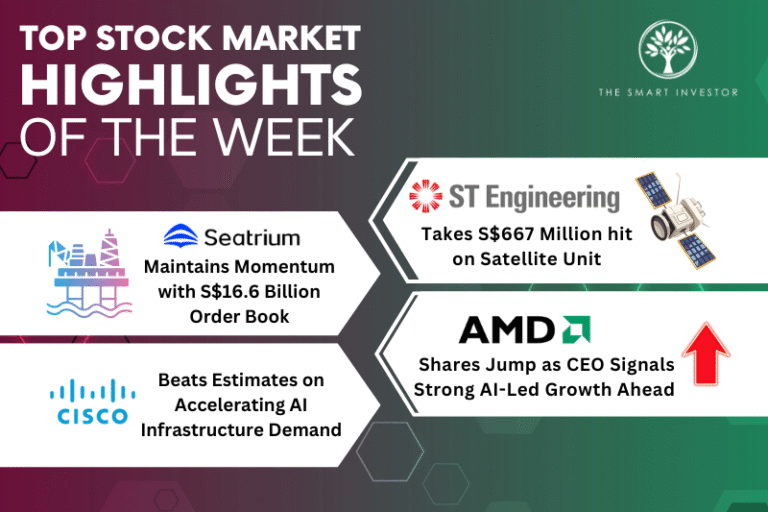

This week saw contrasting fortunes as Singapore’s engineering giants faced different trajectories, while US tech stocks surged on renewed confidence in artificial intelligence infrastructure spending.

From significant writedowns to record order books and AI-driven revenue growth, these developments underscore the rapidly evolving landscape across both traditional engineering and cutting-edge technology sectors.

Welcome to this week’s edition of top stock market highlights.

Singapore Technologies Engineering (SGX: S63) announced a significant S$667 million non-cash impairment on its iDirect satellite communications subsidiary on 12 November 2025, reducing the unit’s carrying value to just S$170 million from S$837 million.

The massive writedown reflects the rapidly evolving satellite industry, where Non-geostationary Satellite Orbit (NGSO) operators like Starlink and Kuiper are disrupting traditional players.

These newcomers have deployed over 2,600 and 150 satellites respectively, introducing proprietary ground systems that reduce reliance on third-party equipment providers like iDirect.

Revenue for the unit declined 9% year on year in the first nine months of 2025, while EBITDA fell 22%.

Despite the impairment, partially offset by S$258 million in divestment gains from CityCab, LeeBoy and SPTel, ST Engineering expects to remain profitable for fiscal 2025 and plans to pay a total dividend of S$0.23 per share for the year.

Offshore and marine engineering giant Seatrium (SGX: 5E2) maintained strong momentum with its net order book standing at S$16.6 billion in the third quarter of 2025.

The company continues to eye more new order wins after securing significant contracts throughout the year, including floating production units for major oil companies.

Management remains optimistic about converting its robust pipeline of opportunities, particularly in the oil and gas sector where customer final investment decisions are progressing despite some delays from geopolitical uncertainties.

The order book provides revenue visibility through 2031, spanning 25 projects with approximately 34% anchored in renewables and cleaner energy solutions.

Seatrium’s diversified portfolio across traditional offshore projects and green energy initiatives positions it well for sustained growth, with analysts maintaining buy ratings and target prices ranging from S$2.76 to S$3.05 per share.

Advanced Micro Devices (NASDAQ: AMD) saw its stock soar 9% on 12 November after CEO Lisa Su dismissed concerns about excessive AI spending, calling it “the right gamble” during a CNBC interview.

Read More: ST Engineering’s Satellite Writedown, Seatrium’s Order Wins, AMD’s AI Surge