Key Insights

- The considerable ownership by retail investors in Edelweiss Financial Services indicates that they collectively have a greater say in management and business strategy

- 51% of the business is held by the top 10 shareholders

- Insiders own 31% of Edelweiss Financial Services

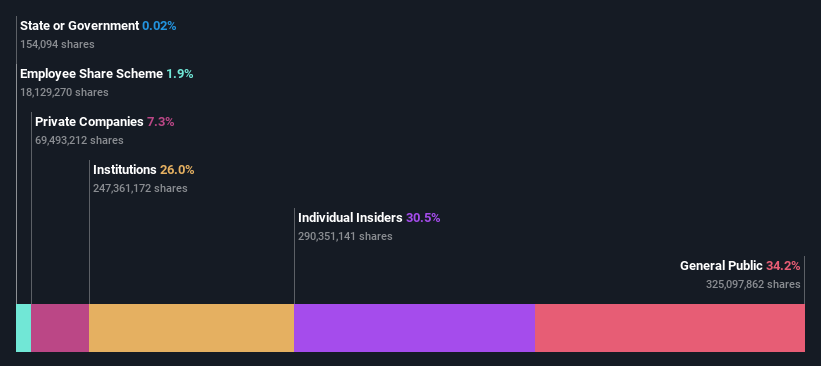

To get a sense of who is truly in control of Edelweiss Financial Services Limited (NSE:EDELWEISS), it is important to understand the ownership structure of the business. We can see that retail investors own the lion’s share in the company with 34% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

While retail investors were the group that benefitted the most from last week’s ₹4.7b market cap gain, insiders too had a 31% share in those profits.

In the chart below, we zoom in on the different ownership groups of Edelweiss Financial Services.

Check out our latest analysis for Edelweiss Financial Services

What Does The Institutional Ownership Tell Us About Edelweiss Financial Services?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

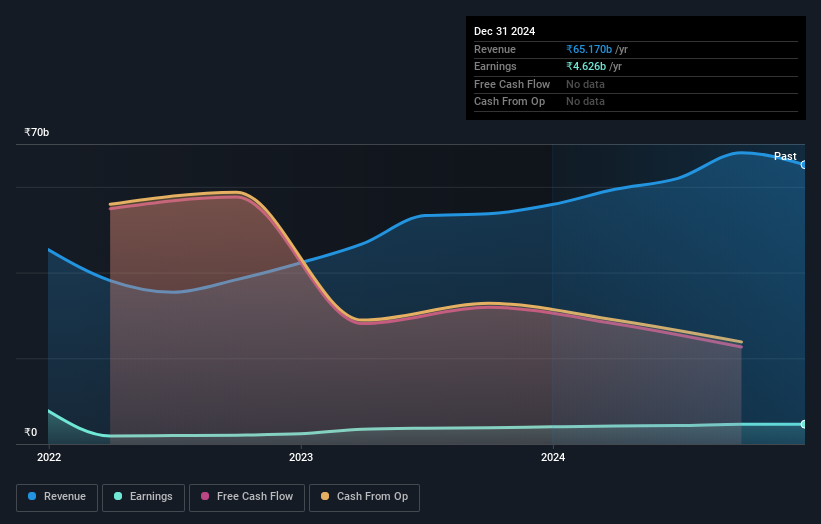

We can see that Edelweiss Financial Services does have institutional investors; and they hold a good portion of the company’s stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there’s always a risk that they are in a ‘crowded trade’. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Edelweiss Financial Services’ historic earnings and revenue below, but keep in mind there’s always more to the story.

Edelweiss Financial Services is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is the CEO Rashesh Shah with 15% of shares outstanding. Venkatchalam Ramaswamy is the second largest shareholder owning 7.5% of common stock, and CITIC Securities Company Limited, Asset Management Arm holds about 6.4% of the company stock. Interestingly, the second-largest shareholder, Venkatchalam Ramaswamy is also Top Key Executive, again, pointing towards strong insider ownership amongst the company’s top shareholders.

We also observed that the top 10 shareholders account for more than half of the share register, with a few smaller shareholders to balance the interests of the larger ones to a certain extent.

Researching institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be achieved by studying analyst sentiments. As far as we can tell there isn’t analyst coverage of the…

Read More: Retail investors who hold 34% of Edelweiss Financial Services Limited