The “FinTech” (Financial Tech) revolution is taking over the financial world by progressively replacing, or at least forcing change upon, the incumbent players in the sector, older banks, insurance companies, and investment funds that were more focused on rent-seeking than innovation.

What started with just online payment with companies like PayPal (PYPL +2.49%) is now becoming a major force shaping the financial industry.

As a result, international money transfer, currency exchange, banking, and many other financial services are increasingly moving online and becoming quicker, cheaper, and more user-friendly.

In some regions of the world, this is an even more important change because a large part, if not most of the population, is unbanked and unable to access financial services at all. This has long hindered the economic growth of the so-called “Global South”, with a large part of its population having to pay exorbitant fees, reducing their capacity for saving, investing, or entrepreneurship.

“Those moneylenders applied up to 280% of the original value of money credited in 24 hours, which is extortion.

In the legal system, it’s around 2.5% monthly. So fintechs became a suitable option for millions of people.”

Eduardo Montañes Silva, CEO of Bogotá-based consultant LiSim International

Luckily, modern fintechs are working on changing that, and nowhere is it as visible as in Latin America, with a dominant player emerging: Nu Holding, and its subsidiary Nubank.

Nu Holdings Ltd. (NU +0.97%)

Challenges and Opportunities in Latin America’s Financial System

Latin American banks have historically mostly served the wealthier portion of the population, leaving out of the banking and financial system a large part of the people. While this has somewhat improved, it still leaves anywhere from 13%-60% of the population unbanked, depending on the country, while the region is home to almost 670 million people.

Source: USCB

The sector is still currently highly concentrated; for example, in Brazil, nearly 70% of deposits are held by the top three banks.

“A significant portion of the population, both consumers and small to medium-sized enterprises, still lack full access to traditional financial services, creating a substantial opportunity for fintechs offering innovative and accessible solutions.”

Andrés Fontao – co-founder of Finnovista, a Mexican venture capital firm focused on fintechs

As for the e-commerce sector, the slow arrival of the Internet, and then the explosion of smartphone usage has radically altered consumption pattern in the region.

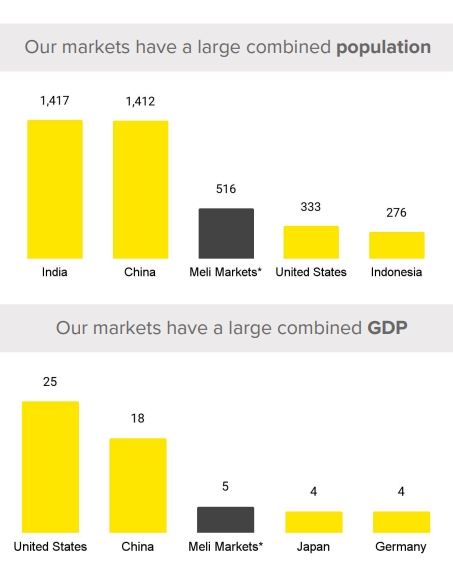

This is a phenomenon that has lifted other companies like MercadoLibre (MELI +1.2%), now a leader in e-commerce in the area, but also fintech (you can read more about MercadoLibre’s history and competitive position in our dedicated report).

Source: Mercado Libre

Latin America as a whole is growing, but slowly, with 2.4% GDP growth expected in 2025. The region’s average rate of informal employment will stand…

Read More: NuBank (NU): How Latin America’s Top Fintech Is Rebuilding Banking