PM Images

The S&P 500 “SPX” (SP500) has had an excellent rebound, recovering most of its losses from the grizzly selloff in July and early August. We discussed staying calm during the market panic and that the early August capitulation-style selling was a buying opportunity instead of a sign to sell. Another fascinating element was the VIX, jumping to its highest level in years on news of a possible growth scare.

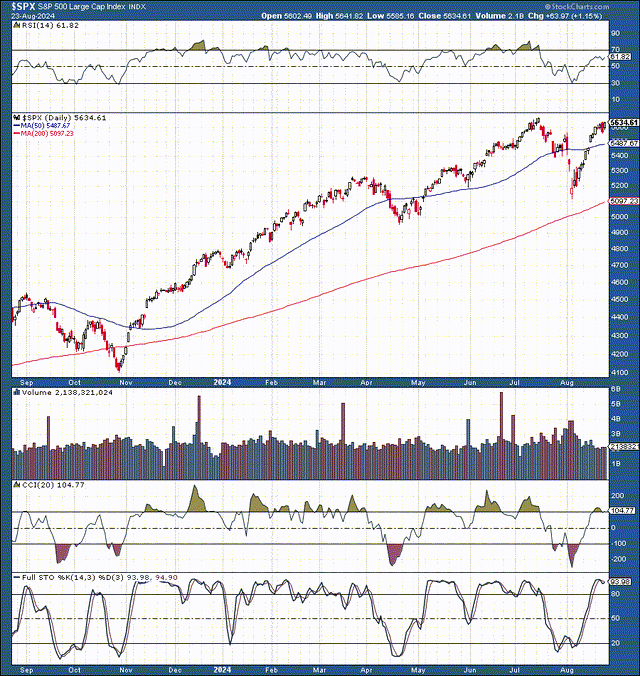

The SPX: 1-Year Chart

SPX (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools)

The SPX became highly overheated and needed to cool off. It went through a textbook technical 10% correction and then experienced a sharp V-shaped recovery. Also, we should consider that many market-leading stocks became significantly overbought after the late 2023 and 2024 rally.

Therefore, we needed most stocks to pull back technically and have their frothy valuations reset as well. Now that we’ve seen considerable corrections and valuation adjustments in many market-leading companies, we can focus on the factors that could propel stocks to new ATHs in H2.

The Fed’s transition to a more accessible monetary policy is a substantial catalyst for higher stock prices. However, we also need inflation to continue moderating without transitioning into deflation. The labor market must avoid deterioration, and corporate profits must stay in line or exceed the consensus estimates. We also need the AI growth engine and other pockets of the economy to continue expanding.

This constructive economic dynamic could enable the current bull cycle to continue expanding, leading the SPX and other major averages to new ATHs. Due to the solid fundamental backdrop and the improving technical image, I am adjusting my year-end SPX target slightly to 6,200 from the 6,000-6,200 range.

Crucial Data Week Ahead: Core-PCE Friday

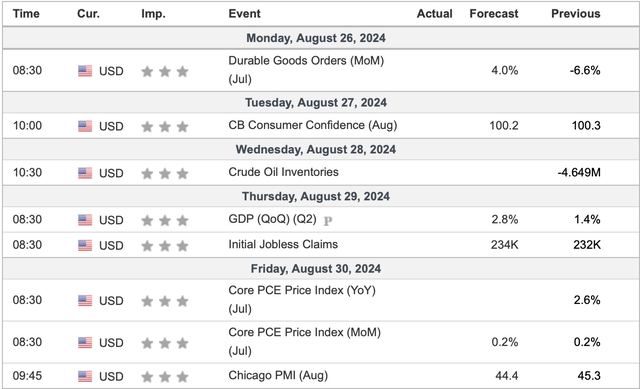

Data (Investing.com – Stock Market Quotes & Financial News)

We have a heavy economic data week. We kick off Monday with durable goods orders. On Tuesday, we will get another gauge of the consumer via the CB consumer confidence reading. On Wednesday, the market will receive the oil inventories. We will get the Q2 GDP reading on Thursday, and most importantly, on Friday, the market will receive the crucial inflation reading (core-PCE).

We need these crucial data points to remain around the estimates (not significantly lower). Since the market anticipates at least a 25Bps rate cut in September, “bad news” is not considered good news anymore. The greatest threat to market stability now is the risk of economic deterioration, which could lead to a recession instead of the soft landing scenario we want.

Nvidia’s Earnings Are On Deck

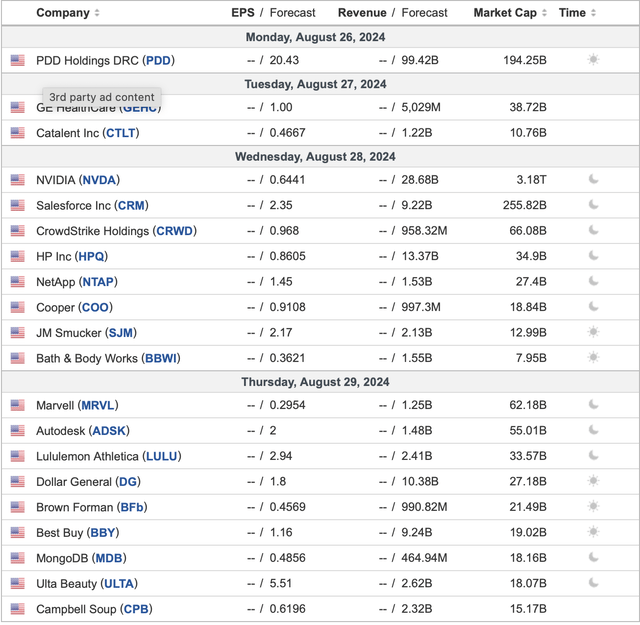

Earnings (Investing.com – Stock Market Quotes & Financial News)

While the broader earnings season is behind us, one of the most critical earnings announcements (possibly ever) is on deck. Nvidia (NVDA) is set to report its highly anticipated earnings after the bell on Wednesday. The primary reason why this earnings…

Read More: Moving Markets: PCE, GDP, And Nvidia’s Earnings This Week (SP500)