Apple plans to ramp up investments to catch up in AI developments.

Apple (AAPL 4.24%) has long been one of the premier stocks on the U.S. stock market, spending most of the past decade as the world’s most valuable public company. However, the company has seemingly taken a step back in the past few years as the artificial intelligence (AI) boom has boosted the value of many other big tech companies.

In the past three years, Apple’s stock is only up around 30%, making it the second-worst performer of the “Magnificent Seven” stocks (trailing only Tesla) and underperforming the S&P 500. That’s not something investors are used to seeing from Apple.

Despite Apple seemingly lagging behind, there could possibly be a breath of fresh air coming to the company, sparking new life into the stock.

A much-needed rebound for the iPhone and Mac products

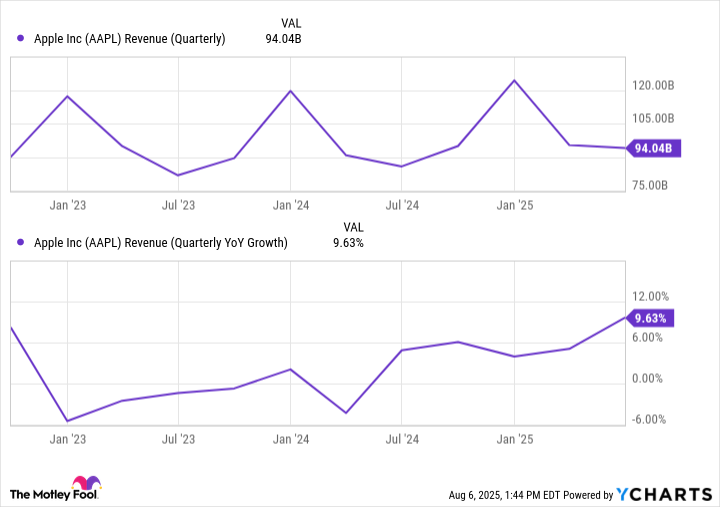

Apple’s fiscal third-quarter earnings, for the period ended June 28, were a pleasant surprise for many people. Its revenue grew nearly 10% year over year to $94 billion, which is a June quarter record for the iPhone maker. And speaking of iPhone, the smartphone’s revenue grew 13% year over year to $44.6 billion, which Apple noted was driven by the popularity of the iPhone 16 family.

Mac (which includes products like MacBook Pro, MacBook Air, iMac, and Mac Studio) revenue grew 15% year over year to $8 billion, but iPad and wearables, home, and accessories sales were noticeably down — 8% and 9% year over year, respectively.

Still, Apple’s hardware revenue grew by 8% year over year and accounted for nearly 71% of its total revenue for the quarter. Apple’s services segment reached an all-time high, bringing in $27.4 billion, but hardware remains — and will likely remain — king for the company.

AAPL Revenue (Quarterly) data by YCharts

Apple’s year-over-year revenue growth was its highest in the past three years.

Is Apple finally getting serious about AI?

The big cloud hanging over Apple’s business has been AI (what it calls “Apple Intelligence”), and the lack of urgency in the space compared to rivals like Alphabet and Microsoft. It seems Apple is beginning to take it more seriously and address this issue.

A major advantage on Apple’s side is the number of devices it has in people’s pockets, homes, and offices. Ideally, Apple can integrate AI into its various hardware, giving people even more of a reason to choose it over competitors. This has been the plan for a while, but it hasn’t gone as smoothly or as quickly as most people thought or hoped.

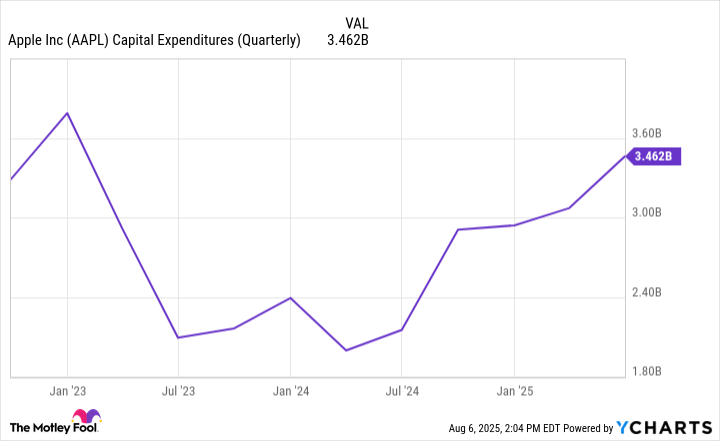

That should change soon, with Apple’s management noting on its latest earnings call that Apple is “increasing [its] investment significantly in AI,” both in infrastructure and company personnel. In its latest quarter, Apple spent nearly $3.5 billion on capital expenditures, its most since its fiscal quarter that ended in January 2023.

AAPL Capital Expenditures (Quarterly) data by YCharts

Apple has always moved cautiously and with…

Read More: Apple’s AI Momentum Is Building — Here’s What It Means for Investors