The Reserve Bank of Australia (RBA) has defied expectations by deciding to hold the official cash rate at 3.85 per cent. The central bank was largely predicted to provide the third rate cut of the year on Tuesday, but homeowners will have to hold on for at least another few weeks.

The RBA decision was not unanimous, with the board publishing an unattributed record of votes in the post-meeting statement for the first time. Today’s decision was made with six in favour of a hold and three against.

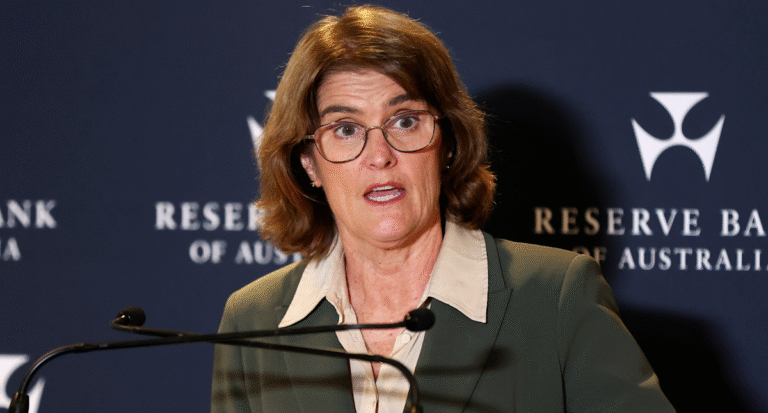

RBA governor Michele Bullock said the board’s decision today was about “timing rather than direction”, with the board deciding to “wait a few weeks” to confirm inflation was on track to reach 2.5 per cent before it continued its “easing path”.

Headline inflation eased to 2.1 per cent over the year to May, down from 2.4 per cent the previous month. Underlying inflation eased to 2.4 per cent over the year to May, which was down from 2.8 per cent in April and the lowest in three and a half years.

Bullock said she understood that households with mortgages were keen to see interest rates decline.

“I’m also very conscious that we don’t want to end up having to fight inflation again. We want to make sure we’ve nailed it,” she said.

Bullock noted that we’ve only had one quarter of underlying inflation at 2.9 per cent. By the August meeting, it will have the June quarter CPI data due July 30, which, if it comes in as expected, would “validate” the bank’s easing rates.

“That’s what we’re waiting for,” she said.

Do you have a story to share? Contact tamika.seeto@yahooinc.com

All of the Big Four bank economic teams were expecting a 0.25 per cent cut today, with the majority of experts all predicting a cut and markets pricing in a 96 per cent chance of a cut.

Mozo personal finance expert Rachel Wastell told Yahoo Finance today’s “surprise” proves mortgage holders shouldn’t be waiting for the RBA or their lender to cut their rate for them.

“The smarter move is to compare and switch. There’s often no prize for loyalty and no reward for waiting. If your rate is above 6 per cent, it’s time to ask why,” she said.

Just four experts surveyed by Finder expected a hold today.

Read More: RBA holds interest rates at 3.85 per cent in shock decision for millions