Report Overview

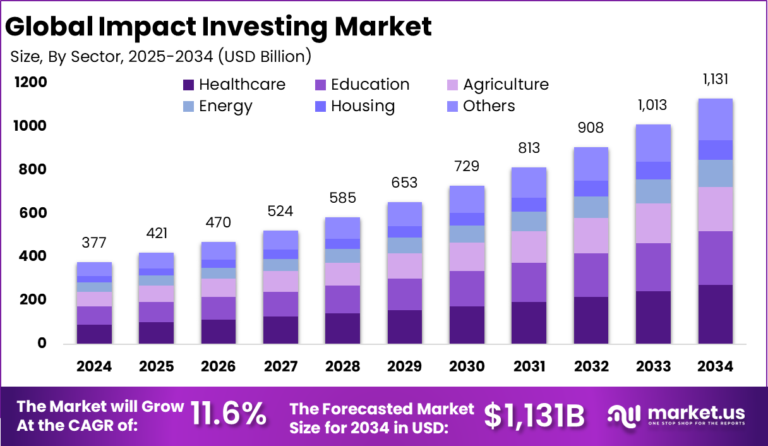

The Global Impact Investing Market size is expected to be worth around USD 1,131.0 Billion By 2034, from USD 377 billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 143.2 Billion revenue. In the United States, the market is valued at USD 136.0 Billion in 2024 and is projected to grow at a CAGR of 9.7% during the forecast period.

The impact investing market has experienced substantial growth, driven by investors seeking both financial returns and positive social or environmental outcomes. This dual objective has attracted a diverse range of investors, including institutional entities and high-net-worth individuals, who are increasingly aligning their investment strategies with sustainability goals.

The primary drivers of the impact investing market include the growing demand for sustainable investment options and the alignment with global sustainability objectives. Investors, particularly Millennials and Generation Z, are increasingly interested in investments that generate positive social and environmental outcomes alongside financial returns.

![]()

The Global Impact Investing Network (GIIN) reports a substantial footprint in the impact investing sector, with over 3,907 organizations worldwide managing an impressive $1.571 trillion USD in assets under management (AUM). A detailed breakdown reveals a concentration of these organizations in developed markets, with 45% based in Western, Northern, and Southern Europe, and 34% in the U.S. and Canada.

Conversely, impact investors with headquarters in emerging markets such as sub-Saharan Africa (6%), Southeast Asia (3%), and the Middle East and North Africa (2%) represent a smaller fraction of the total. Notably, organizations in developed regions are responsible for 95% of the observed AUM, while their counterparts in emerging markets manage a modest 5%.

According to Bank of America, 80% of young investors – mainly Millennials and Gen Z – are now actively interested in alternative investments, including commodities, private equity, and real estate, marking a significant departure from the traditional equity-heavy approach favored by older generations.

On average, young investors allocate 16% of their portfolios to these alternative assets – three times more than older investors – while allocating just 25% to stocks, which is half the proportion held by Baby Boomers. In contrast, older investors commit only 5% of their capital to alternatives and 55% to equities.

Interestingly, 75% of young investors believe that relying solely on traditional stocks and bonds is insufficient for achieving above-average returns. This generational change is unfolding against the backdrop of a projected transfer of nearly $84 trillion in U.S. personal wealth from Baby Boomers to Gen X and Millennials…

Read More: Impact Investing Market Size, Share