By

Chau Anh

Sat, May 3, 2025 | 8:17 am GMT+7

Vietnam will roll out a two-year sandbox trial of peer-to-peer (P2P) lending, credit scoring, and data sharing via open application programming interfaces, starting July 1, according to a newly-issued government decree.

Decree 94, dated April 29, establishes a regulatory sandbox – a controlled testing mechanism – for fintech solutions in the banking industry.

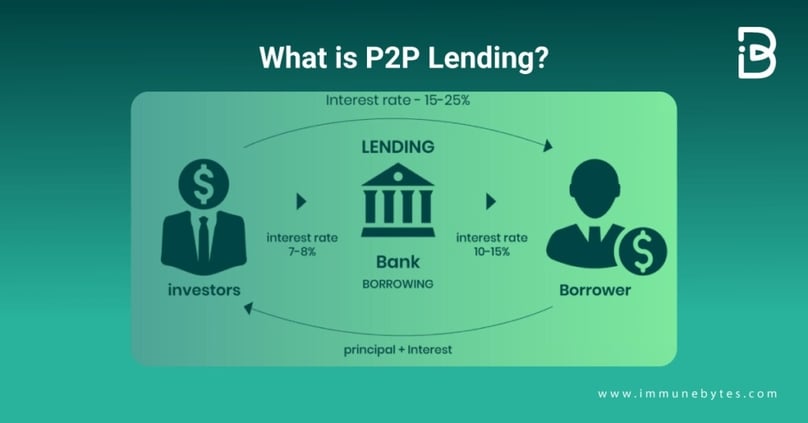

One of the fintech solutions approved for controlled trial is P2P lending that connects borrowers directly with lenders through an online platform, bypassing traditional financial institutions.

Only P2P lending companies licensed by the State Bank of Vietnam (SBV) – the central bank – will be allowed to operate. Foreign banks are excluded from participation.

Credit institutions and fintech firms can apply for the regulatory sandbox, but this does not guarantee their future compliance with business and investment regulations once formal laws are enacted.

The results of the trial will serve as the basis for regulators to research, develop, and refine the legal framework for this lending sector.

Vietnam will begin a two-year trial of peer-to-peer (P2P) lending in July 2025. Illustration courtesy of ImmuneBytes.

The latest decree also permits the trial of other fintech activities, including credit scoring and data sharing via open application programming interfaces (Open APIs).

Each fintech solution may be tested for up to two years, depending on the specific area and type of service, starting from the date the central bank issues a certificate of participation. However, the trial period may be extended in accordance with regulations.

The rollout of the fintech trial is limited to Vietnam’s territory and may not be conducted across borders.

P2P lending companies participating in the regulatory sandbox are prohibited from engaging in any business activities not specified in their participation certificate. They are also barred from providing guarantees for customer loans, acting as borrowers themselves, or offering P2P lending solutions to pawnshop businesses.

Credit institutions, foreign bank branches, and fintech companies that choose not to participate in the regulatory sandbox or have not been approved for it must operate in compliance with existing laws on enterprises and investment, and other relevant regulations,…

Read More: Vietnamese approves two-year sandbox trial of P2P lending