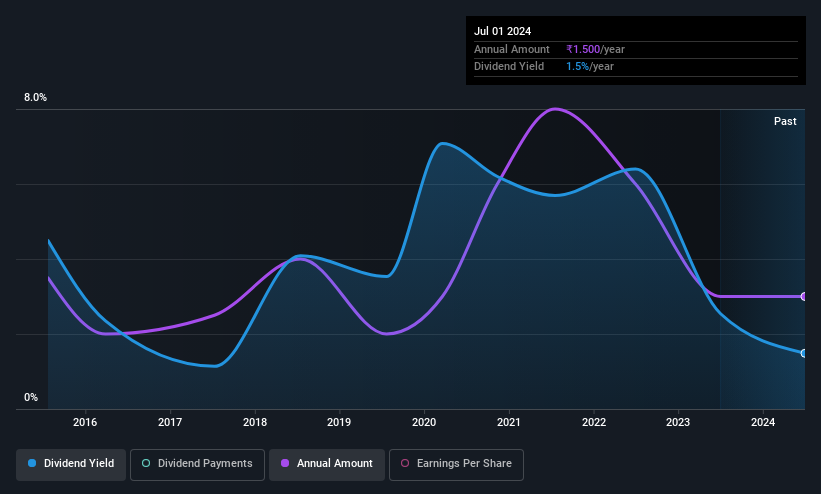

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was ₹0.10 in 2015, and the most recent fiscal year payment was ₹1.50. This works out to be a compound annual growth rate (CAGR) of approximately 31% a year over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It’s encouraging to see that Geojit Financial Services has been growing its earnings per share at 25% a year over the past five years. Earnings per share is growing at a solid clip, and the payout ratio is low which we think is an ideal combination in a dividend stock as the company can quite easily raise the dividend in the future.

An additional note is that the company has been raising capital by issuing stock equal to 17% of shares outstanding in the last 12 months. Regularly doing this can be detrimental – it’s hard to grow dividends per share when new shares are regularly being created.

We Really Like Geojit Financial Services’ Dividend

In summary, it is good to see that the dividend is staying consistent, and we don’t think there is any reason to suspect this might change over the medium term. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

It’s important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an…

Read More: Geojit Financial Services (NSE:GEOJITFSL) Is Due To Pay A Dividend Of ₹1.50