Key points

- National home ownership affordability fell 11.1 percent in July, the sharpest decline since 2013.

- Home price appreciation moderated in July, increasing 17.6 percent over the past year.

- A median-income household would need to spend 32.1 percent of its earnings to own the median-priced US home, the highest cost of ownership since 2008.

- Buyer sentiment is starting to weaken as concerns about decreasing affordability continue to rise.

Higher prices remain the most significant hurdle to home ownership for median-income households, the latest reading of an Atlanta Fed measure shows. For a growing share of consumers, higher home prices have negated the benefits from low interest rates and wage growth.

National affordability: Average home price tops $340,000

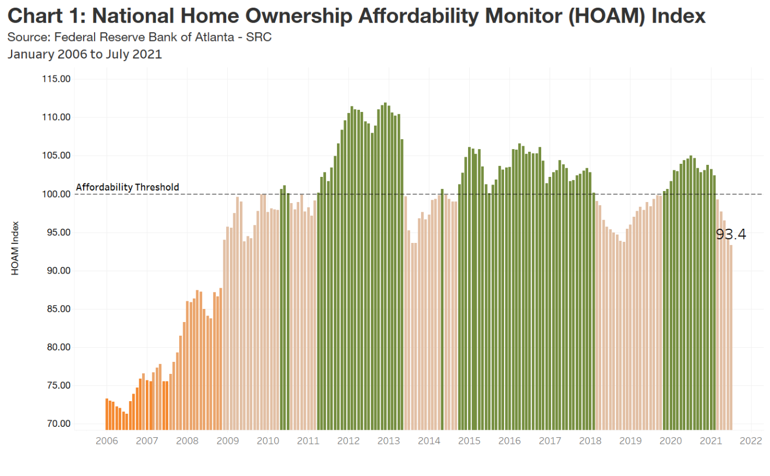

With a 93.4 rating in July, the Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor (HOAM) index fell to its lowest level since 2008 (see chart 1). A HOAM index reading below 100 is an indication that a median-income household cannot absorb the costs of owning a median-priced home on the market. The HOAM index has remained below 100 since March. Over the past year, US home ownership affordability dropped 11.1 percent as home prices sustained upward movement. Although the pace of home price growth has lessened, the median existing home sales price tag continues to increase, reaching a record $342,350 (three-month moving average) in July, according to data tracker CoreLogic. Despite still low 30-year fixed mortgage rates, the median-income US household would need to spend 32.1 percent of its annual income to own the median-priced home, above the 30 percent affordability threshold recommended by the federal Department of Housing and Urban Development.

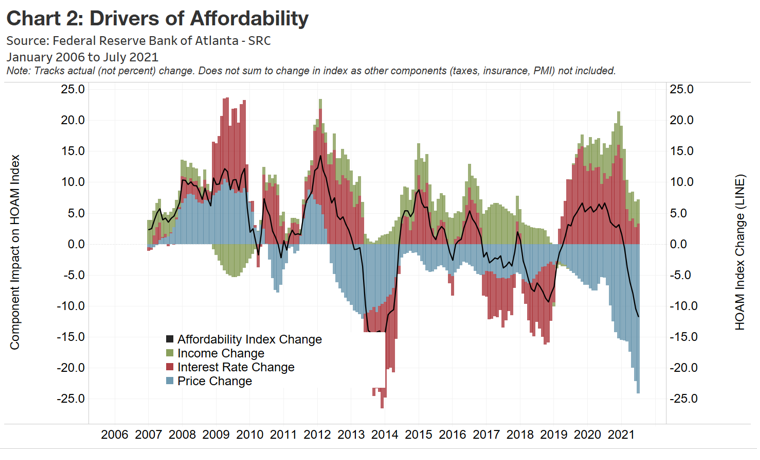

Historically low interest rates remain the primary driver of housing demand. Improving wage growth as the economy emerges from the coronavirus pandemic has helped households that are considering purchasing a home. However, for a growing share of those looking to purchase a home, rising home prices have erased the benefits of low rates and wage growth. (see chart 2).

Regional affordability: Midwest stands out

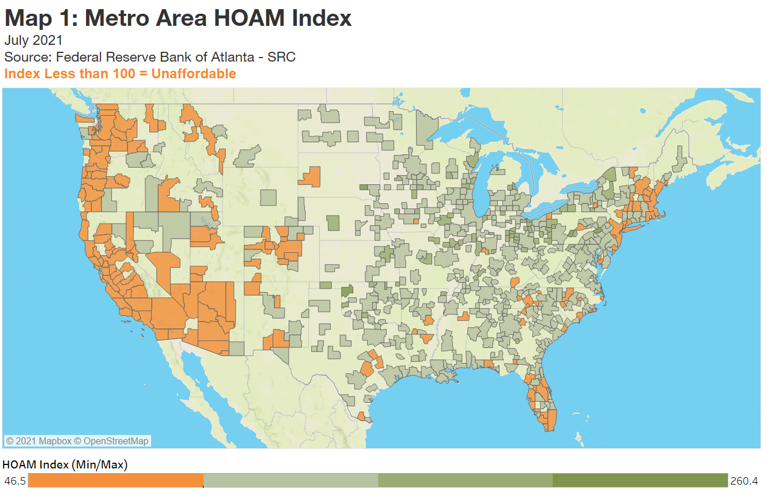

Although prices have risen across most US metropolitan areas, markets with more moderate price growth remain affordable. According to HOAM, Midwest metros tend to be among the most affordable in the country (see map 1). The Youngstown-Warren-Boardman area in northeast Ohio and western Pennsylvania remains the nation’s most affordable large metro. The median home sales price there was relatively low at $138,250 in July, and home price growth was flat over the past year. On average, owning a median-priced home in the market would consume 19.1 percent of the annual median household income ($49,287), the lowest cost of ownership among large US metros.

Alternatively, metros in California continue to be among the country’s least…

Read More: Soaring Home Prices Choke Affordability