- JPMorgan looked at the top cryptocurrency’s performance in April.

- Bitcoin outperformed gold over the past year.

Things are looking good for Bitcoin.

It’s a sharp reversal from a few months ago, when Bitcoin was trading around $80,000. JPMorgan examined Bitcoin’s strong price performance through April, which seems to only be accelerating in May.

It was a brutal few weeks after US President Donald Trump unveiled sweeping tariffs and triggered fears of a global trade war, which weighed on global markets.

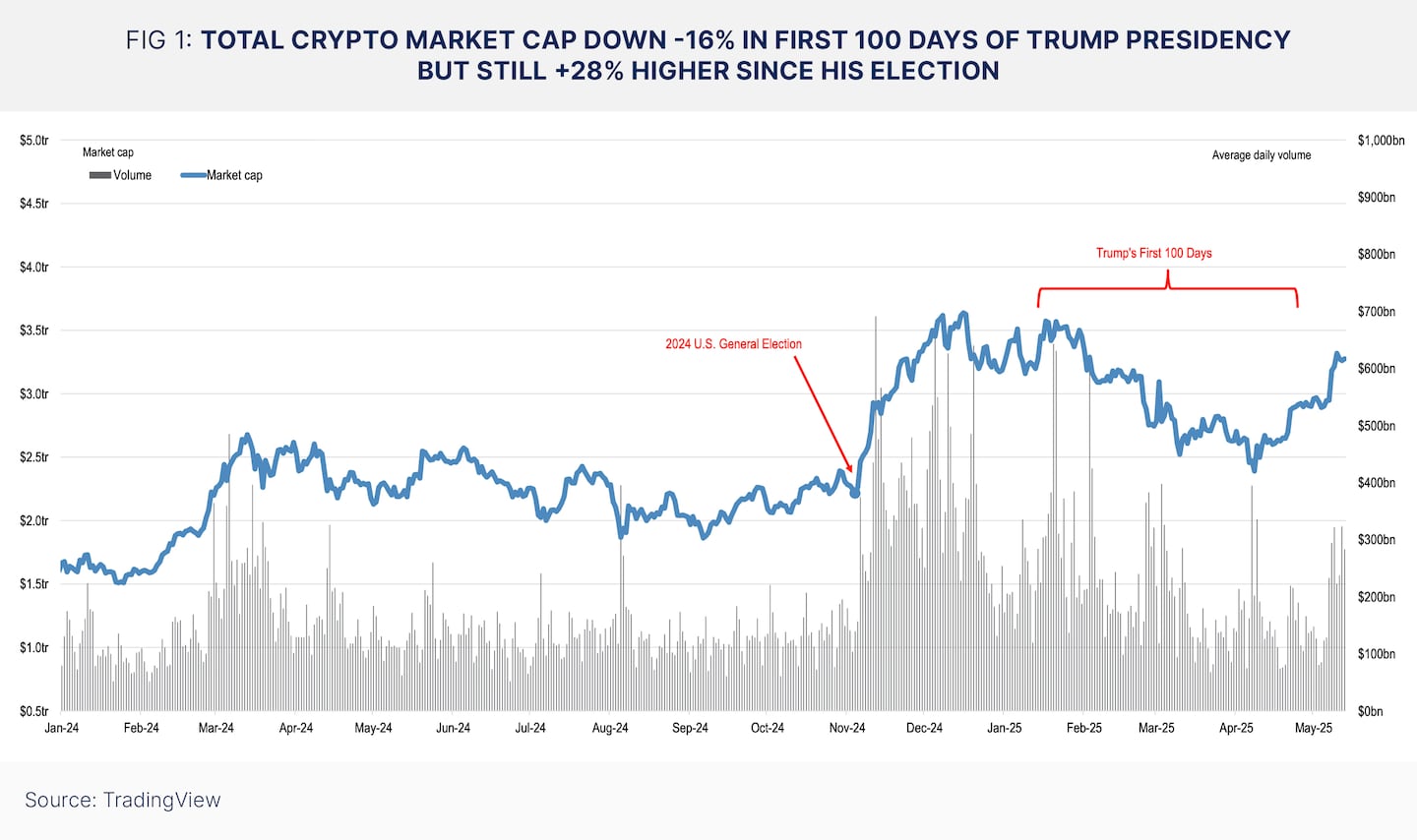

Trump touted pro-crypto policies, but failed to create an uptick in crypto prices or regulatory change in his first 100 days in office, JPMorgan wrote in a May 14 note.

Still, pessimism eased as Trump backed down on trade, and amid more signs of global crypto adoption from corporates and countries.

“The bull case for Bitcoin has never been stronger,” tweeted David Marcus, a former PayPal executive and a prominent Bitcoin backer, on May 10. “Buckle up.”

The top cryptocurrency is up 10% since the beginning of May and trading at $103,500.

JPMorgan highlighted six charts to outline its recovery.

Bitcoin’s big value

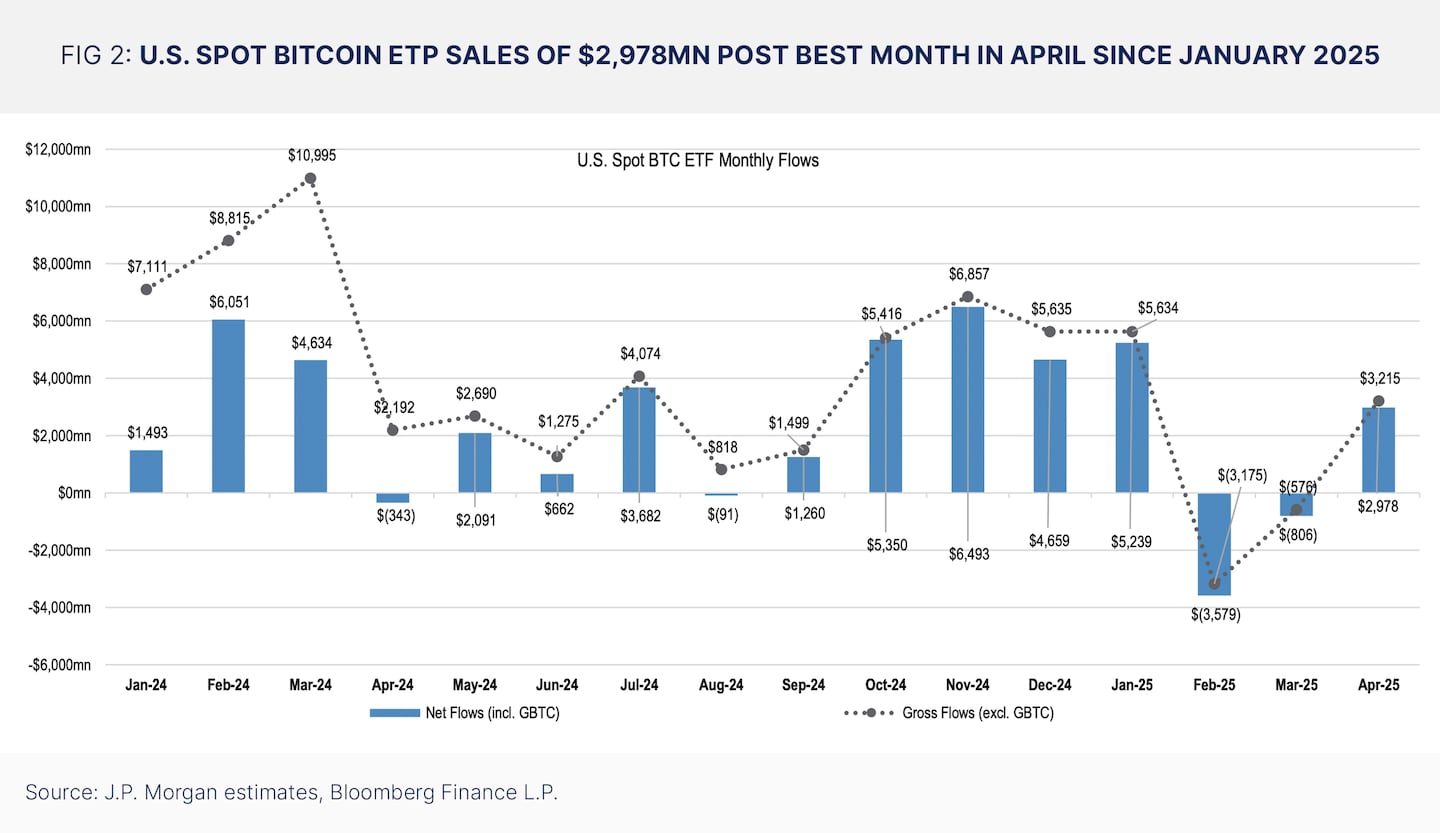

Bitcoin’s slump at the beginning of the year has now reversed, with inflows to exchange-traded products, including Bitcoin ETFs issued by BlackRock and Fidelity, flipping positive to post their best month since January.

BlackRock’s IBIT was the largest gainer by far in April. The fund took in 84% of the total flows to Bitcoin ETFs, which totalled $3 billion in April, JPMorgan wrote.

The overall Bitcoin ETF market is dominated by BlackRock’s IBIT, which has a 52% market share, according to Dune Analytics.

Bitcoin ETFs have drawn in a combined $96 billion since their 2024 launch, according to DefiLlama, By comparison, Ethereum ETFs have $5 billion in assets under management.

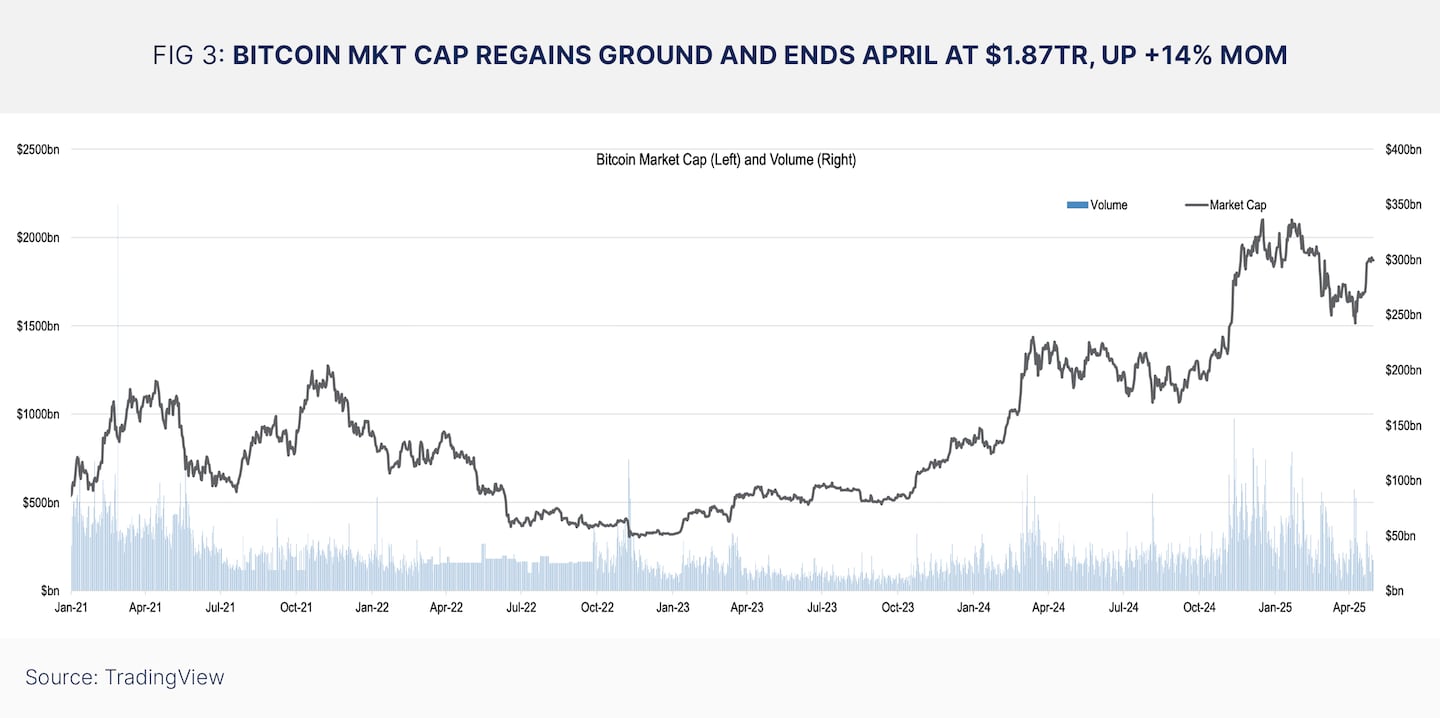

Bitcoin value ‘regains ground’

Trump’s tariff tumult defined April, which sent markets reeling before recent pauses and deals helped prices recover.

The tech-stacked Nasdaq, which Bitcoin historically tracks, spent a majority of April about 15% lower than its level on the day of Trump’s inauguration in January.

It’s since recovered, as Bitcoin has now thundered past $100,000.

Much of Bitcoin’s gains were “largely concentrated in the final week of the month,” JPMorgan wrote.

Comparison to gold

BlackRock CEO Larry Fink who have touted Bitcoin’s potential as is a safe haven asset like gold.

So far, that potential hasn’t manifested, JPMorgan found.

Meanwhile, Bitcoin has grown less volatile. JPMorgan notes that 30-day volatility for both Bitcoin and gold have fallen in tandem, according to CoinGlass.

Read More: Bitcoin’s stunning comeback in six charts – DL News