Stay informed with free updates

Simply sign up to the Chinese business & finance myFT Digest — delivered directly to your inbox.

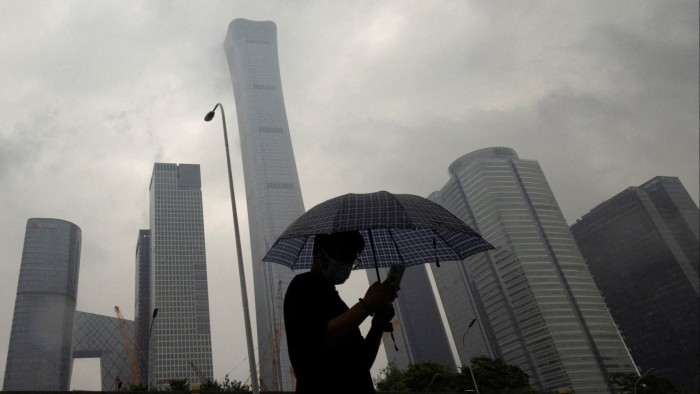

China is accelerating efforts to build a series of giant banks and brokerages as it pushes to consolidate the financial sector and make it better able to weather economic shocks.

Nearly one in 20 of the country’s rural banks have shut their doors over the past year, according to data from China’s National Financial Regulatory Administration, in a sweeping revamp of the banking sector in the aftermath of a years-long property crisis.

In separate data compiled by S&P Global Ratings, mergers have taken place or are under way at Chinese securities companies managing more than one-fifth of the sector’s assets since late 2023.

The consolidation campaign aims to transform China’s historically fragmented financial sector and produce a few strong, dynamic companies that can compete with the likes of JPMorgan and Morgan Stanley.

President Xi Jinping has previously urged regulators to “cultivate a few top-ranked investment banks and investment entities . . . to enhance the effectiveness of financial services for the real economy”. Last month, the China Securities Regulatory Commission reiterated the need to “enhance core competitiveness of top-tier investment banks via merger and acquisitions”.

A system with more big banks and brokerages would help “shape China’s financial policies in the long period of economic transitions that lies ahead . . . and can help de-risking the system in the process”, said George Magnus, an associate at Oxford university’s China Centre.

The accelerated pace of mergers reflects the authorities’ belief that they have removed the worst risks from the financial system and can now get it in shape to support China’s growth.

“This is likely to be a decade-long process rather than a couple of years,” said Ryan Tsang, managing director at S&P Global Ratings, noting that the process was probably only halfway complete. “The key is not just about reducing the number of institutions, but also strengthening their ability to manage risk.”

In recent years, Beijing has sought to reduce risk in a hugely overleveraged financial system by closing insolvent rural banks, cracking down on indebted property developers such as Evergrande and pushing local governments to restructure their debt.

As a result, “China’s financial system is now at its most stable point in the past decade,” said Richard Xu, financial analyst at Morgan Stanley. “The timing seems right to push to further streamline the sector and improve efficiency.”

In 2025, analysts expect more consolidation among state-owned brokerages, trust companies and financial leasing groups, as policymakers seek to create leaner and more competitive financial institutions.

After years of credit-driven growth, authorities are trying to…

Read More: China pushes for mergers to create global banking and securities giants