The anticipated Trump-Putin meeting has become the dominant storyline in commodity markets this week, as traders and analysts weigh the chances of a sweeping geopolitical deal.

August 8, 2025

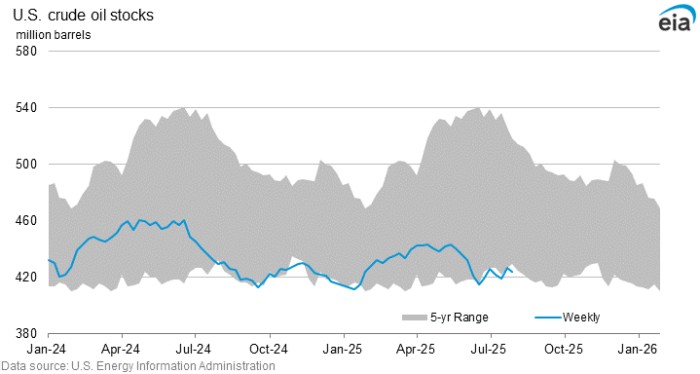

The Trump-Putin meeting has become the main commodity market news of this week, with analysts speculating about the likelihood of a comprehensive deal and the impacts this could have on oil markets. ICE Brent has been gradually sliding closer to $65 per barrel as lower sanction risks on Russia could further erode the market’s in-built risk premium, however a potential failure in the talks could spark another price rally above $70.

Saudi Arabia Hikes September Prices. Saudi Aramco (TADAWUL:2222) hiked its formula prices for September-loading cargoes, raising Asia-bound OSPs by 1.20 per barrel for both its light grades and by 0.90 per barrel for its largest export stream Arab Light, in line with changes in the Dubai M1-M3 spread.

US Crude Exports Dip on Tightly Shut Arbitrage. US crude exports fell to 3.1 million b/d last month, a 0.5 million b/d drop compared to June and the lowest monthly rate since October 2021, mostly driven by Asia’s weakening appetite for light sweet WTI with China continuing to boycott US crude imports.

Iraq Flaunts Imminent Kurdish Pipeline Restart. Iraq’s oil minister Hayan Abdul Ghani announced this week that 80,000 b/d of oil exports through the Kirkuk-Ceyhan pipeline (shut since February 2023) are poised to begin this week, even though most of Kurdish production remains offline after drone attacks.

Exxon Launches Fourth Guyanese FPSO. Four months ahead of schedule, the Stabroek consortium led US oil major ExxonMobil (NYSE:XOM) began production at the One Guyana FPSO, its fourth project in the country that adds 250,000 b/d in capacity and develops the Yellowtail-Redtail fields.

Indian Refiners Go Big on Spot Tenders. India’s state-owned oil refiner IOC bought 5 million barrels of crude from Brazil, US and Libya in its second spot tender organized this week, taking the total volume of spot crude bought this week in avoidance of Russian supply shocks to a whopping 22 million barrels.

Israel Signs Giant Gas Deal with Egypt. Israel and Egypt have signed a 25-year natural gas supply deal worth 35 billion that would see gas output from the offshore Leviathan field delivered by pipeline to Egyptian customers, totalling 130 bcm by 2040 at an average assumed price of 7.75 per mmBtu.

Argentina Consolidates Its Oil Assets. Argentina’s state-controlled oil firm YPF (NYSE:YPF), already the country’s largest producer with oil output soaring to 270,000 b/d lately, has agreed to sell TotalEnergies’ (NYSE:TTE) oil-weighted assets in the Vaca Muerta shale basin for 700 million, adding 51,000 net acres.

Mexico Mulls Lifting Fracking Ban. Pemex’s new 10-year strategic plan envisages a thorough evaluation of Mexico’s potential for hydraulic fracturing, a practice banned by former President Lopez Obrador but now tacitly…

Read More: Trump-Putin Talks Put Oil Markets on Edge