As the U.S. stock market experiences a surge with major indices like the S&P 500 and Nasdaq Composite reaching all-time highs, investors are increasingly optimistic about potential interest rate cuts by the Federal Reserve following stable inflation reports. In this buoyant environment, dividend stocks become particularly appealing for their ability to provide steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.74% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 3.87% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.52% | ★★★★★★ |

| Ennis (EBF) | 5.56% | ★★★★★★ |

| Employers Holdings (EIG) | 3.10% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.82% | ★★★★★☆ |

| Dillard’s (DDS) | 5.56% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.93% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.97% | ★★★★★☆ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.56% | ★★★★★☆ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orrstown Financial Services, Inc., with a market cap of $623.72 million, operates as the financial holding company for Orrstown Bank, offering commercial banking and financial advisory services to retail, commercial, non-profit, and government clients in the United States.

Operations: Orrstown Financial Services, Inc. generates its revenue primarily through its Community Banking segment, which accounts for $233.72 million.

Dividend Yield: 3.4%

Orrstown Financial Services offers a stable dividend yield of 3.36%, supported by a low payout ratio of 43.4%, ensuring coverage by earnings. The company recently increased its quarterly dividend to $0.27 per share, marking a 35% rise since merging with Codorus Valley Bancorp, reflecting consistent growth over the past decade. Despite large one-off items affecting results, recent earnings and net interest income have shown significant improvement, enhancing its appeal to dividend investors seeking reliability and growth potential.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shore Bancshares, Inc. is a bank holding company for Shore United Bank, N.A., with a market cap of $513.63 million.

Operations: Shore Bancshares, Inc. generates its revenue primarily through its Community Banking segment, which accounted for $208.21 million.

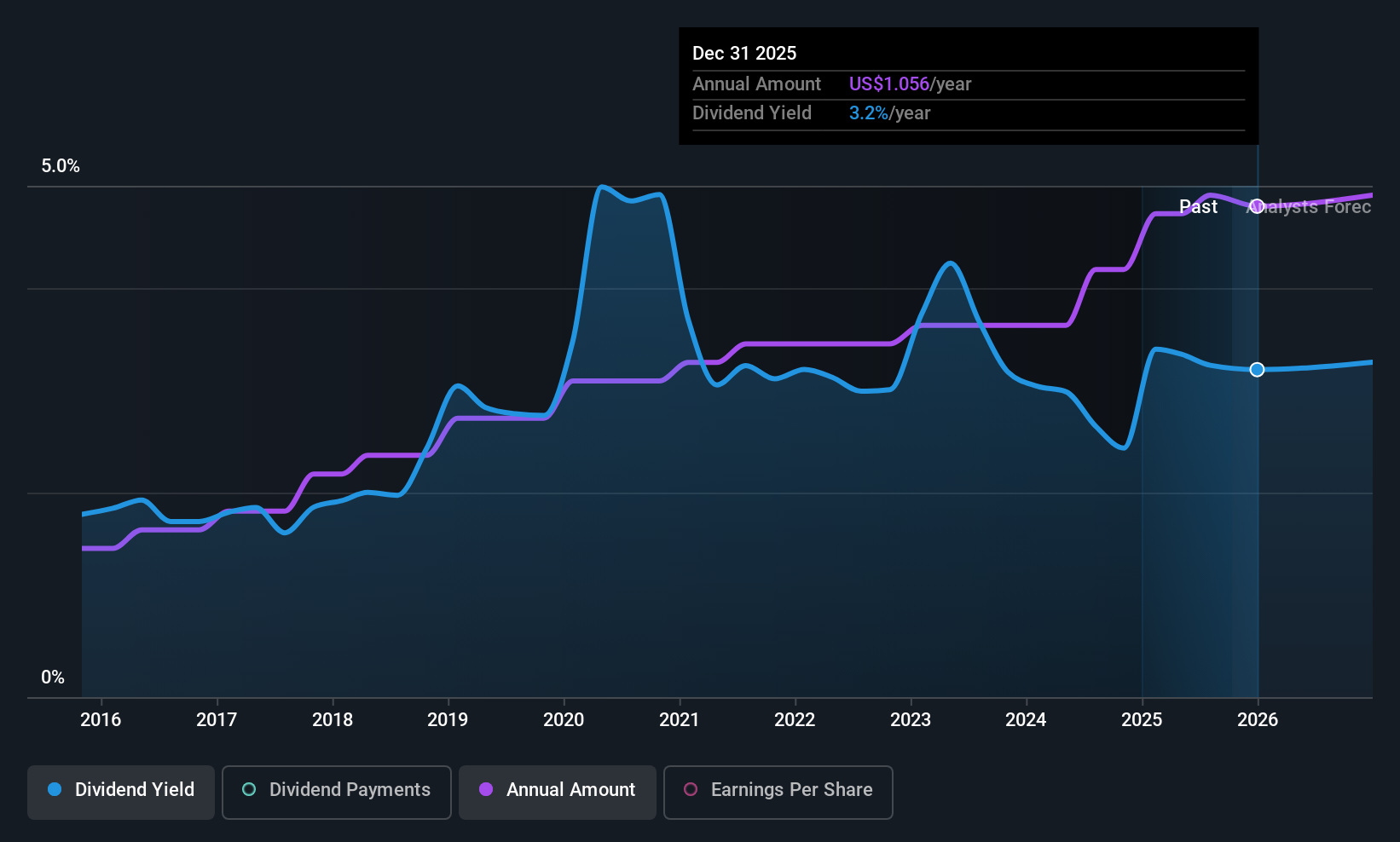

Dividend Yield: 3.1%

Shore Bancshares maintains a stable dividend history, recently affirming a quarterly dividend of $0.12 per share. With a payout ratio of 29.8%, dividends are well-covered by earnings, supported by recent net income growth to US$15.51 million in Q2 2025 from US$11.23 million the previous year. Although its 3.14% yield is below top-tier payers, the company’s consistent earnings and low price-to-earnings ratio offer value for…

Read More: Orrstown Financial Services And 2 Other Top Dividend Stocks