Australians made over 4 billion mobile payment transactions in 2024, totaling over $100 billion, a new industry report has revealed.

The 2025 Bank On It report by the Australian Banking Association (ABA) revealed that the digital revolution continues to reshape the country’s banking sector, with cash withdrawals and branch visits steeply declining.

In 2024, 99.3% of all customer interactions with the banks were digital, a slight increase from 99.1% the year prior. Satisfaction with these digital banking channels also remains exceptionally high, ABA CEO Anna Bligh noted.

“Australians consistently express greater satisfaction with their digital banking experiences compared to international peers. Banks’ sustained investment in secure, intuitive platforms continues to translate into world-leading user satisfaction,” she stated.

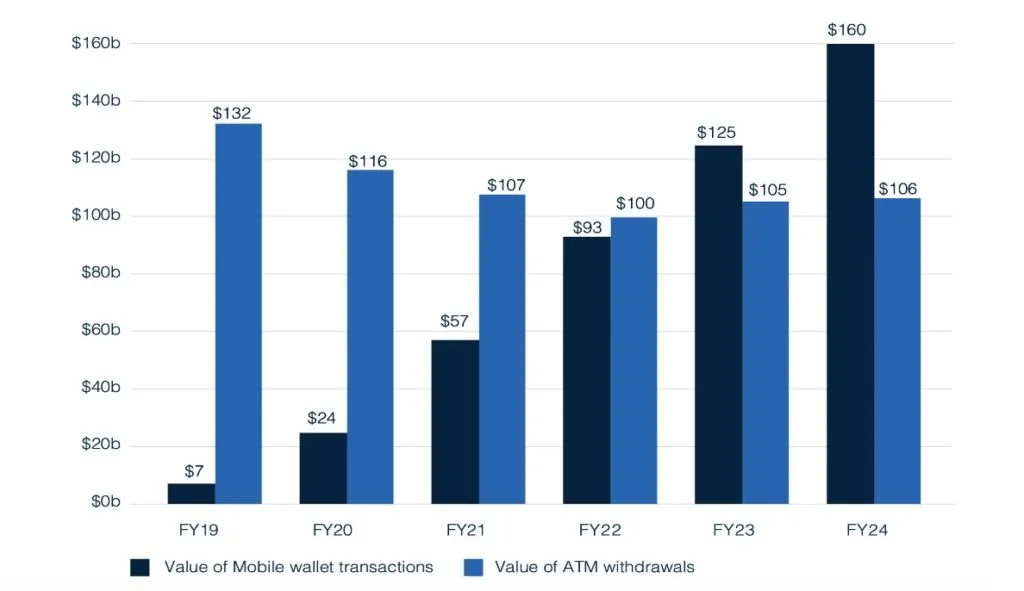

The most dominant channel was mobile banking. The report revealed that Australians made over 4 billion transactions in 2024, worth over AUD160 billion ($105 billion), from their mobile wallets, a 28% increase year-over-year. This represents a 2,300% surge since 2019; mobile wallet transactions are now 11x that of cash ATM withdrawals.

The decline in customer visits to physical bank branches comes despite Australia’s widespread branch access. The country has a commercial bank branch density of 17 branches for every 100,000 adults, higher than OECD peers with similar urbanization levels, such as Finland and New Zealand.

Australians are also more satisfied with their banking channels than their peers from other OECD countries. Digital apps, for instance, have a 66% satisfaction rate, compared to 60% in other countries.

The shift to digital has also boosted the country’s financial inclusion rate. Australia now ranks third among G20 economies for ownership of bank accounts by citizens aged 15 and above, sitting behind the U.K. and Canada, respectively. It also ranks 23% above the global average for account access.

Australia’s digital banking hasn’t been without its challenges. Neobanks in the country have struggled to compete with legacy giants, unlike in other major economies like the U.K., where they have been a massive success. The country’s first neobank, Volt, shut down in 2022, just three years after launch, after failing to raise sufficient capital.

Even mobile wallets, whose user numbers have been skyrocketing in recent years, raise fresh concerns for regulators. In February, the ABA called on lawmakers to amend payment laws to tighten regulations for mobile wallet operators. She claimed that the lax oversight gave mobile wallets an unfair advantage over their legacy banking rivals.

Australia’s…

Read More: Australians made 4B mobile wallet payments in 2024: report