Trying to decide what to do with M&T Bank stock? You are not alone. Investors have seen M&T’s share price pull back over the past month and quarter, down 7.1% in the last week and 8.7% in the last 30 days. Even with those recent drops, M&T Bank is still up 112.0% over the past five years, showing just how much long-term potential this regional bank has delivered. The mild year-to-date dip of 4.2% makes it clear the market is pausing for breath despite resilient one-year returns of 0.4%.

Much of this movement has tracked the wider financial sector’s jitteriness, as markets digest changing rate expectations and shifting risk appetites. Still, it is the fundamentals and valuation picture that ultimately matter for most long-term shareholders. That is where things get interesting for M&T Bank. Looking at our latest valuation assessments, M&T earns a score of 6 out of 6, meaning it is viewed as undervalued across every key metric we test.

This raises a compelling question: what exactly is going on under the hood with M&T’s valuation? In the next section, we will walk through each valuation approach, and later, I will share the most meaningful perspective on whether this stock really has room to run.

Why M&T Bank is lagging behind its peers

Approach 1: M&T Bank Excess Returns Analysis

The Excess Returns valuation model evaluates a company by examining how much profit it generates above its cost of capital. In other words, it looks at whether M&T Bank is putting its shareholders’ money to work efficiently, earning excess returns over what would be expected for the risk taken.

For M&T Bank, the key metrics are strong. The current Book Value stands at $166.95 per share, and analysts estimate a Stable EPS of $18.42 per share based on projected future returns on equity. The average Return on Equity is 10.4%, while the Cost of Equity is $12.30 per share, resulting in an Excess Return of $6.11 per share. Additionally, the Stable Book Value is projected to reach $177.10 per share, according to future estimates.

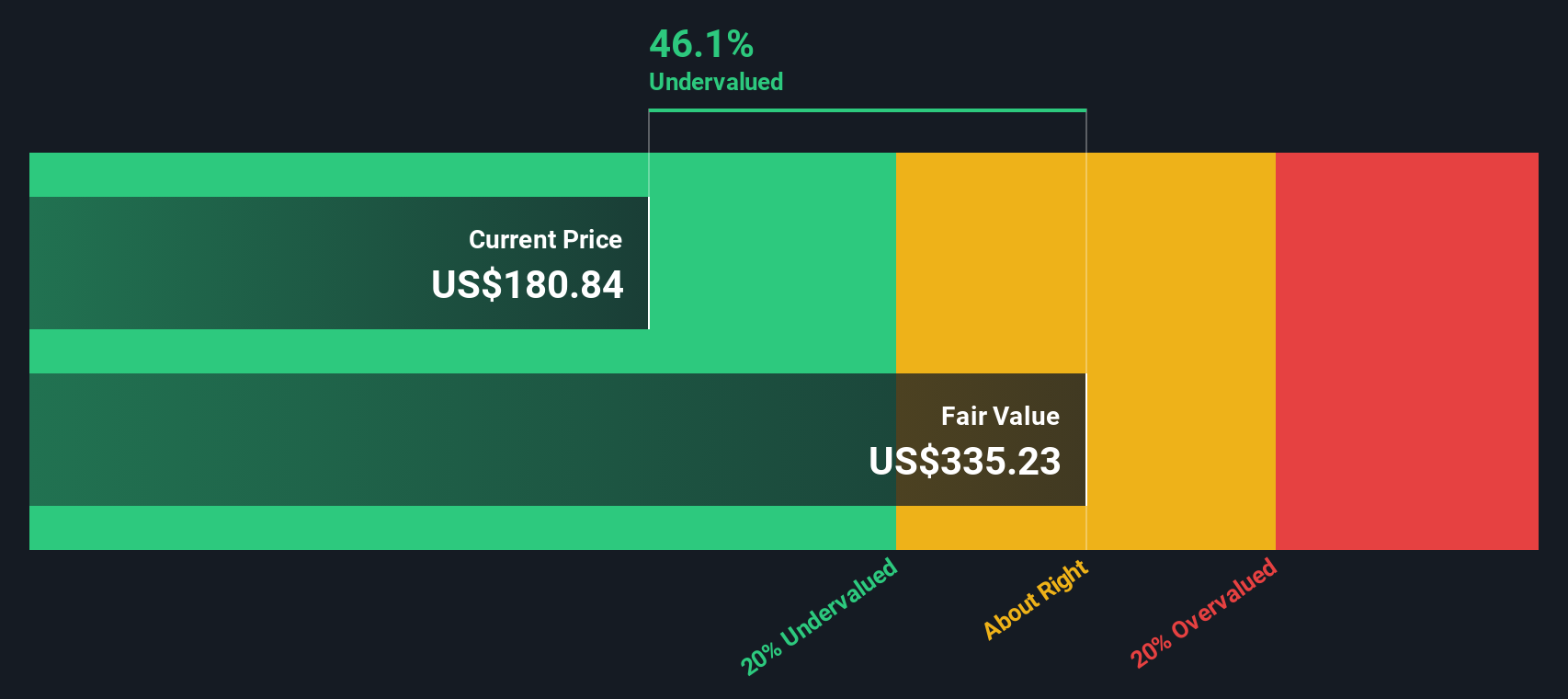

This model’s findings translate into a compelling estimated intrinsic value that is 46.1% higher than the current share price. In simple terms, the stock is viewed as substantially undervalued by this method. This reflects both M&T Bank’s efficient use of shareholder capital and its robust underlying fundamentals.

Result: UNDERVALUED

Our Excess Returns analysis suggests M&T Bank is undervalued by 46.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: M&T Bank Price vs Earnings

For well-established and profitable companies like M&T Bank, the Price-to-Earnings (PE) ratio is a staple valuation measure. It captures how much investors are willing to pay for each dollar of earnings, making it a sensible yardstick when earnings are steady and…

Read More: Assessing M&T Bank’s Value After Recent Share Price Drop and Banking Sector