- Ever wondered if Columbia Banking System is actually a bargain, or if the market has already priced in all its potential? If you’re searching for hidden value or warning signs, you’re in the right place.

- The stock has seen slight movement recently, notching a 0.5% gain over the last week even as it remains down 11.9% for the year. This hints at shifting investor optimism or risk perceptions.

- Media coverage has highlighted steady bank sector volatility and consolidation trends that continue to influence sentiment for regional players like Columbia. In the past month, analysts and market watchers have debated how banking regulation updates and merger activity could impact valuations across the industry.

- On our 6-point undervaluation scale, Columbia Banking System currently scores a 4, suggesting clear upside in some areas but potential overpricing in others. We will break down how different valuation approaches stack up and point you toward an even better way to cut through the noise at the end of this article.

Find out why Columbia Banking System’s -11.9% return over the last year is lagging behind its peers.

Approach 1: Columbia Banking System Excess Returns Analysis

The Excess Returns valuation model estimates a company’s intrinsic value by examining the return it generates on its invested capital, particularly relative to its cost of equity. For Columbia Banking System, this method provides a focused view on whether the company is creating genuine value for shareholders beyond the minimum required rate of return.

According to this approach, Columbia’s Book Value stands at $26.04 per share, while its Stable EPS is $3.03 per share. These earnings projections are based on weighted future Return on Equity estimates from eight analysts. The company’s average Return on Equity is 10.78%, and the expected Cost of Equity is $1.91 per share. Notably, the calculated Excess Return, which represents the value created above the cost of equity, is $1.13 per share. Looking ahead, analysts expect the Stable Book Value to rise to $28.12 per share, as reflected in estimates from ten different analysts.

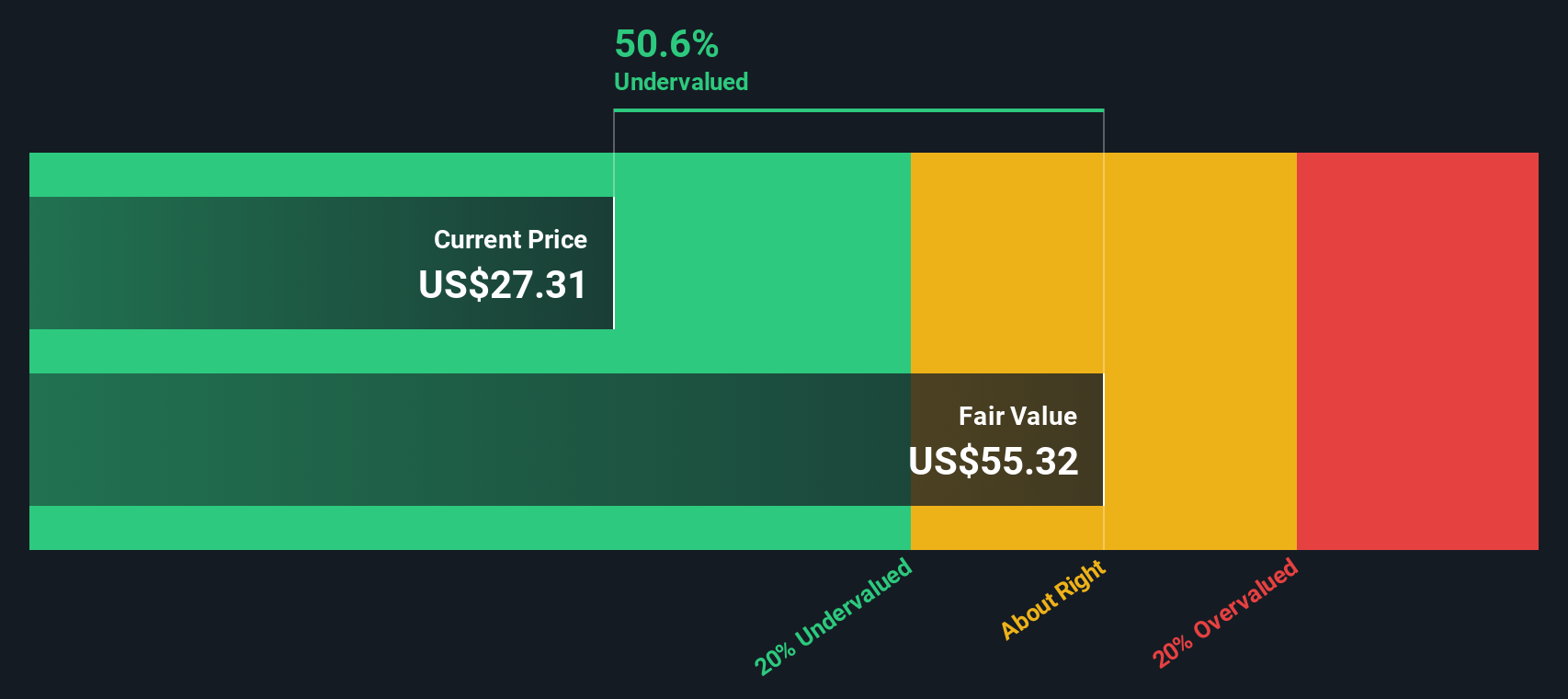

Based on these inputs, the model assigns an intrinsic value significantly above current market levels. This implies Columbia Banking System is 54.8% undervalued, suggesting the stock offers attractive upside potential under the excess returns framework.

Result: UNDERVALUED

Our Excess Returns analysis suggests Columbia Banking System is undervalued by 54.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Columbia Banking System Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as the go-to valuation metric for established, profitable companies because it directly relates a company’s stock price to…

Read More: Is Columbia Banking System Fairly Priced After Recent Analyst Debates on