Welcome to this week’s edition of top stock market highlights.

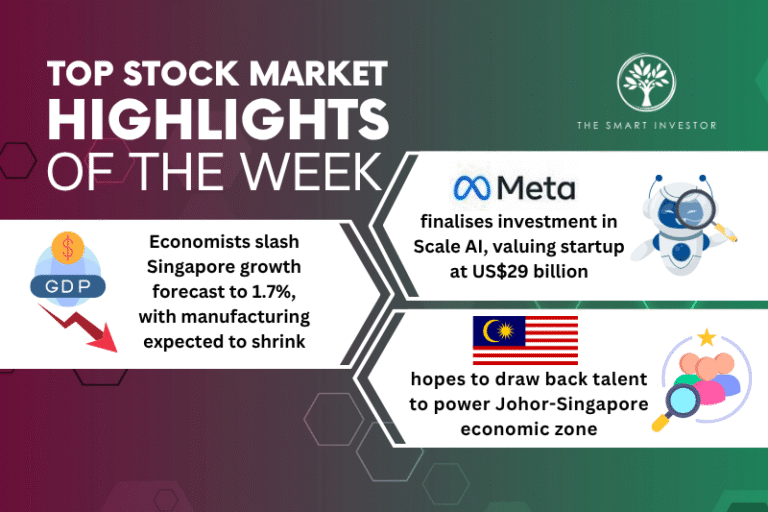

Meta Platforms has concluded an investment in Scale AI, valuing the startup at over US$29 billion.

According to sources, the technology behemoth’s investment in Scale AI amounted to US$14.3 billion, giving Meta a 49.3% stake in the artificial intelligence (AI) firm.

Scale AI’s CEO and co-founder, Alexandr Wang, will join a new superintelligence unit within Meta that seeks to achieve artificial general intelligence (AGI).

AGI is a term used to describe machines that can match or even surpass human capabilities.

This deal is now Meta’s second-largest ever, just behind its US$19 billion purchase of WhatsApp back in 2014.

By buying a stake in Scale AI, Meta CEO Mark Zuckerberg could also take a sneak peek into what his competitors have been up to.

Many of these technology giants contracted Scale AI for data services.

Scale AI was valued at around US$14 billion just one year ago, with funding coming from Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), and Meta itself.

The startup was set up in 2016 and is famous for its accurately labelled data sets, which are used for training generative AI models.

These labels are manually done by gig workers who are recruited and managed by Scale AI.

Economists have downgraded Singapore’s full-year GDP growth and inflation expectations in the latest quarterly survey published by the Monetary Authority of Singapore (MAS).

This downgrade came on the back of deteriorating US-China relations and Trump’s raft of reciprocal tariffs announced in early April.

The median growth forecast is for Singapore’s economy to grow by 1.7% this year, dragged down by an anticipated manufacturing contraction.

This level is down from the previous projection of 2.6%.

The good news is that inflation is also expected to plunge, with core inflation expected to come in at just 0.8%, down from 1.5% in the previous survey.

That said, inflation could rear its ugly head again with Middle East tensions ratcheting up, as oil prices have recently surged in response to the unrest.

MAS is expected to further ease monetary policy at its next meeting in July to counteract this slowdown.

Despite the lowering of the official growth forecast, expectations are still within the original estimates of between 0% to 2% for growth, and 0.5% and 1.5% for inflation.

The respondents cited geopolitical tensions along with worsening trade relations as a key factor for the downgrade in the domestic outlook.

On the flip side, some factors could potentially boost growth.

Read More: Meta Platforms, Singapore’s Growth Forecast and Johor-Singapore Economic