Banking has undergone a massive digital transformation in the past decade, and 2025 is shaping up to be a milestone year for open banking API integration. With the rise of fintech banking industry solutions and digital transformation, businesses can now connect directly to banks for real-time financial services with just a few taps on our smartphones. This change is largely thanks to a technology that works behind the scenes: the bank API Integration.

The global open banking market size was USD 31.61 billion in 2024. By 2030, it is expected to climb to USD 135.17 billion. This reflects a CAGR of 27.6% between 2025 and 2030 (according to Grand View Research).

The rise of APIs is fueling a new era of digital finance. Here are some quick numbers on how the bank works in the API era:

- About 90% of financial institutions across the globe currently use APIs for better experiences. This represents a jump from 78% in 2022, plus it underscores just how common API adoption has become.

- Over 85% of banks worldwide have now implemented open banking APIs enabling safe third-party access to customer data and supporting new service delivery models.

- API upgrades were considered a priority in the 2024 technology budgets for more than 70% of U.S.-based banks from 58% back in 2022.

These figures display the enormous promise of banking’s opening and API tools. Open banking along with API technology are being rapidly adopted, as well. These changes are a real shift for bank operations not simply a fad.

This guide will break down everything you need to know about bank API integration, its benefits, types, and the practical steps for successful implementation.

What is a Bank API?

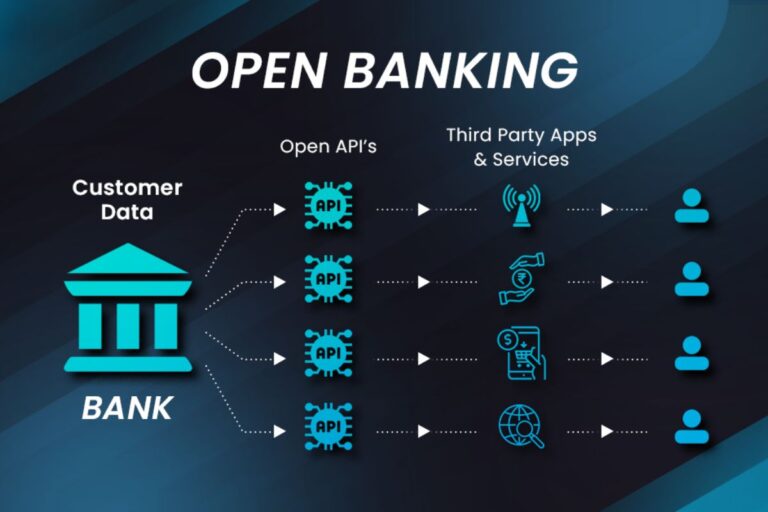

A bank API (stands for Application Programming Interface in banking) is a secure gateway that allows software applications to communicate with a bank’s database or services.

In simple terms:

- Bank API acts as a bridge between your app and the bank’s system. It’s easier for banking mobile app development to integrate banking services directly into their platforms.

- It enables functions like balance checks, bank transactions API access, and payment processing.

- APIs ensure smoother integrated banking solutions for businesses and individual users.

When we talk about a financial services API, it is an API that allows third-party applications to access a bank’s data along with functionality. This includes tasks such as the checking of account balances and the initiating of payments. Viewing bank transactions API data also is included. For example, apps such as Chime use Plaid to verify and connect accounts, and that makes banking operations faster and safer for customers.

Common Types of Bank API Integration and How They Work

Different API models serve various purposes in the fintech banking industry.

Types of Financial API Integrations

For various API types, there is usage within the financial sector for…

Read More: The Ultimate Guide To Open Banking APIs