Most readers would already know that Hartford Financial Services Group’s (NYSE:HIG) stock increased by 7.1% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on Hartford Financial Services Group’s ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder’s equity.

See our latest analysis for Hartford Financial Services Group

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, based on the above formula, the ROE for Hartford Financial Services Group is:

19% = US$2.9b ÷ US$16b (Based on the trailing twelve months to June 2024).

The ‘return’ is the yearly profit. That means that for every $1 worth of shareholders’ equity, the company generated $0.19 in profit.

Why Is ROE Important For Earnings Growth?

So far, we’ve learned that ROE is a measure of a company’s profitability. Based on how much of its profits the company chooses to reinvest or “retain”, we are then able to evaluate a company’s future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don’t necessarily bear these characteristics.

A Side By Side comparison of Hartford Financial Services Group’s Earnings Growth And 19% ROE

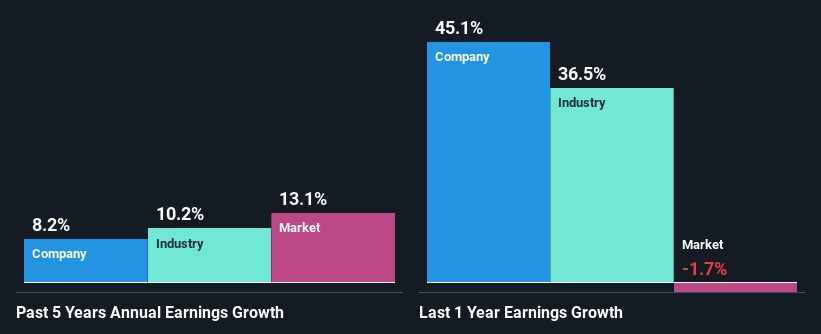

At first glance, Hartford Financial Services Group seems to have a decent ROE. Further, the company’s ROE compares quite favorably to the industry average of 13%. This certainly adds some context to Hartford Financial Services Group’s decent 8.2% net income growth seen over the past five years.

Next, on comparing Hartford Financial Services Group’s net income growth with the industry, we found that the company’s reported growth is similar to the industry average growth rate of 10% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Hartford Financial Services Group fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Hartford Financial Services Group Making Efficient Use Of Its Profits?

Hartford Financial Services Group has a low three-year median payout ratio of 23%, meaning that the company retains the remaining 77% of its profits. This suggests that the management is reinvesting most of the profits to grow the business.

Additionally, Hartford Financial Services Group has…

Read More: Is The Hartford Financial Services Group, Inc.’s (NYSE:HIG) Stock’s Recent