The easy part for the Federal Reserve on Wednesday will be announcing a widely anticipated interest rate cut when it wraps up its two-day policy meeting. The hard part will be taking care of other details that are presenting substantial challenges to policymaking these days.

Markets are assigning a nearly 100% probability that the Federal Open Market Committee will approve a second consecutive quarter percentage point, or 25 basis point, reduction in the federal funds rate. The overnight lending benchmark is currently targeted between 4%-4.25%.

Beyond that, policymakers are likely to debate, among other things, the future path of reductions, the challenges posed by a lack of economic data and the timetable for ending the reduction in its asset portfolio of Treasurys and mortgage-backed securities.

Underlining all of those deliberations will be a growing divergence of opinion over what the future holds for monetary policy.

“They are at a moment in the policy cycle where there’s genuine disagreement between people who are thinking we will probably cut rates but I’m not ready to cut again just yet, and people who think even though there’s risks, it’s time to do more now,” said Bill English, a Yale professor and the Fed’s former director of monetary affairs. “There’s dissent between people who want to cut now, and people who want to wait and see a bit more.”

Judging by recent statements and prevailing Wall Street sentiment, newly appointed Governor Stephen Miran is likely to dissent in favor of a bigger cut, as he did at the September FOMC meeting.

At the same time, regional Presidents Beth Hammack of Cleveland, Lorie Logan of Dallas and Jeffrey Schmid of St. Louis have expressed reluctance to go much further on cuts, though it’s far from clear whether they will vote against a cut this week. Only Miran, who wanted a half-point reduction, actually dissented in what was an 11-1 committee vote last month to cut by a quarter point.

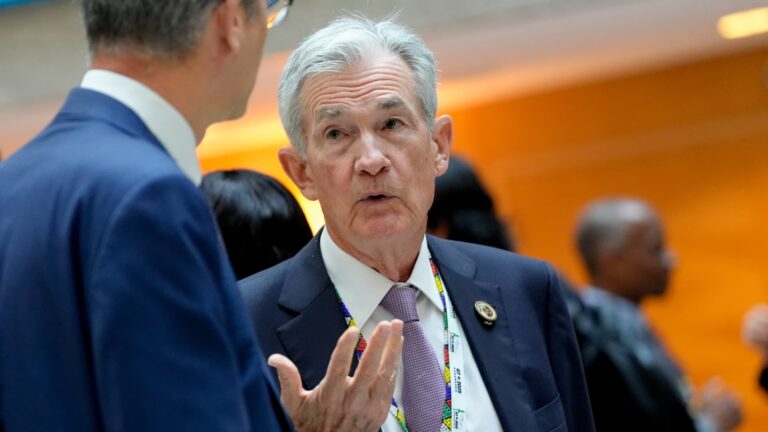

Left to try to straddle the difference will be Chair Jerome Powell, who in a recent speech gave an implied nod to an October cut when he expressed worry over the state of the labor market.

Investors will look to the central bank chief, who will leave the position in May 2026, for guidance on the prevailing sentiment.

“I would expect him to try to walk a middle ground, not tip his hand necessarily, on December,” English said, referring to the next policy meeting after this one. “I don’t think he wants to be locked into a rate cut in December. But on the other hand, it does seem like he’s worried about the labor market and about the outlook for real activity, so he doesn’t want to come across as hawkish.”

Markets currently also are pricing in a near-certainty of a December reduction, according to the CME Group’s FedWatch tool, so it would take a lot do dissuade Wall Street from anticipating more Fed easing.

Worries about jobs

One big reason officials are in the mood to lower is concern over the labor market. Even with an absence of…

Read More: Fed has a rate cut plus a bunch of other things on its plate this week