Despite an already strong run, Capital Industrial Financial Services Group Limited (HKG:730) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it’s encouraging to see the stock is up 28% in the last year.

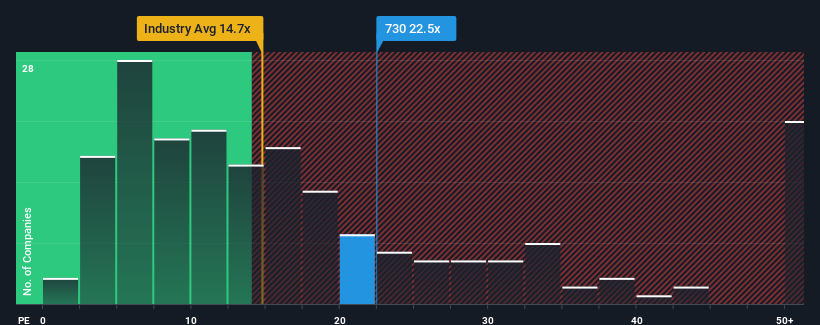

Following the firm bounce in price, Capital Industrial Financial Services Group’s price-to-earnings (or “P/E”) ratio of 22.5x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E’s below 5x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it’s justified.

We’d have to say that with no tangible growth over the last year, Capital Industrial Financial Services Group’s earnings have been unimpressive. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Capital Industrial Financial Services Group

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Capital Industrial Financial Services Group will help you shine a light on its historical performance.

Is There Enough Growth For Capital Industrial Financial Services Group?

In order to justify its P/E ratio, Capital Industrial Financial Services Group would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow EPS by an impressive 82% in total over the last three years. Therefore, it’s fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 22% growth in the next 12 months, the company’s momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it interesting that Capital Industrial Financial Services Group is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than recent times would indicate and aren’t willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

Capital Industrial Financial Services Group’s P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn’t be the defining factor in whether you buy a stock or not, it’s quite a capable barometer of earnings expectations.

Our examination of Capital…

Read More: Earnings Not Telling The Story For Capital Industrial Financial Services