The rapid increase in profits of securities firms is attributed to the fact that securities firms are far ahead of banks in asset management capabilities, and the recent “Money Move” caused by the revitalization of the stock market has driven securities firms into a stampede. In fact, due to the combination of the actual transfer of retirement pensions conducted last year and the competitiveness of securities companies’ investment products, there is also a phenomenon in which the ranking of reserves in the retirement pension market is reversed. In particular, the comprehensive investment account (IMA), introduced to foster super-large investment banks (IBs), is expected to be a catalyst for accelerating the movement of funds from the banking industry to the securities industry in the future.

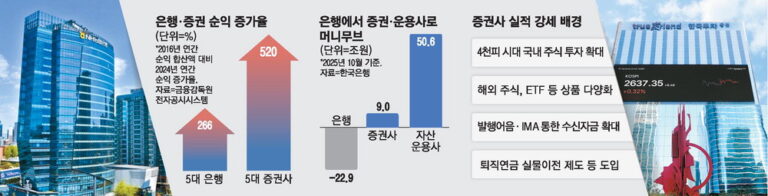

According to the Financial Services Commission, the Bank of Korea, and the Financial Investment Association on the 20th, the pace of money movements from the banking sector to the capital market is accelerating. In October, bank receivables fell 22.9 trillion won from the previous month, while asset management firms’ receipts increased 50.6 trillion won. Investor deposits at securities firms, which are the stock market’s standby funds, also increased by KRW 9 trillion.

Analysts say that funds are flocking to securities firms because investment fever has risen around certain themes such as artificial intelligence (AI) this year, and policy efforts to improve shareholder rights, such as expanding dividends, have been combined. “The belief that policies such as the revision of the commercial law will continue to stimulate the stock market is leading the inflow of funds into the capital market,” said Ahn Dong-hyun, a professor at Seoul National University. Due to the activation of actual transactions, Kiwoom Securities saw its stock commission income rise 45.6% year-on-year to KRW 185.2 billion in the third quarter of this year.

Securities firms’ asset management capabilities are also cited as the cause of improved performance and money movement. Securities companies are considered to have an advantage over banks in the defined contribution (DC) retirement pension and personal retirement pension (IRP) market, where various product lineups and returns are important. According to the Financial Supervisory Service’s integrated pension portal, the total retirement pension reserves in the securities sector increased by 7.129 trillion won in the third quarter, while the banking sector increased by only 5.6884 trillion won. Korea Investment & Securities entered the list of the top 10 businesses in IRP reserves at the end of June, followed by Mirae Asset Securities and Samsung Securities, and NH Investment & Securities was listed at the end of September. As baby boomers, the richest generation, enter retirement period, competition for retirement asset management is expected to affect changes in the…

Read More: The rapid increase in profits of securities firms is attributed to the fact