filo

Alexandria Real Estate Equities, Inc. (NYSE:ARE) is a well-managed real estate investment trust with an operational focus on life science real estate.

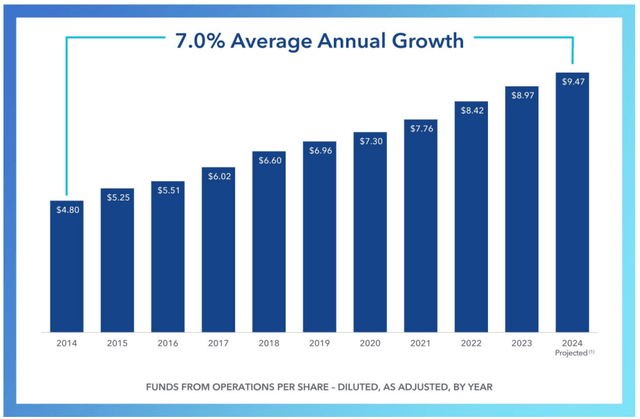

The trust has enjoyed consistent funds from operations growth in its main business over the years and has strong portfolio metrics to back up a favorable outlook for passive income investors.

Alexandria Real Estate Equities pays out just a tad more than 50% of its funds from operations, and the stock is moderately valued.

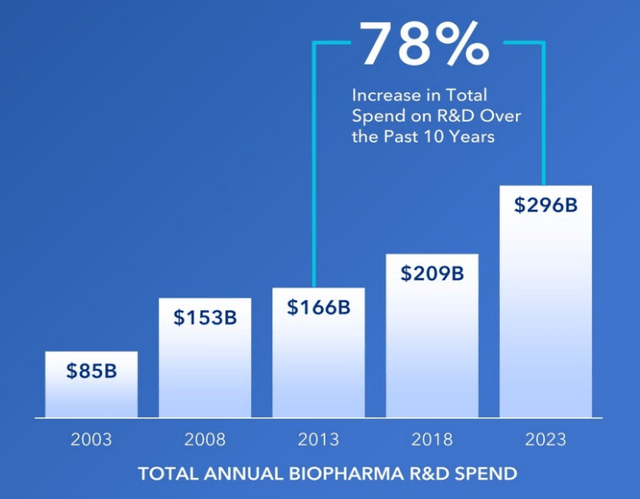

Since the life science trusts also profit from long-term, secular R&D spending tailwinds in the pharmaceutical industry, I think investors will continue to see Alexandria Real Estate Equities’ dividend grow moving forward.

My Rating History

My first coverage of Alexandria Real Estate Equities in June 2023, leading to a Buy stock classification, was that the real estate investment trust was unfairly lumped into a group of office REITs.

Since investors were very much concerned with the office market at the time, and to some extent still are today, the life science REIT made a compelling value proposition at the time.

The trust continues to earn a steady amount of funds from operations and is growing its FFO as well as dividend. The trust just last month raised its dividend again by 2.3% and the portfolio is well occupied.

Stable Portfolio, Consistent FFO Growth

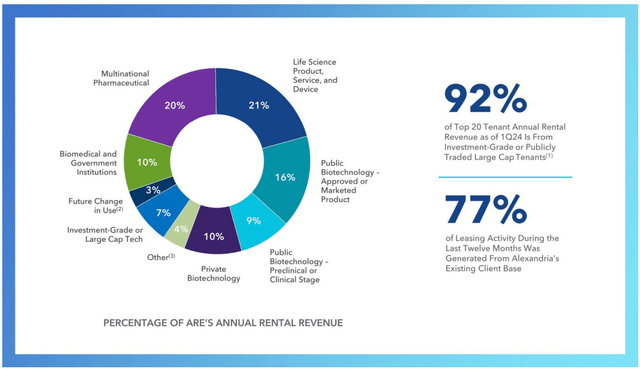

Alexandria Real Estate Equities is a real estate investment trust that leases its real estate predominantly to life science and biotechnology companies, many of which are large multinational companies.

The trust owned a real estate portfolio worth $37.5 billion and leased its properties primarily to investment-grade or large cap tenants such as Amgen, Merck, Roche, or Pfizer in the pharmaceutical industry.

Percentage Of Annual Rental Revenue (Alexandria Real Estate Equities, Inc)

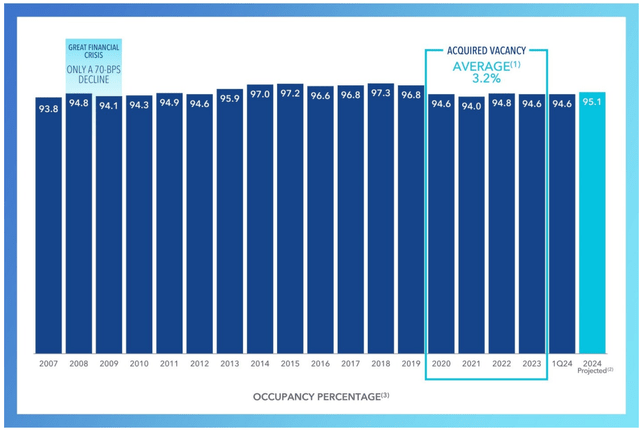

Alexandria Real Estate Equities’ portfolio is well-leased and had an occupancy of 95.1% in 1Q24, which reflected the highest occupancy percentage since 2019.

Occupancy Rates (Alexandria Real Estate Equities, Inc)

Given its portfolio of high-quality tenants, Alexandria Real Estate Equities has been able to consistently collect all of its owed rents (rent collection of 99.9% in 1Q24) and grow its funds from operations. The trust produced 7% FFO growth per annum since 2014 and the forecast is bullish also.

Funds From Operations Growth (Alexandria Real Estate Equities, Inc)

Support for Alexandria Real Estate Equities’ funds from operations growth comes from tailwinds in the pharmaceutical business, particularly R&D spending. Large pharmaceutical companies, such as Merck, Moderna or GSK, invest billions of dollars annually in order to develop new medicines.

With pharmaceutical companies spending big on R&D, Alexandria Real Estate Equities is well-positioned with its lab-focused real estate portfolio to take its share of the pie.

Total Annual Biopharma R&D Spend (Alexandria Real Estate Equities, Inc)

Dividend Coverage And Growth…

Read More: Alexandria Real Estate: Undervalued Passive Income Gem With A 4.2% Yield