Key points

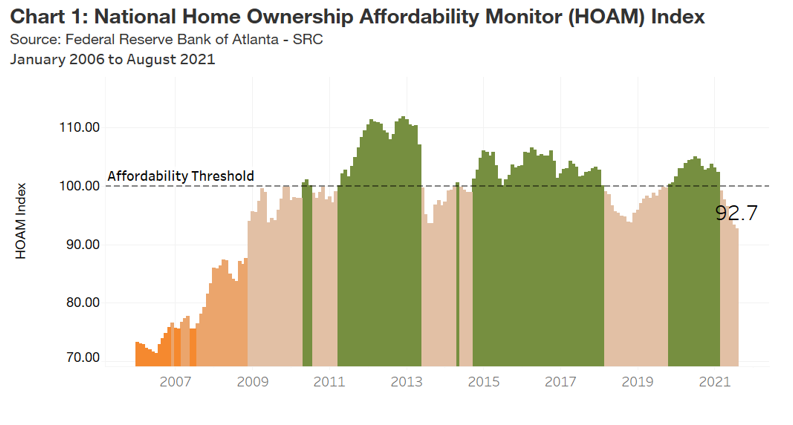

- National home ownership affordability fell 11.5 percent in August year over year, the sharpest decline since 2013.

- Home price appreciation moderated slightly in August but was still up 21.1 percent over the past year.

- A median-income household would need to spend 32.4 percent of its earnings to own a median-priced US home, the highest cost of ownership since 2008.

- Homebuyers are increasingly concerned about the decline in affordability and fewer believe it is a good time to buy.

National affordability: Affordability declines by 11.5 percent

Home ownership affordability continued to decline in August, according to the Federal Reserve Bank of Atlanta’s Home Ownership Affordability Monitor (HOAM) index. In August, the HOAM index dropped to 92.7, down 11.5 percent from August 2020 (see chart 1). Since March 2021, the HOAM index has remained below 100, which means a median-priced home on the market is unaffordable for a median-income US household. The median home price in August rose to $343,472 (3-month average), according to CoreLogic. This was up 21.1 percent over August 2020. Given current home prices, a median-income household would need to spend 32.4 percent of its annual income to own a median-priced home. This is above the 30 percent affordability threshold set by the US Department of Housing and Urban Development (HUD). The current share of income needed to afford a median-priced home remains at levels not seen since the last housing downturn in 2008.

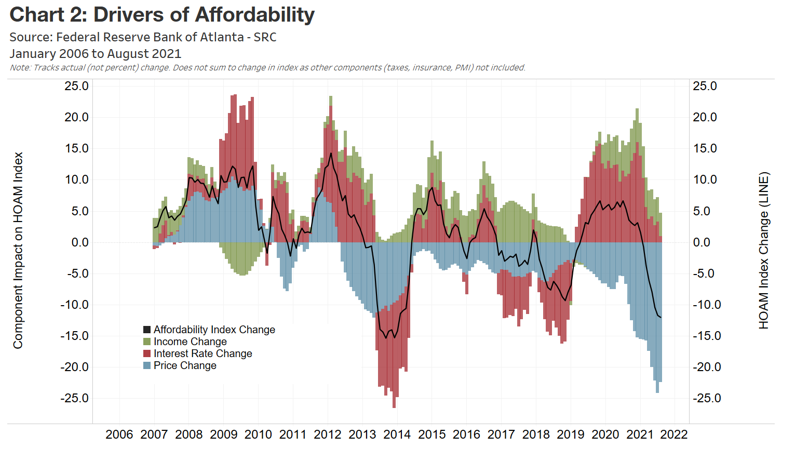

Although 30-year fixed mortgage interest rates have risen slightly, they remain near historic lows and remain a positive driver of affordability. Steady wage growth as the economy emerges from the COVID-19 pandemic-related slowdown has also added to the purchasing power of households considering buying a home. However, the benefits created by both low interest rates and higher wage growth for home ownership affordability have declined over the past few months (see chart 2). Perhaps more importantly, a sharp rise in home prices has offset whatever benefit potential homebuyers could have gained from lower rates and higher wages.

Regional affordability: Decline in affordability is widespread across most regions

Metro areas in the Midwest remain amongst the most affordable in the country (see map 1). The Youngstown-Warren-Boardman area in northeast Ohio and western Pennsylvania was the nation’s most affordable large metro in August, with a relatively low median home sales price at $150,750. On average, owning a median-priced home in the market would consume 20.8 percent of the area’s annual median household income ($49,331). Though remaining the most affordable large metro in the country, affordability in Youngstown declined by 5.9 percent over the past year as home prices in the area rose by 10.1 percent.

Metros in California continue to be among the country’s least affordable. With a median home price of…