The Commercial Real Estate Momentum Index (CREMI) provides easy access to various metrics for individual markets by sector and facilitates comparisons of conditions across markets. The index tracks movements in specific metrics (such as occupancy/vacancy rate, rent growth, and the construction pipeline) and provides a targeted view of real estate conditions in the industrial, multifamily, office, and retail sectors. Additional metrics, including employment and population growth, provide information specific to each sector as appropriate. CREMI derives a momentum index value for each sector within a market and gives an overall momentum index value for the entire market. Upward and downward momentum correspond with aggregated trends in the market metrics, not necessarily indicating “good” or “bad.”

August 2021 Spotlight: Retail’s Promise and Challenges

Every month, we explore a different aspect of the Commercial Real Estate Momentum Index (CREMI) and how it can inform us about the commercial landscape. This month, we’ll focus on retail indicators and how the sector has evolved during the pandemic. There are many, many variables that affect the retail momentum index. A few of the more notable ones these days include excess retail space, labor shortages, and e-commerce trends.

National retail sector overview

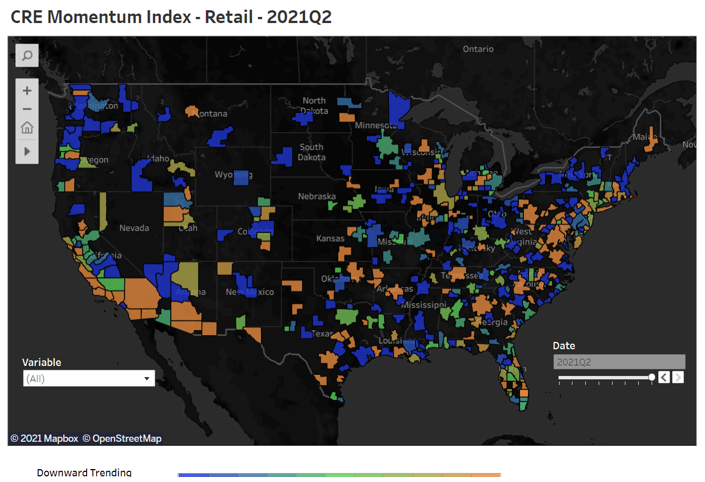

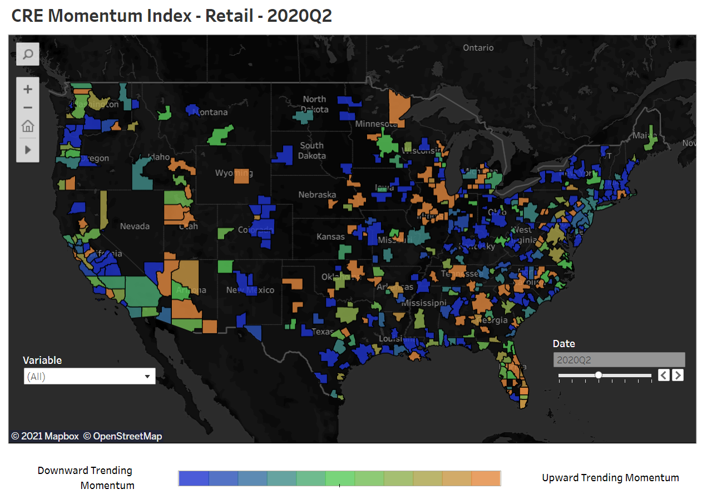

The US retail sector continues to experience mixed results because of a myriad of elements including shifting population trends, too much space, changing consumer buying habits, and evolving technology. The national CREMI results for retail indicate minimal change in activity as a whole between July 2020 and July 2021. This can be seen by comparing the US map graphics (see below) for these periods.

While the overall national results are generally unchanged, effects at the local level are much more pronounced. In some markets, such as those in the Southeast, mid-Atlantic, and southern West Coast, accelerating momentum indicates a resurgence in activity. On the other hand, areas like the Northwest, Texas Gulf Coast, upstate New York, and the Midwest remain muted. In the Northwest and Midwest, activity has declined from a year ago. Individually, markets such as Atlanta; Charlotte, North Carolina; Nashville, Tennessee; Pittsburgh; and San Antonio continue to show upward momentum. Austin, Texas; Houston; Las Vegas; Memphis, Tennessee; and Seattle are experiencing slowing activity. By contrast, the CREMI for retail shows a rebound in markets that were most depressed by COVID-19 restrictions, such as Chicago, New York, Los Angeles, Dallas/Fort Worth, and Washington, DC.

Retirees often move from higher-cost markets to lower-cost areas with moderate weather. As technology enables workers and businesses to be more mobile, reducing the friction…

Read More: Commercial Real Estate Update: Pandemic’s Impact on Each Sector