January 15, 2021

National affordability

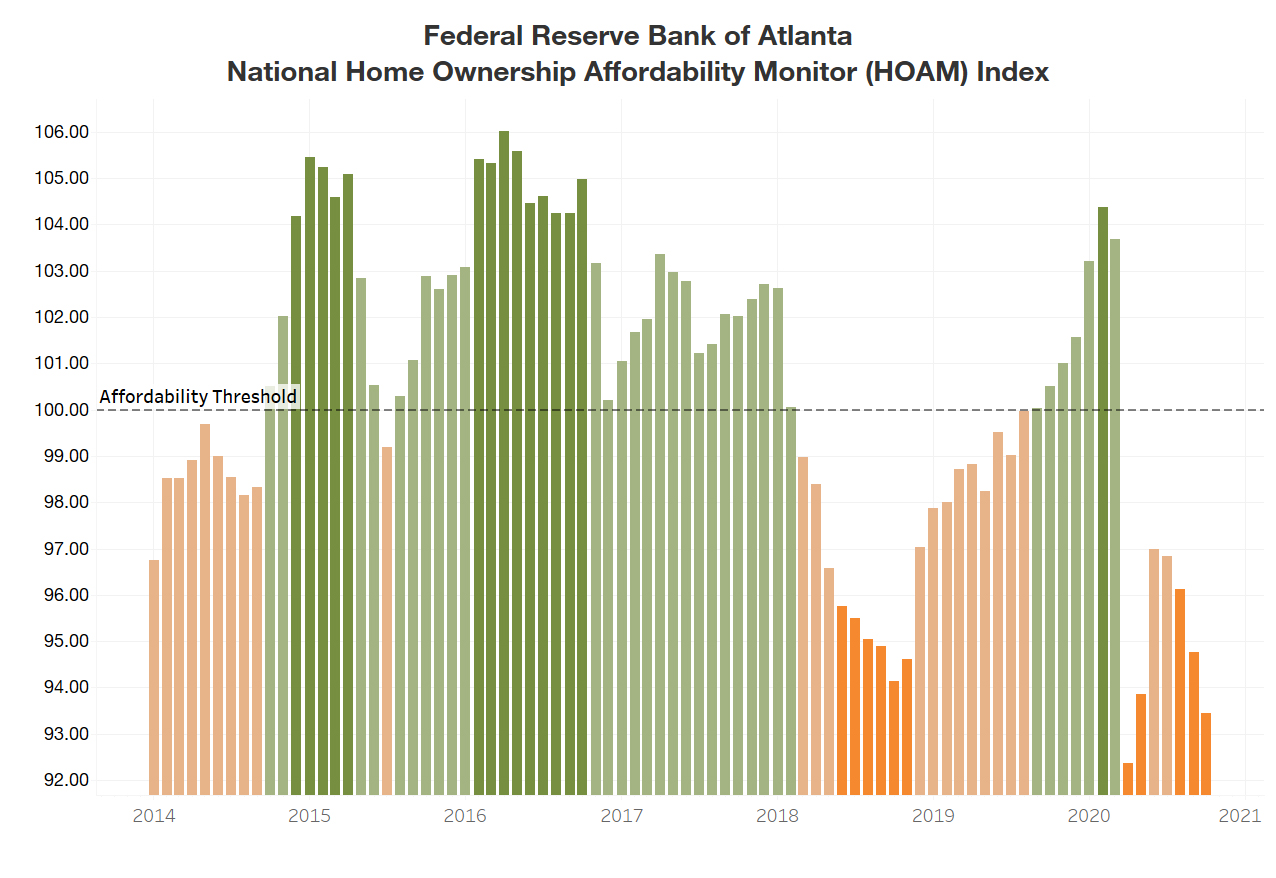

Higher prices continued to make owning a home less affordable in the United States during October 2020, according to

the Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor (HOAM) index. Despite historically low interest

rates, a spike in house prices as well as the strain on household incomes created by the COVID-19 recession

continued to box the average income household out of owning a home.

A HOAM index below 100 indicates that the median-priced home is unaffordable to the median-income household given the

current interest rate. In October, the HOAM index dropped to 93.4 from a revised 94.8 in September, indicating that

the median-priced home remained too expensive for the median-income household. The HOAM index was also below its

100.52 reading a year earlier. Home ownership costs in October (as measured by principal and interest, taxes, and

insurance) accounted for 32.1 percent of the annual median income of U.S. households, which is above the 30 percent

affordability threshold set by the U.S. Department of Housing and Urban Development. October marked the seventh

month in a row that the national HOAM index was below 100.

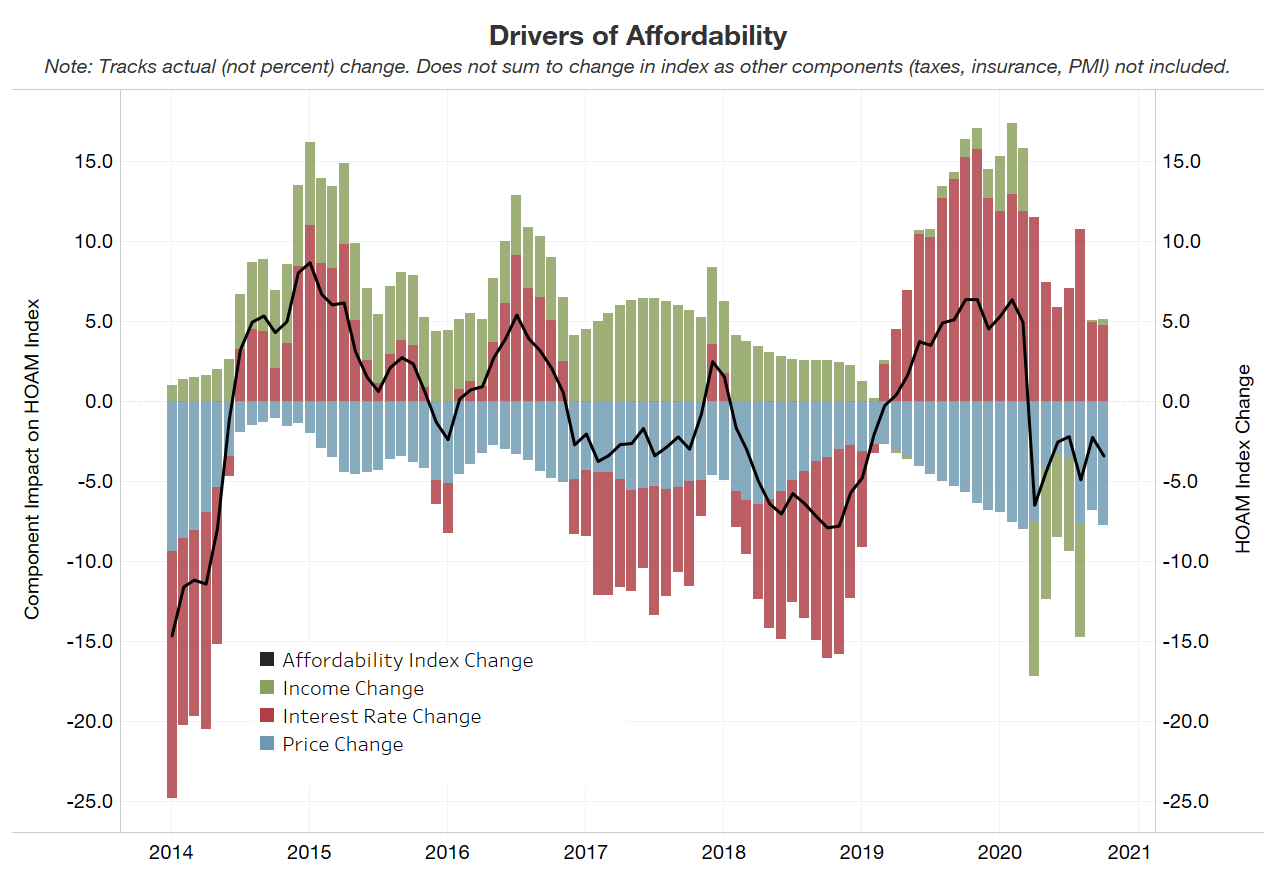

Declining interest rates remain a positive for home ownership affordability. The 30-year fixed mortgage interest rate

ended the month of October at 2.8 percent, a drop of six basis points (bp) from September and an 86 bp decline from

October 2019. However, the strain on household incomes and steadily rising prices have been more than enough to

offset any positive effects on home ownership affordability from lower rates. With the COVID-19 pandemic still

weighing on the economy, the estimated median household income in the United States in October ($59,532) was down

5.4 percent from a year earlier. Meanwhile, the national median existing home price (three-month moving average)

rose to $300,002 in October, up 2.6 percent to from a revised $292,502 for September. However, compared with a year

ago, home prices were up a sharp 12.2 percent in October. Prolonged inventory shortages in many markets are exerting

steady upward pressure on home prices, which continue to reach record levels.

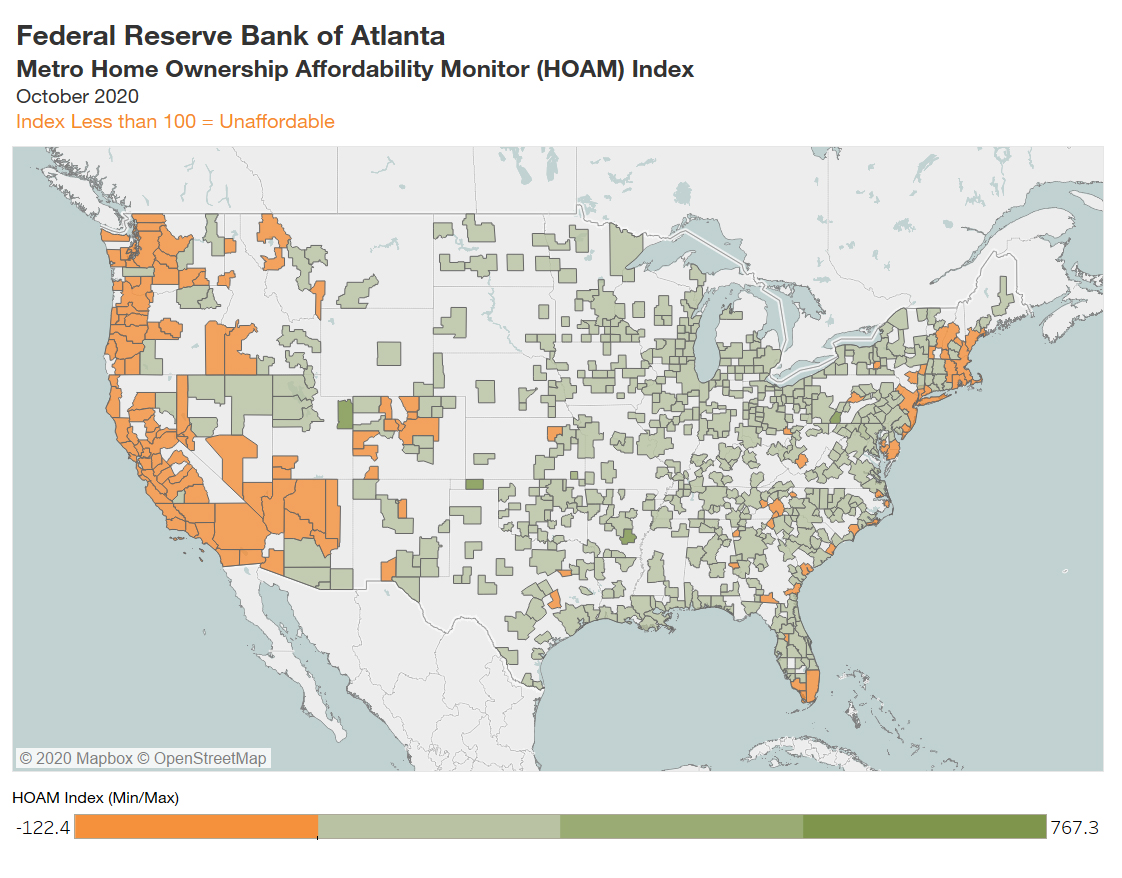

Regional affordability

Just over 22 percent of metro areas in the United States had a HOAM index below 100 in October, indicating that they

were unaffordable to median-income households. By contrast, 78 percent had an index above 100 and were considered

affordable. Even so, 57 percent of metro areas experienced a decline in affordability from September to…

Read More: Home Ownership Affordability Monitor Update