Key Insights

- Significant insider control over China Financial Services Holdings implies vested interests in company growth

- A total of 2 investors have a majority stake in the company with 57% ownership

- Past performance of a company along with ownership data serve to give a strong idea about prospects for a business

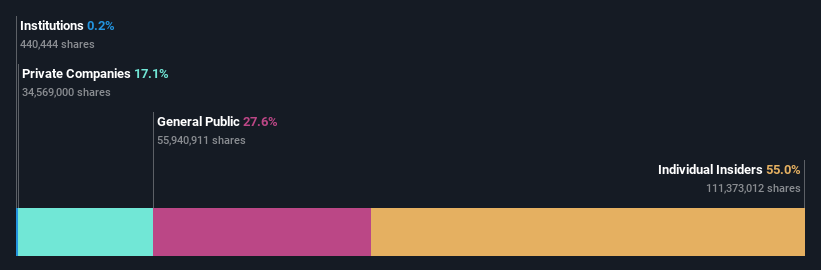

A look at the shareholders of China Financial Services Holdings Limited (HKG:605) can tell us which group is most powerful. With 55% stake, individual insiders possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

As a result, insiders were the biggest beneficiaries of last week’s 5,525% gain.

Let’s take a closer look to see what the different types of shareholders can tell us about China Financial Services Holdings.

View our latest analysis for China Financial Services Holdings

What Does The Lack Of Institutional Ownership Tell Us About China Financial Services Holdings?

We don’t tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it’s not particularly common.

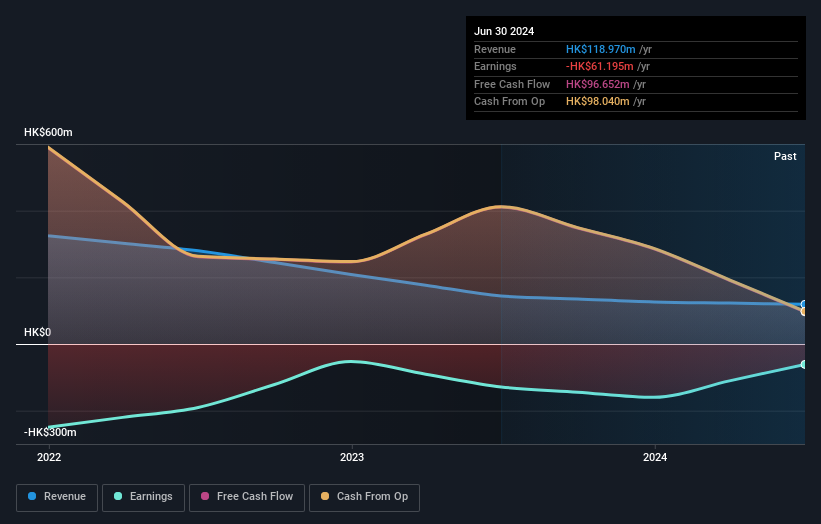

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don’t attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. On the other hand, it’s always possible that professional investors are avoiding a company because they don’t think it’s the best place for their money. China Financial Services Holdings’ earnings and revenue track record (below) may not be compelling to institutional investors — or they simply might not have looked at the business closely.

China Financial Services Holdings is not owned by hedge funds. Our data shows that Siu Lam Cheung is the largest shareholder with 43% of shares outstanding. With 15% and 13% of the shares outstanding respectively, China United SME Guarantee Corporation and Lo Wan are the second and third largest shareholders.

A more detailed study of the shareholder registry showed us that 2 of the top shareholders have a considerable amount of ownership in the company, via their 57% stake.

Researching institutional ownership is a good way to gauge and filter a stock’s expected performance. The same can be achieved by studying analyst sentiments. We’re not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of China Financial Services Holdings

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO…

Read More: Insiders with their considerable ownership were the key benefactors as