Metro Atlanta homebuilder Piedmont Residential raised its new home prices because of higher lumber costs. One of its best-selling homes, which is pictured, is now priced in the $300,000 range, up from the low $200,000 range two years ago. Photo courtesy of Piedmont Residential

Tarla Atwell and her husband want to buy a home in a good school district in metropolitan Atlanta’s suburban Gwinnett County but can’t find one in their price range. When their agent locates a good prospect, the house already has several offers on the table by the time they arrive to tour it.

“There has not been much available, and if something is available, you have to bid over the asking price because of the competition,” said Atwell, an attorney who has been looking for at least a year. “It is frustrating, and we’re trying to exercise patience.”

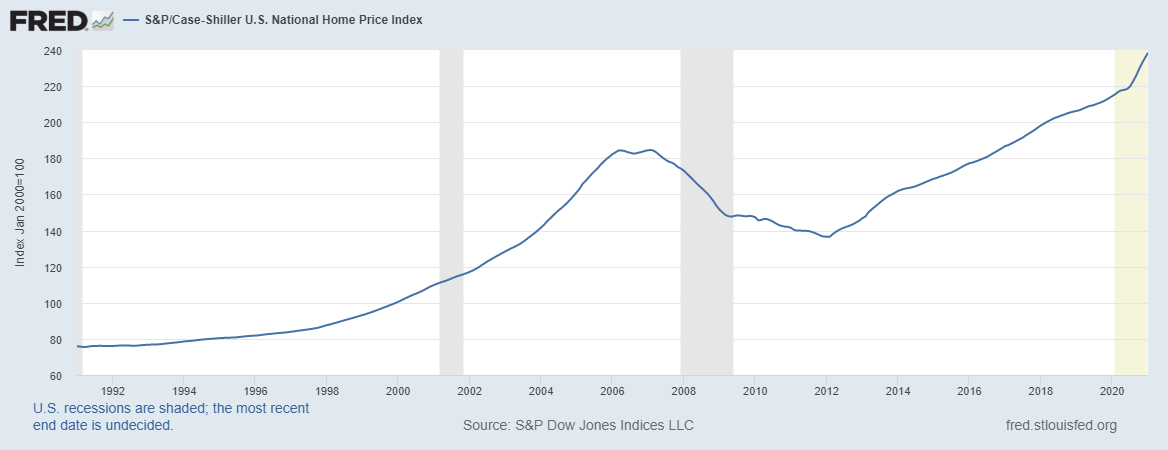

Atwell’s is not an isolated story. Many consumers looking to purchase a home are finding a similar situation. Historically low interest rates, a lean supply of available homes, and skyrocketing demand have brought dramatic changes to the housing market—one of those changes being upward price pressure. With house prices climbing at double-digit percentages in the past year, it’s becoming harder for many to realize the dream of home ownership.

“With the interest rates being at all-time lows, more people are able to become homeowners,” said Shantay Williams, a real estate agent in Birmingham, Alabama. “But the most desirable homes go fast.”

Atlanta Fed expert cites structural change

Domonic Purviance, a subject matter expert in the Atlanta Fed’s Supervision, Regulation, and Credit Division, attributes the current supply shortage to structural changes in the housing market. Fewer homes have been built since the Great Recession, and now, “so many people have refinanced their mortgages and locked into low rates, and there’s a disincentive for them to sell,” Purviance said.

Other factors are also hindering people like Atwell and her husband in their home searches: the COVID-19 pandemic has fueled a desire for more spacious homes and millennials are beginning to exert their influence on homebuying (see the chart). “The confluence of all these factors together makes this upward trend in the housing cycle very unique,” Purviance said.

Last year, Purviance and other researchers at the Atlanta Fed unveiled the Home Ownership Affordability Monitor (HOAM) index, an interactive tool that measures the ability of a median-income household to manage the costs of owning a median-price home in a given metropolitan area. The index shows that houses in the six states of the Atlanta Fed’s coverage area—Alabama, Florida, Georgia, Louisiana, Mississippi, and Tennessee—are mostly affordable. Still, Purviance cautions that house affordability is declining in pockets of major Southeast metros because of home-price growth.

The Atlanta Fed’s Domonic Purviance. Photo by…

Read More: For Many, Affordable Homes Becoming Scarcer