Key points:

-

Home ownership affordability in U.S. fell 2.6 percent in past

year - Home prices have reached record levels

-

Bridgeport, Connecticut, among cities with largest declines in

affordability

A key measure of housing affordability from the Federal Reserve Bank of

Atlanta suggests the dream of home ownership is becoming less realistic for

U.S. median-income households as both new and existing house prices have risen

sharply.

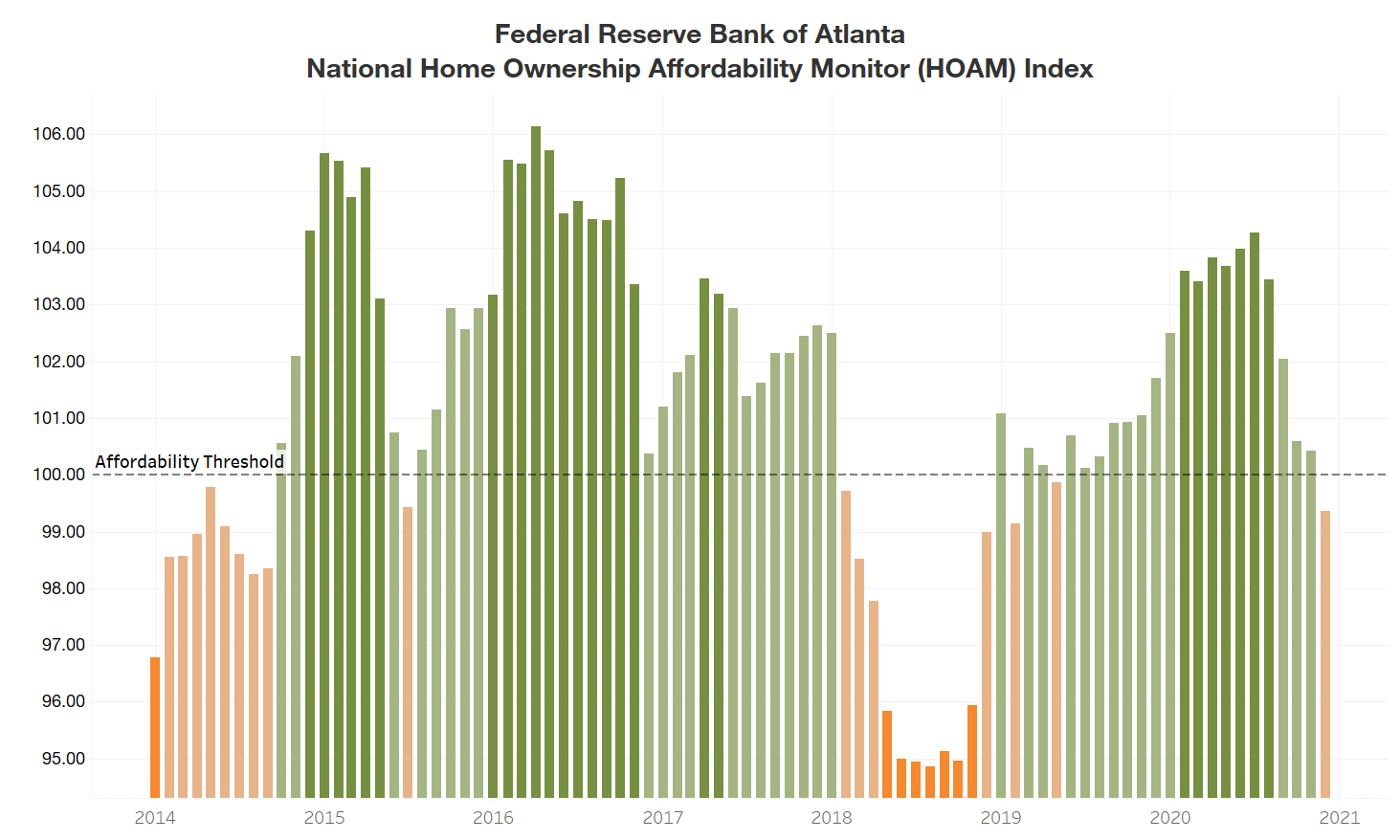

National affordability

The Atlanta Fed’s

Home Ownership Affordability Monitor

(HOAM) index shows that homes continue to become less affordable. Supplies of

existing and new homes have failed to keep pace with demand driven by

historically low interest rates. Consequently, home prices have climbed

sharply, greatly affecting what the average household can buy in today’s

market.

A HOAM index below 100 indicates that the median-priced home is unaffordable

to the median-income household given the current interest rate. In December,

the HOAM index fell below 100, indicating that the median-income household

cannot afford the median-priced home. At 99.36, the December HOAM index was

below its 101.71 reading a year earlier. Home ownership costs in December as

measured by principal and interest, taxes, and insurance accounted for 30.1

percent of the annual median income of the average U.S. household, slightly

above the 30 percent affordability threshold set by the U.S. Department of

Housing and Urban Development.

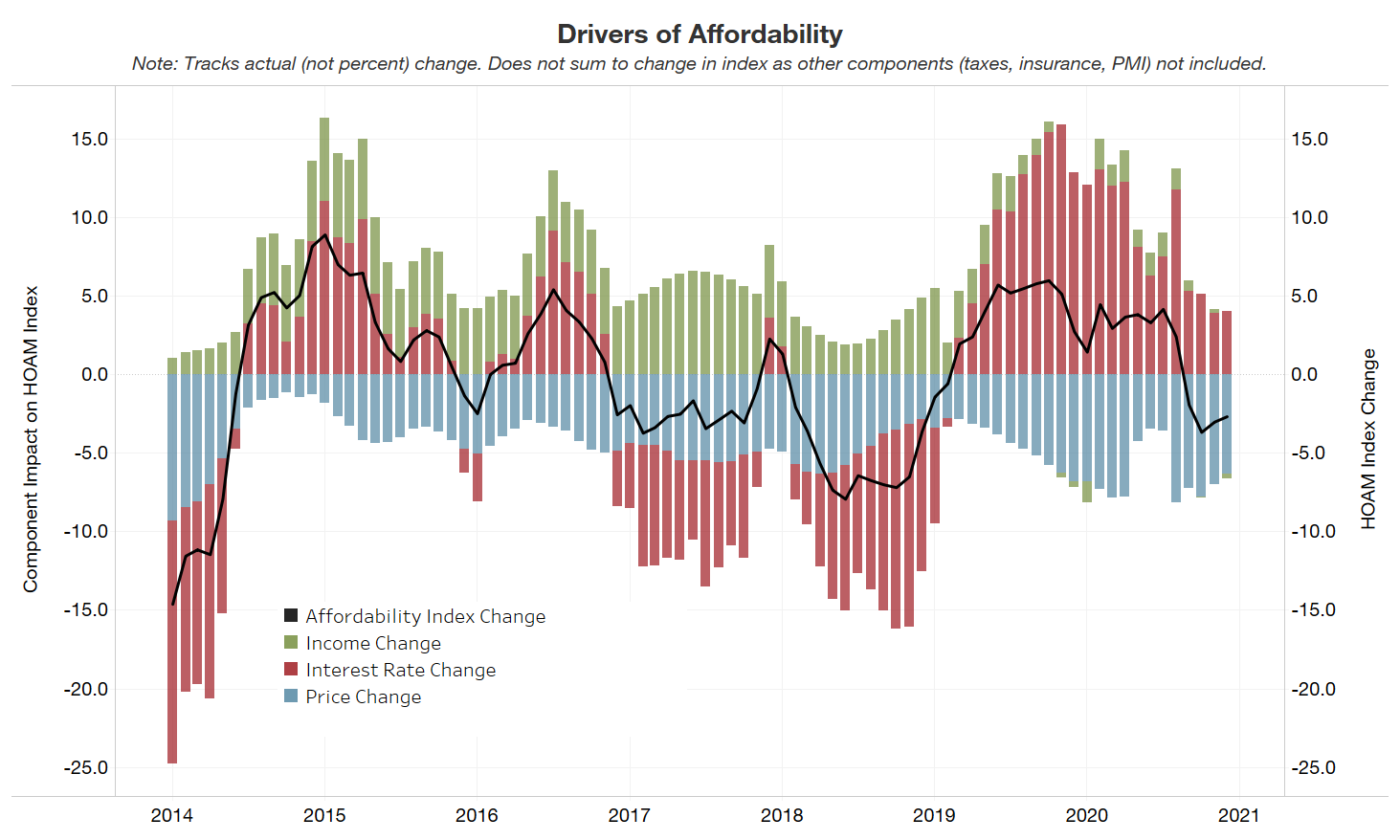

Relatively low interest rates have had a positive impact on affordability. In

December, the 30-year fixed mortgage interest rate dropped to 2.68 percent, 9

basis points lower than November and a decline of about 104 basis points from

December 2019. Meanwhile, throughout the pandemic, the projected national

median household income remained stable, increasing by only 0.6 percent to end

the year at $63,726. Still, any benefits from low interest rates and stable

household incomes continue to be offset by rapidly rising home prices. The

national median existing home price (three-month moving average) peaked at

$307,552 in December, up 2.07 percent from a revised $301,297 for November.

However, compared with a year ago, home prices rose 16 percent in December.

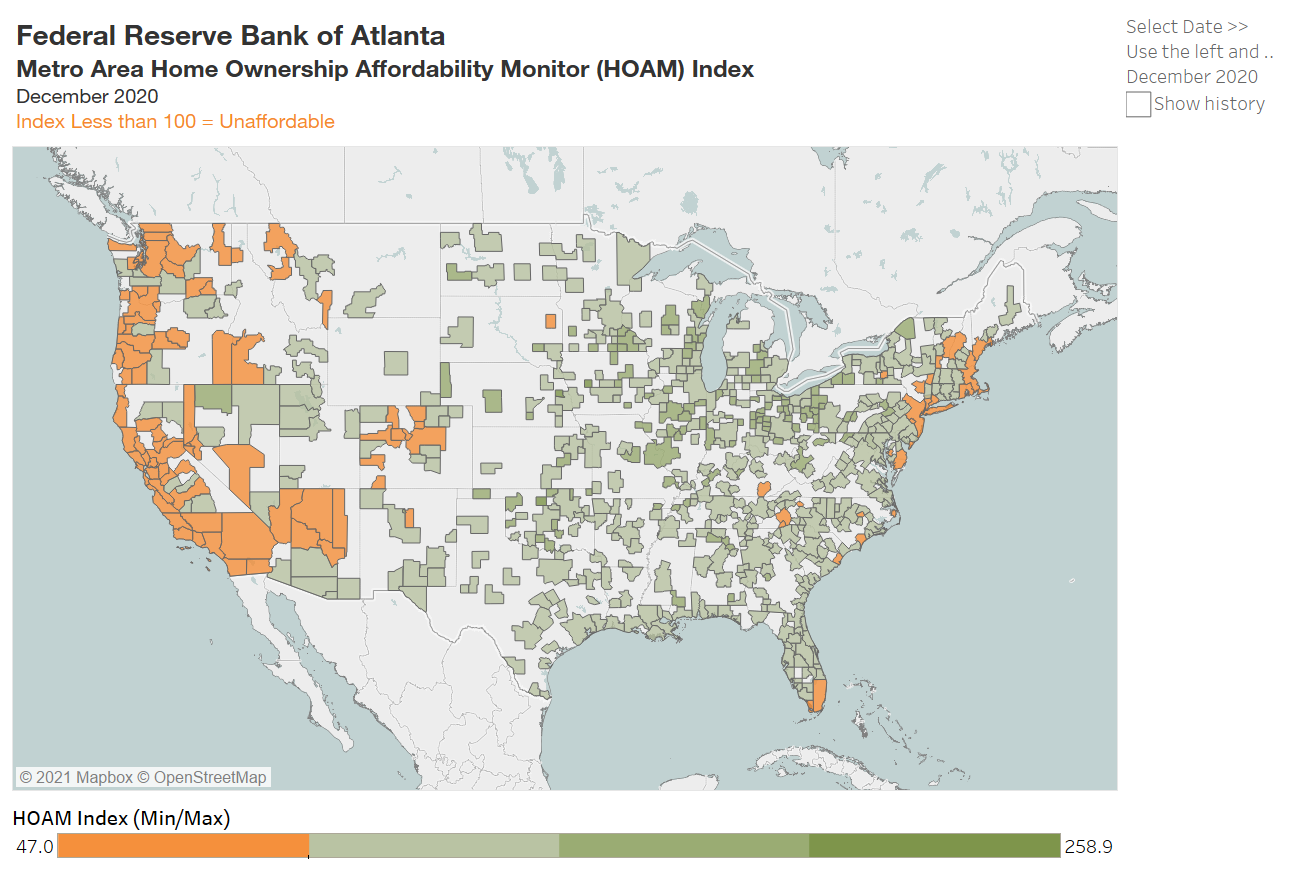

Regional affordability

In most regions, lower interest rates have helped keep housing affordable.

Only about 17 percent of metro areas in the United States had a HOAM index

below 100 in December. For the most part, high-cost metro areas on the West

Coast as well as in the Northeast and south Florida were among the least

affordable, while metros in the middle of the country, particularly in the

Midwest, tended to be the most affordable. Even so, the affordability trend in

many regions is eroding. In December, 33 percent of metro areas saw a decline

in affordability from the year…

Read More: Low Interest Rates, Inventories Affect Housing Affordability