September 09, 2021

Key points

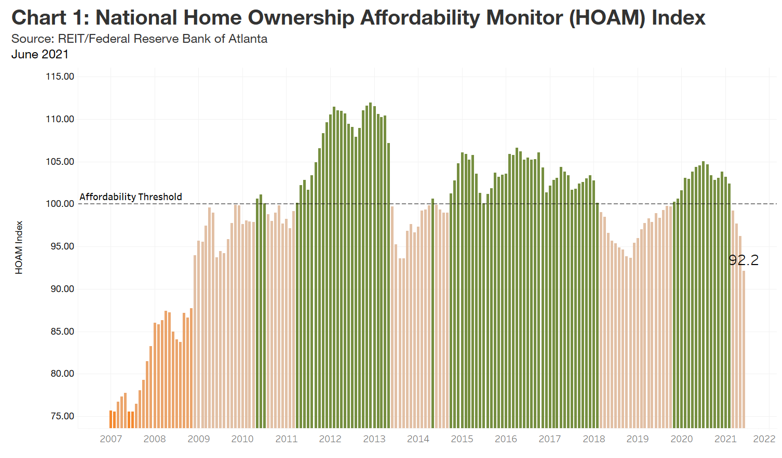

- The national HOAM index stood at 92.2 in June, its lowest level since 2008.

- National housing affordability fell 11.9 percent in June, the sharpest drop since 2014.

- Home sale prices were up 23.8 percent over the past year.

- On average, a median-income household would need to spend 32.6 percent of its annual earnings to own a median-priced home.

- Although demand for housing remains strong, steadily declining affordability is beginning to affect buying decisions.

The latest reading of an Atlanta Fed measure and US housing trends show home ownership is becoming out of reach for many buyers and resistance to higher prices is building. More than 80 percent of US metro areas had a drop in affordability.

National affordability

With a 92.2 rating in June, the Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor (HOAM) index fell to its lowest level since 2008 (see chart). The index fell below 100 in March and has remained there. A reading below 100 indicates that a median-income household can no longer afford to own a median-priced home on the market. Over the past year, the index shows that US home ownership affordability dropped by 11.9 percent as prices soared. In June, median existing home sale prices rose above a record $340,000 (three-month moving average), according to data provider CoreLogic. This valuation represents a 23.8 percent increase over the past 12 months, one of the highest year-over-year price gains on record. Even with relatively low 30-year fixed interest rates (2.87 percent in August), a median-income household would spend 32.6 percent of its annual income to own a median-priced home, which is above the 30 percent affordability threshold set by the US Department of Housing and Urban Development.

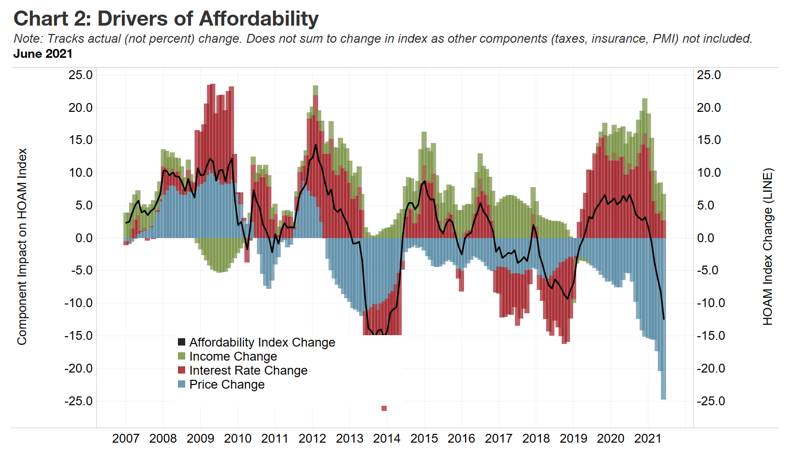

Following the onset of the pandemic in March and April 2020, declining mortgage interest rates became the primary catalyst for a surge in housing demand. Although home sale prices began to rise during the pandemic, lower rates were more than enough to offset the higher cost burden for consumers. In addition, greater income growth as the US economy emerged from COVID-19-related shutdowns helped maintain affordability as prices rose. However, this trend began to shift in 2021, when sale prices reached peak levels and low interest rates and higher incomes could no longer offset the increased cost (see chart). As a result, home ownership affordability began to weaken significantly.

Regional affordability

Markets in Ohio and Pennsylvania dominated the ten most affordable metro areas. To a large degree, they have seen relatively modest growth in home sale prices. For example, in the Youngstown-Warren-Boardman…

Read More: HOAM Update: Median-Income Buyers Priced Out