August 03, 2021

Key points

- Home ownership affordability declined for the fifth consecutive month as home prices reached a new record.

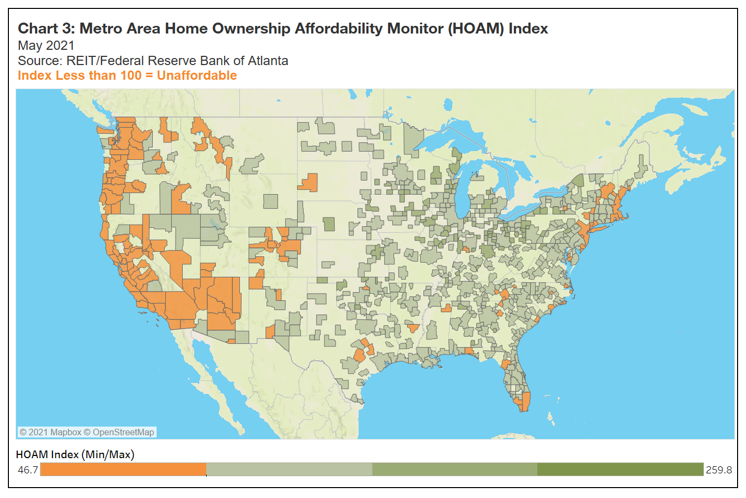

- Among all U.S. metros, 23 percent were unaffordable based on the Atlanta Fed’s HOAM index, up from 16 percent a year ago.

- Markets that tend to attract new residents from higher-cost regions continued to post the sharpest year-over-year declines in affordability.

- Eroding affordability is starting to slow home sales in many markets.

National affordability

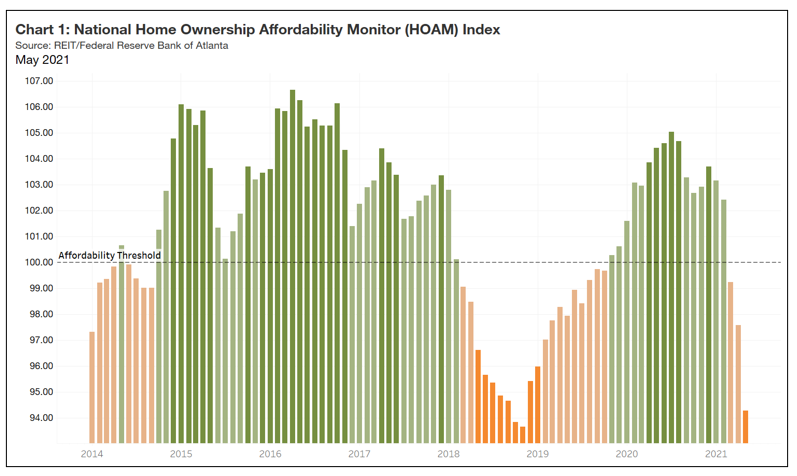

Despite historically low interest rates, home ownership affordability continued to erode nationally as well as in most metro areas in May. The Federal Reserve Bank of Atlanta’s national Home Ownership Affordability Monitor (HOAM) index fell from 97.58 in April 2021 to 94.29 in May (see chart 1). An index reading below 100 is an indication that the cost of owning an area’s median-priced home is no longer affordable to households earning the median income. As of May, median home prices peaked at $330,500 on a three-month moving average, a record 21.6 percent increase from a year earlier. At the same time, the median income was estimated to be around $66,740. With home prices reaching record levels, the median-income household would pay about 32 percent of its income to own the average-priced home, a level that exceeds the 30 percent affordability threshold set by the U.S. Department of Housing and Urban Development.

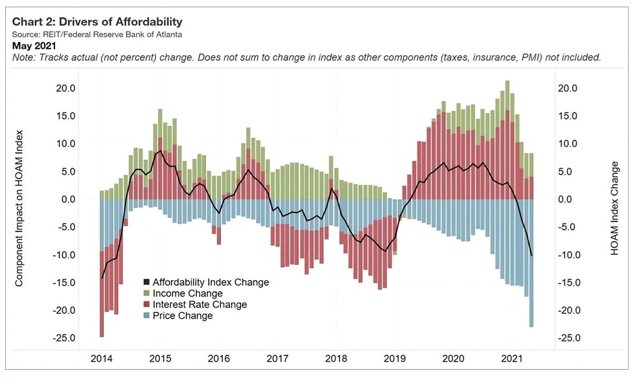

Year over year, affordability dropped by 10.13 percent, marking the sharpest fall since 2018 (see chart 2). Unlike previous declines, which primarily followed spikes in interest rates, sharply rising home prices have mainly driven recent deteriorating affordability. Interest rates have fallen 30 basis points from May 2020 and remain near historic lows. The HOAM index indicates that the increase in home prices outweighed the gains in affordability offered by lower interest rates.

Regional affordability

Nine of the 10 least affordable metropolitan areas in May were in California, with the New York-Newark-Jersey City area ranking sixth (see the table). With home prices at record levels in these markets, many current homeowners have decided to sell and move to lower-cost areas. At the same time, a majority of the 10 most affordable metros were clustered in Ohio and Pennsylvania (see chart 3). Other affordable areas included Des Moines-West Des Moines, Iowa; St. Louis, Missouri-Illinois; Little Rock-North Little Rock-Conway, Arkansas; and Syracuse, New York. Although prices may have increased in these markets, home prices remained moderately affordable to households earning the median income.

In the region supervised by the Atlanta Fed, which includes Florida, Georgia,…

Read More: HOAM Update: Affordability Falls in Most Metro Areas