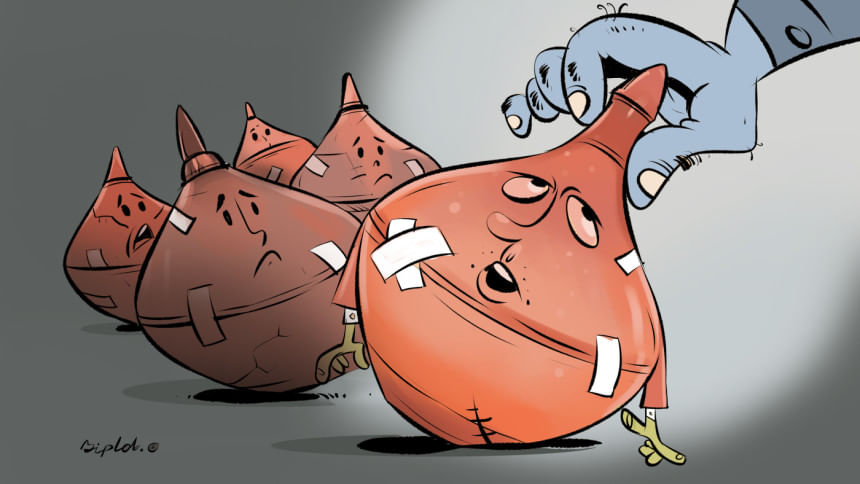

The risk associated with the bank merger is a significant challenge to reducing the loan default rate. ILLUSTRATION: BIPLOB CHAKROBORTY

”

The risk associated with the bank merger is a significant challenge to reducing the loan default rate. ILLUSTRATION: BIPLOB CHAKROBORTY

Poor management and weak governance have long posed significant challenges to Bangladesh’s banking sector, as evidenced by various indicators. As a result, the sector’s overall performance has suffered, its efficiency and soundness declining over the years. Since the country’s financial system mainly relies on banks, the sector’s poor health presents a significant risk to economic growth. In recent times, the Bangladesh Bank has been implementing several reform measures to improve the sector’s health. These include restructuring the boards of several weak commercial banks, forming task forces, revising the Bank Company Act, adopting the Banking Resolution Ordinance, 2025, and revising the Bangladesh Bank Order, 1972, among others.

As part of reforming the commercial banks, the central bank has launched asset quality review (AQR), aiming to evaluate the true financial health of the banks and the actual amount of bad loans. In the initial phase, six banks—First Security Islami Bank, Global Islami Bank, Union Bank, Exim Bank, Social Islami Bank, and ICB Islami Bank—were assessed by global audit firms Ernst & Young and KPMG. Their AQR results show significant underperformance, highlighting issues such as capital shortfalls, high levels of classified loans, large provision gaps, and liquidity shortages. As a result, these banks have failed to pay their depositors and return funds to their lenders, which has badly shaken public confidence in the banking sector. This presents a serious threat to the stability of the country’s financial system.

The urgency of a bank merger arose in the face of the above-mentioned banks’ troubled financial health revealed by their AQRs. For years, these banks had presented sanitised financial statements that masked the true scale of bad loans. The AQRs revealed that, in some cases, the actual amount of non-performing loans (NPLs) were even four times higher than reported. In light of these developments, the central bank recently decided to merge five of these banks under the Bank Resolution Ordinance. The goal is to create a stronger bank with higher capital that can effectively serve its customers, handle the losses, and restore public trust.

According to the Bangladesh Bank, the…

Read More: The promises and perils of a bank merger

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.