The Commercial Real Estate Momentum Index (CREMI) provides easy access to various metrics for individual markets by sector and facilitates comparisons of conditions across markets. The index tracks movements in specific metrics (such as occupancy/vacancy rate, rent growth, and the construction pipeline) and provides a targeted view of real estate conditions in the industrial, multifamily, office, and retail sectors. Additional metrics, including employment and population growth, provide information specific to each sector as appropriate. CREMI derives a momentum index value for each sector within a market and gives an overall momentum index value for the entire market. Upward and downward momentum correspond with aggregated trends in the market metrics, not necessarily indicating “good” or “bad.”

What’s New with CREMI?

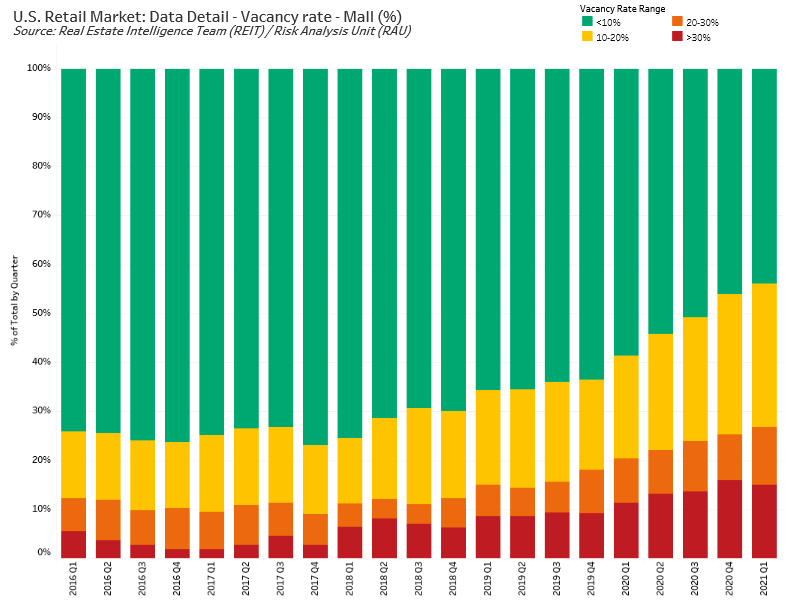

Be sure to explore the tool’s newest feature under the Retail Analysis tab. This graph shows how markets’ retail vacancy rates change over time relative to predefined vacancy rate ranges. Read on to see how this information was used to assess the health of the retail mall segment.

Every month we explore another aspect of the information the Commercial Real Estate Momentum Index (CREMI) provides and what it can tell us about commercial real estate conditions. This month, we’ll focus on mall space in the retail sector. Variables that go into the retail momentum index include vacancy rates, vacancy trends, rent growth, construction forecasts, and retail sales growth. To gauge e-commerce activity, it also provides information on nonretail and retail sales. Our look at conditions in the mall space will focus on vacancy rates, including the effect of the COVID-19 pandemic, and we provide a note about prospects for repurposing retail mall space.

Retail vacancies trending upward

The national retail (all retail) vacancy rate has drifted upward since late 2018 (see the chart). By the first quarter of 2021, the all retail vacancy rate stood at 5.1 percent. However, recent trends by property subtype vary widely, ranging from a low of 3.2 percent (general retail) to a high of 7.9 percent (neighborhood centers).

Mall vacancy rates rising faster than other subgroups

Mall vacancies began rising in mid-2017, before overall retail sector rates increased (see the chart). In the 15 quarters since the 2017 low point of 3.7 percent, mall vacancy rates have almost doubled and are estimated to be 6.9 percent as of the first quarter of 2021, according to Costar. This subgroup has experienced significant stress from the development of e-commerce and changes in consumer shopping preferences and has seen the sharpest increase in vacancies during the COVID-19 pandemic.

Of the…

Read More: Commercial Real Estate Update: Mall Vacancy Rates Keep Climbing