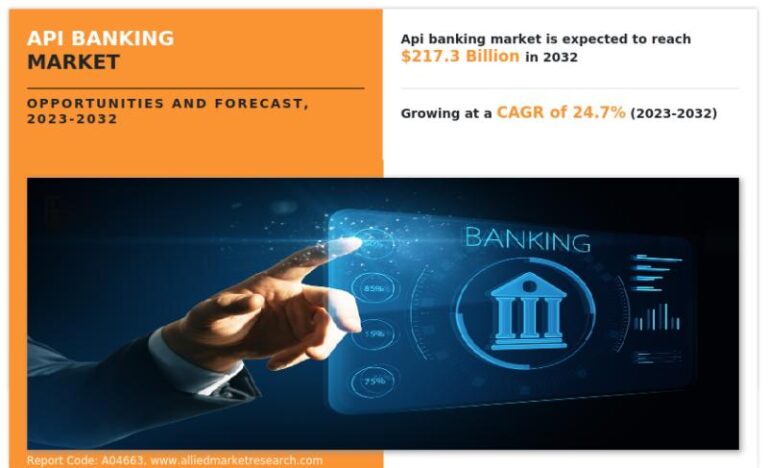

Allied Market Research published a report, titled, “API Banking Market by Component (Solution and Service), Deployment (On-premise and Cloud), and Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises): Global Opportunity Analysis and Industry Forecast, 2022-2032”. According to the report, the global API banking industry generated $24.7 billion in 2022, and is anticipated to generate $217.3 billion by 2032, witnessing a CAGR of 24.7% from 2023 to 2032.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/5025

Application programming interface (API) banking makes use of API (XML/JSON codes) for communication between bank and client servers, making data transfer between these two systems seamless, ensuring seamless and secured integration between the customer’s and bank’s systems. This ability of API banking helps the customers to perform banking transactions in an easy manner without switching between the enterprise resource planning (ERP) platform and the bank.

The rapid digital transformation in the banking and financial services industry is a major driver of the API banking industry. Banks are increasingly adopting API to enable seamless integration with third-party applications, allowing them to offer innovative digital services and enhance customer experience.

Prime determinants of growth

Open banking regulations, such as the European Union’s Revised Payment Services Directive (PSD2) and similar initiatives in other regions, are fueling the growth of the global API banking market. Furthermore, banks are investing heavily in digital transformation to meet evolving customer expectations and stay competitive, thus supplementing the market growth. Simultaneously, rapid advancements in technology such as cloud computing, big data analytics, and artificial intelligence (AI), have paved the way for lucrative opportunities in the industry. Changing customer expectations and preferences have also been instrumental in driving the adoption of API banking.

Covid-19 scenario

The COVID-19 pandemic had a positive impact on the API banking market size. The pandemic accelerated digital transformation, increased reliance on remote banking, fostered open banking initiatives, improved security measures, and drove collaboration between banks and FinTech start-ups.

However, the pandemic forced banks to accelerate their digital transformation efforts to ensure business continuity and meet changing customer needs. As physical branches faced restrictions and people increasingly relied on digital channels, banks needed to enhance their digital capabilities. API played a pivotal role in enabling faster development and integration of digital services, such as mobile banking apps, payment gateways, and online account access.

➡️𝐁𝐮𝐲…

Read More: API Banking Market Booms with 24.7% CAGR, Expected to Reach