November 10, 2020

Given the importance of commercial real estate (CRE) to the U.S. economy, monitoring changes in local and national

trends is essential. To accomplish that, the Atlanta Fed developed a newly released Commercial Real Estate Momentum Index to compile individual market

dynamics to help users better understand momentum in CRE markets across the country. As one of the most

comprehensive quantitative market analyses publicly available, the tool provides one-of-a-kind information. Users of

the CRE Momentum Index can access market-level details for the four major commercial real estate property sectors:

retail, office, industrial, and multifamily.

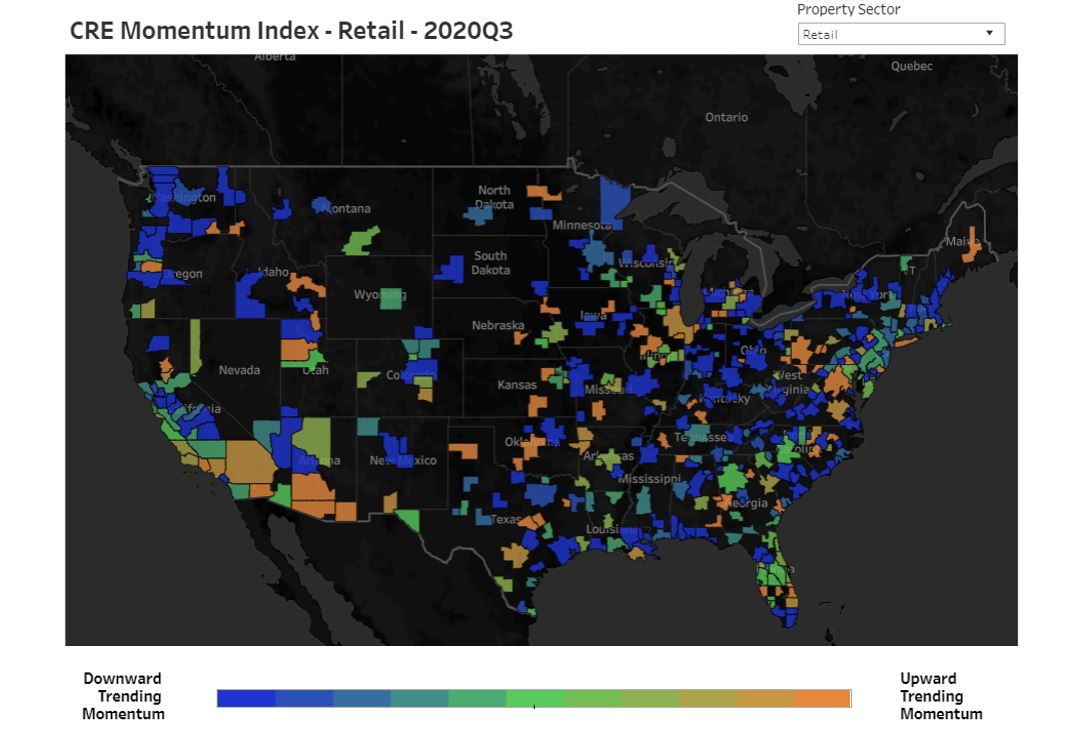

Retail

Most of the early projections for 2020 have undoubtedly not come to fruition. At the end of the first quarter, the

retail sector was already showing signs of downward momentum as local metrics such as vacancy rates and retail sales

growth were well below historical averages. Then, the onset of the COVID-19 pandemic brought business closures and

increased safety precautions, which dramatically affected the retail sector.

As of the end of the second quarter, the majority of markets tracked in the CRE Momentum Index showed increased

downward momentum (see the map). A subset of markets—including Phoenix, Chicago, and Atlanta—had upward

momentum at the beginning of 2020 that expanded further in the second quarter. Phoenix, Chicago, and Atlanta

reflected similar market trends during this time, particularly rising mall vacancies coupled with stronger rent

growth than historically experienced. Exploration of the individual variables that, combined, determine the retail

sector indices show that the upward trending momentum signals areas of weakness within the markets.

The Small Business Administration’s (SBA) Paycheck Protection Program (PPP) has been a significant source of relief for small businesses after the original shocks of

COVID-19. In total, more than 5.2 million loans were made with more than $525 billion in approvals. A significant

portion of these dollars went to businesses operating in retail spaces, such as small shops and restaurants. Lender

participation in the PPP was just shy of 5,500 institutions. While the loans are to be repaid to the government,

there is the potential risk of the SBA rejecting foregiveness claims on loans made, which may pose a significant

challenge for businesses as the effects of COVID-19 continue to unfold.

Moving into the third quarter, downward momentum continued broadly across the country, including within the subset of

markets that had experienced some upward movement between the first two quarters of the year. This downward momentum

was mainly the result of slowing…

Read More: CRE Momentum Index Launches with a Look at the First Three Quarters of 2020