The head of JPMorgan Chase and a potential Treasury secretary candidate says he’s gearing up for a “knife fight” with the country’s top consumer watchdog agency — just after a lobbying group he chairs sued the agency to protect a scheme that prevents consumers from switching banks and particularly benefits his own bank.

The attacks come as corporate interests explicitly call for the ouster of successful consumer protection reformers within the Biden administration — and suggest that no matter who wins the election, big banks will be angling to ensure they’re free to waylay and swindle their customers.

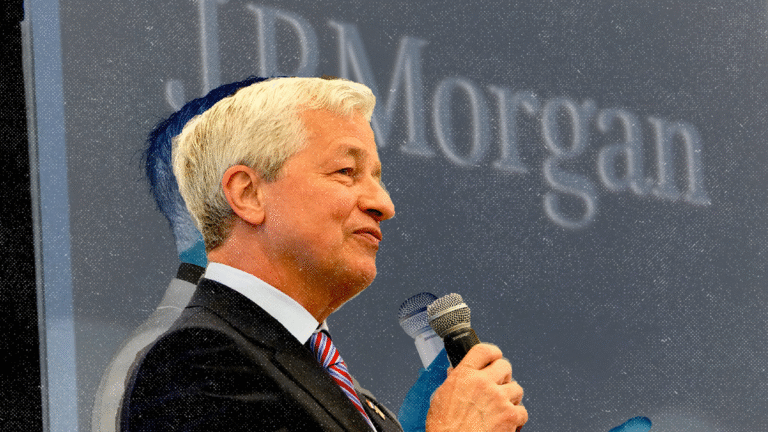

In a presentation on Monday with the American Bankers Association, a banking industry group, JPMorgan Chase CEO Jamie Dimon blasted the Consumer Financial Protection Bureau (CFPB), the federal consumer watchdog agency, and its director, Rohit Chopra, warning of an “onslaught” of regulation against banks.

“If you’re in a knife fight, you better damn well bring a knife,” Dimon said of industry efforts to stop regulators.

Part of that “onslaught” is a new CFPB rule that will make it far easier for consumers to change banks — a step toward an “open banking” system that was envisioned by financial reforms after the 2008 financial crisis, in which predatory lending caused banks to fail and led to a global economic meltdown. (That year, JPMorgan Chase, helmed by Dimon, received a $12 billion bailout from the Federal Reserve.)

The CFPB finalized this rule last week. To come into compliance, banks will now have to allow consumers to access their personal financial data and transfer it to a new bank quickly and free of charge, which proponents say will help free consumers who say they are trapped at their longtime banks. In theory, the increased consumer mobility will force banks to improve their offerings — incentivizing fewer fees, lower interest rates, and better services.

This inertia may be costing them tens of billions of dollars — and has made some banks like JPMorgan Chase the target of lawsuits against these lending practices.

“A lot of things that make it so frustrating and difficult to switch banks would be addressed in this rule,” said Emily Peterson-Cassin, the director of corporate power at Demand Progress, a progressive nonprofit. “It sure seems like Jamie Dimon does not like that.”

Indeed, the pushback from big banks — led by Dimon — has been swift.

“We’re going to fight,” Dimon said of the open banking rule at Monday’s event. “We’re going to win this one, too.”

Master Plan, an investigative podcast series years in the making from The Lever, reveals how political ideologues and corporate forces have spent years orchestrating a system of legalized corruption in America. We are exposing their scheme.

…

Read More: JPMorgan Chase CEO Vows “Knife Fight” To Keep Consumers Trapped