The banking industry is ripe for consolidation. Although there were more than 4,500 banks in the U.S., as of last year, four, in particular, collectively control trillions in assets: JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup. While smaller banks will keep gobbling each other up and merging to obtain scale, this could also take place in the large regional banking market, among banks with $75 billion to $700 billion in assets.

Regulators under President Donald Trump’s administration have given the sector the green light for mergers and acquisitions, a stance that wasn’t embraced under former President Joe Biden’s administration. If the large regional banks truly want to compete against the big four, they’re going to have to get bigger. Acquisition candidates typically can command a nice premium for shareholders.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Here are two banks that could get acquired during the next four years.

1. Comerica: Tough size, attractive markets

At the end of the first quarter of 2025, Comerica(NYSE: CMA) had about $78 billion in assets and operates in attractive U.S. banking markets like Texas and states in the fast-growing Southeast of the U.S. This is an awkward size for a regional bank these days, because it is too big to be a local bank, but not nearly big enough to compete with the bigger players.

Furthermore, $100 billion has previously been a battleground for banking regulators under various administrations when thinking about the size threshold they consider too big to fail — meaning they’re so crucial to the financial system that regulators will bail them out if they are at risk of failing. As such, investors frequently have to reassess regulations and capital requirements for banks around this size.

Image source: Getty Images.

Last year, Comerica announced it will not be extending a banking relationship with the U.S. Treasury Department that provided it with $3 billion in noninterest-bearing deposits, which is essentially a free funding source, although the agreement will continue for the next few years before the transition, which could partly explain its low valuation relative to peers.

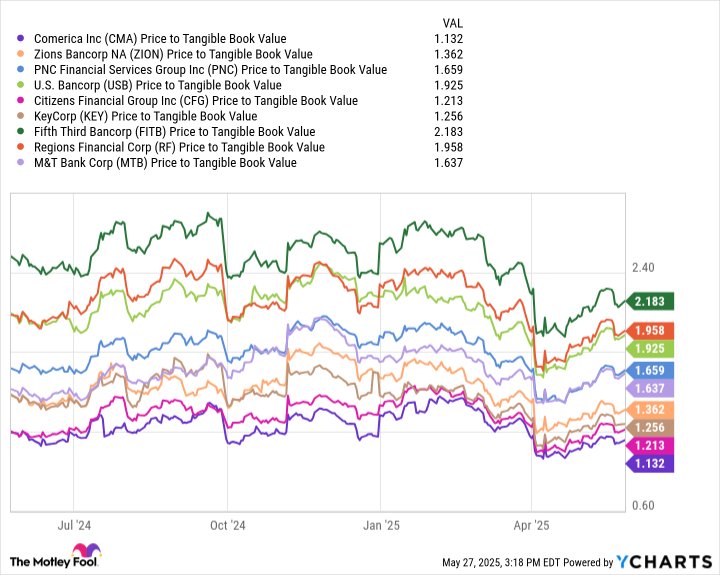

When looking at acquisitions, it’s important to look at a bank’s price-to-tangible book value (TBV), which shows its price relative to its tangible equity, or what the bank might be worth if it were liquidated. The higher a bank’s price-to-TBV, the more likely it is to be a buyer because its stock currency is more valuable, so it could buy banks with smaller price-to-TBVs and see less dilution in an all-stock or part-stock deal.

Here is the price-to-TBV of several major U.S. regional banks.

CMA Price to Tangible Book Value data by YCharts

Now, just because Comerica sits at the bottom of the group doesn’t mean it will automatically be acquired. However, it makes an acquisition more palatable for a buyer. At the end of the day,…

Read More: 2 Large Regional Bank Stocks That Could Get Acquired During the Trump