Copart (CPRT) posted earnings growth of 13.9% over the past year, coming in slightly below its 5-year average of 14.6% per year. Looking ahead, earnings are forecast to rise 9.6% annually and revenue is expected to grow at a similar 9.7% per year. This aligns with the broader US market for revenue growth but falls short of the national average for earnings growth of 15.4%. With a Price-To-Earnings Ratio of 28x, which matches industry averages, and a current share price of $44.87 trading below the $63.67 fair value estimate, investors may view the results as a signal of steady profitability paired with attractive value characteristics.

See our full analysis for Copart.

Next, we will see how Copart’s latest results measure up against the most widely followed narratives in the market. This will highlight where expectations might shift and where surprises could emerge.

See what the community is saying about Copart

Margins Set to Nudge Higher

- Analysts expect Copart’s profit margins to rise from 33.4% now to 33.7% over the next three years. This would support earnings growth even if top-line expansion remains steady.

- The consensus narrative points out that international expansion and digital innovation could open up higher-margin revenue streams.

- Copart’s push into markets like Germany, Brazil, and the Middle East is expected to help drive profitability beyond the mature US business.

- Significant investment into proprietary, AI-enabled platforms may improve auction transaction efficiency, which could lead to improved net margins and more engagement from both sellers and buyers.

DCF Fair Value Stands Above Market

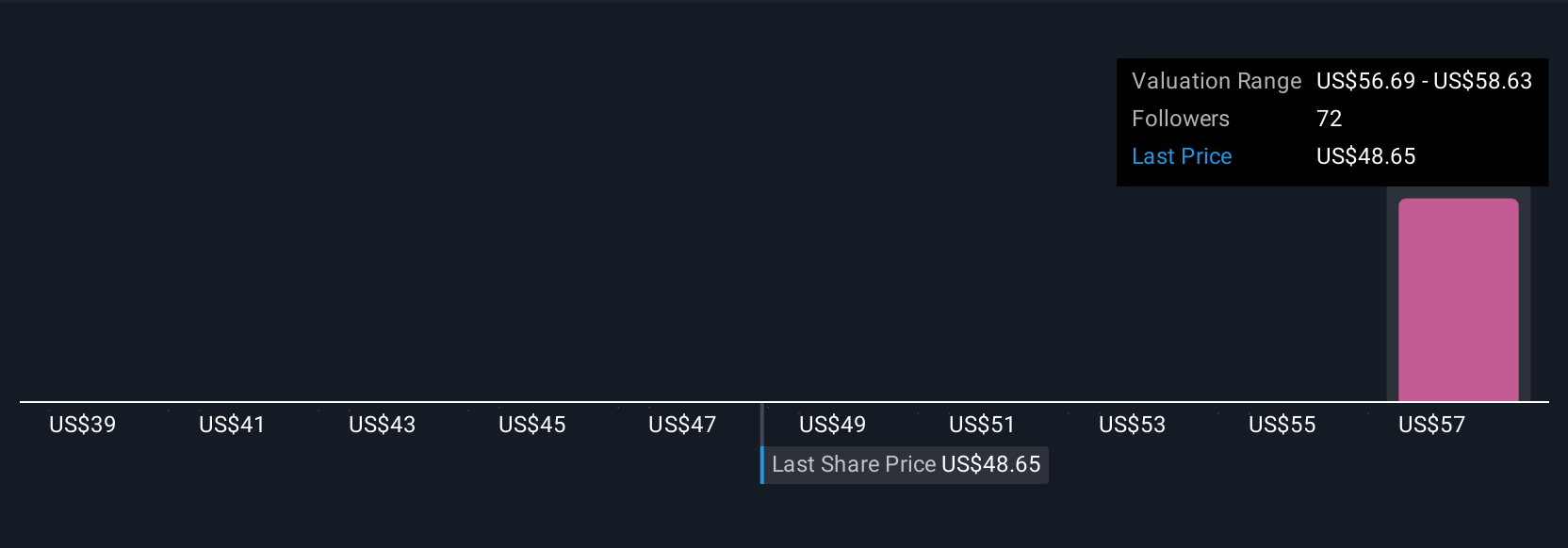

- Copart’s share price of $44.87 is trading 29.1% below its DCF fair value of $63.67. This highlights a significant value gap for investors to consider.

- In the analysts’ consensus view, the current price reflects a scenario where earnings are expected to grow to $2.1 billion by September 2028.

- This, combined with a fair value estimate above recent trading levels, underscores a constructive sentiment toward the stock’s upside potential.

- The consensus analyst price target of $56.63 is also above the current price, pointing to possible re-rating if Copart continues delivering steady expansion and margin gains.

Broader Industry Momentum Supports Growth

- Copart’s revenue growth forecast of 9.7% annually matches the broader US market outlook for sales increases. This positions the company alongside larger sector trends driven by increased vehicle ownership and complexity.

- The analysts’ consensus narrative notes Copart remains a prime beneficiary of growth in sustainable vehicle recycling and value-added services.

- Rising demand for recycled parts and stronger participation in the automotive circular economy are seen as important tailwinds.

- Expanding services like title processing and loan payoff support are expected to build on this momentum by improving EBITDA…

Read More: Copart (CPRT): Earnings Growth Slows Below 5-Year Average, Reinforcing