The US president is prioritizing economic and technology concerns over any strategic China policy, says George Yin. Whether this will strengthen his hand remains to be seen.

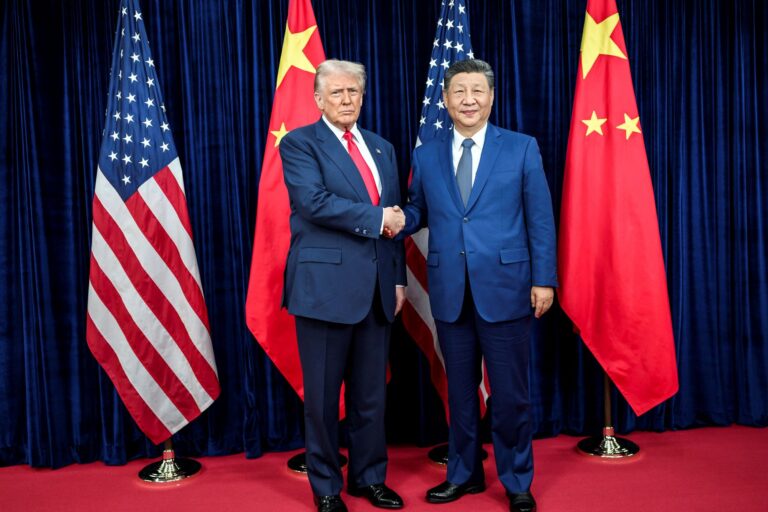

With much anticipation, US President Donald Trump met with Chinese President Xi Jinping on the sidelines of the APEC Summit in Busan, South Korea, on October 30, 2025. After the meeting, Trump hailed it as a success, declaring, “On a scale of zero to ten, with ten being the best, I’d say the meeting was a twelve.” While observers may not share Trump’s optimistic assessment, the Busan meeting nonetheless marks the first real test of the new Trump administration’s approach to China: a transactional drive for quick solutions to pressing issues that happen to involve China, rather than a China strategy in the strict sense.

Under Trump administration 2.0, China experts are often excluded from major decisions and have limited knowledge of policy details – only in July, the State Department was reported to have sacked its top experts on the South China Sea. As a result, the White House’s approach to Trump’s meeting with Xi is likely to have been shaped by Trump-connected experts focused on nuts-and-bolts functional issues who are less specialized in China-related matters – for example, tariff policy towards China by the US president’s economic advisors, or technology policy involving Beijing by his tech advisors.

Trump regularly consults his cabinet on China – the private sector also wields considerable sway

Trump regularly consults his cabinet on China policy, particularly his top economic officials—Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick. Bessent was reportedly appointed after convincing Trump that he could give “honest analysis of different policies and what [their] outcomes might be,” and Lutnick has a relationship with Trump that goes back at least three decades. US Trade Representative Jamieson Greer and White House Counselor Peter Navarro also exert influence, but Bessent and Lutnick are now more visibly at the forefront of policy discussions.

Importantly, Bessent and Lutnick—unlike first-term Trump officials such as Lighthizer — appear less committed to the idea of decoupling from China, a stance that Beijing welcomes. This could be a positive factor in facilitating US – China deal-making.

The private sector can also wield considerable sway on Trump’s China policy. Corporate leaders, especially those from the tech world and Wall Street, play a role in shaping decisions regarding China. Nvidia chief executive Jensen Huang, as well as certain hedge fund managers, have had input. Elon Musk was influential in the past and his fellow PayPal co-founder, Peter Thiel, is close to J. D. Vance.

Nonetheless, foreign policy advisers within the Trump administration also exert influence, notably Secretary of State Marco Rubio and Vice President J.D. Vance. Rubio is a long-time China hawk, while Vance — who has described…

Read More: Art of the deal meets great power politics: Trump 2.0’s approach to China