Key points

-

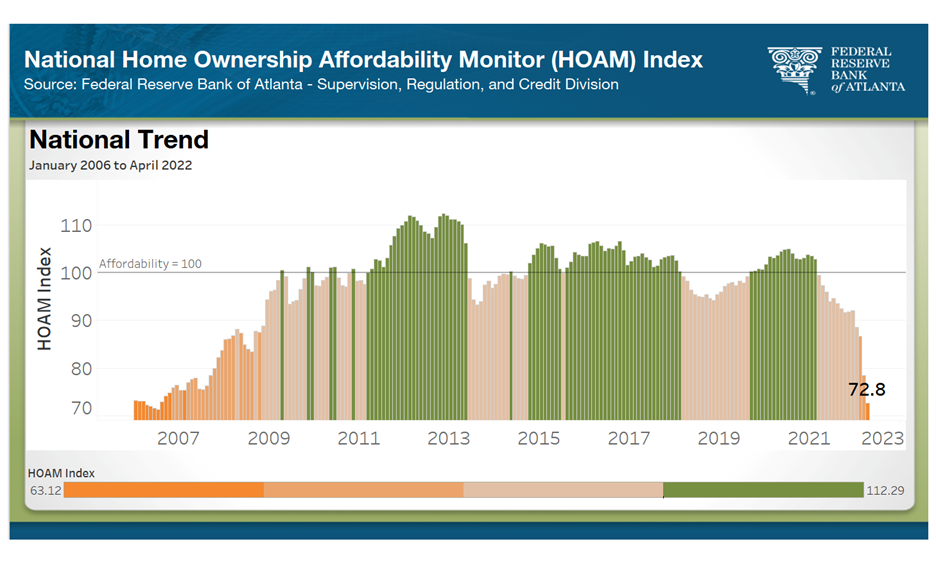

Higher home prices and higher interest rates have led to record declines in

home ownership affordability. -

The Atlanta Fed’s HOAM Index dropped in April to 72.8, its lowest

level since July 2006. -

Home ownership affordability declined by 25.2 percent in April compared to

one year earlier, the sharpest decline on record, going back to 2006. -

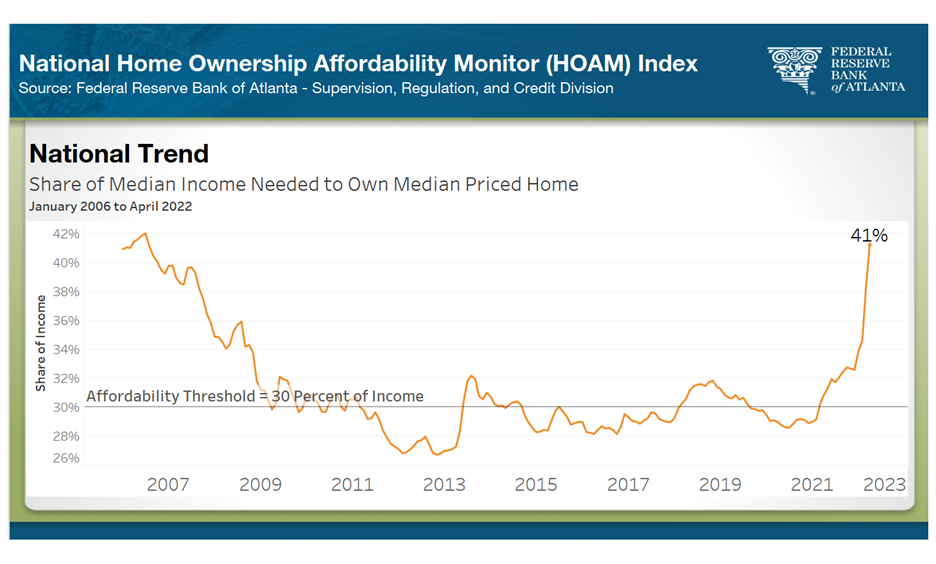

A median-income household would need to spend 41.2 percent of its income to

own a median-priced house, the highest share since August 2006. -

A household would need to pay $639 more per month to own a median-priced

home in April compared to a year ago, the largest increase on record.

Rapid deterioration in home ownership affordability is having a significant

impact on housing demand in the Sixth District and throughout the nation. As

more households are priced out of the market, many are concluding that now is

not a good time to buy.

National affordability: Affordability declines by record level

According to the Federal Reserve Bank of Atlanta’s

Home Ownership Affordability Monitor

(HOAM), affordability declined by 25.2 percent in April 2022 compared to a

year earlier. This is the largest decline on record, going back to 2006.

According to HOAM, the threshold for affordability is an index of 100. When

the index drops below 100, it means that a median-income household cannot

afford a median-priced home. Since February 2021, affordability has been below

the 100 threshold nationally. In April, the index dropped to 72.8 (see chart

1), its lowest since July 2006.

Chart 1

According to HOAM, owning a home is considered affordable if the annual cost

of ownership (that is, the total principal, interest, taxes, and insurance

payments) does not exceed 30 percent of household income. In April, a

median-income household needed to spend 41.2 percent of its annual income to

own a median-priced home, up from 31 percent in April 2021 (see chart 2). This

is the highest this measure has been since August 2006. To put this in

perspective, the average household would spend around $639 more per month to

own a median-priced home compared to a year ago. This is the sharpest

year-over-year change on record.

Chart 2

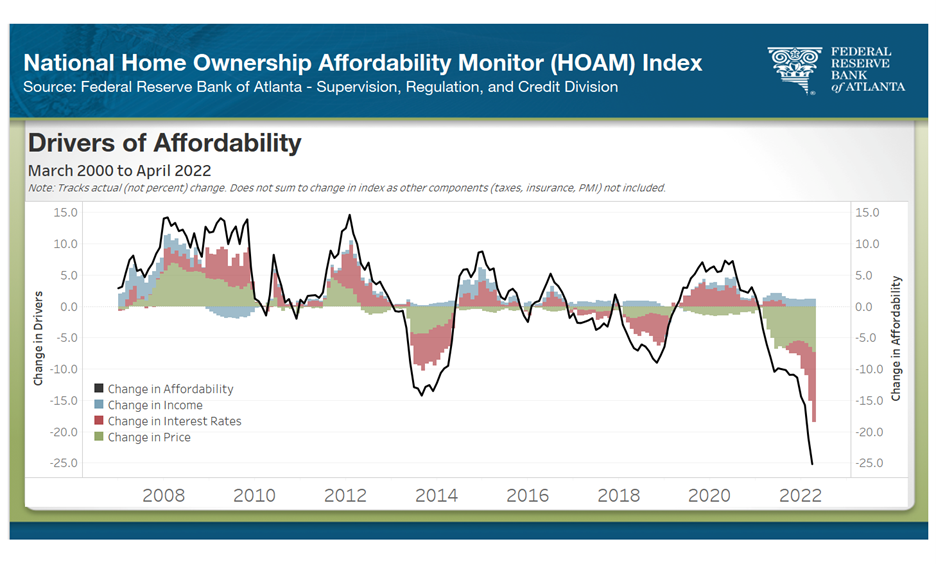

Primary causes of the decline in affordability have been rapid price

appreciation and the rise in interest rates since the beginning of the year

(see chart 3).

Chart 3

-

Home prices: After slowing through the beginning of 2022,

the rate of price appreciation has accelerated over the past few months. The

national median home price in April was up by 17 percent compared to one

year earlier. Meanwhile, the median home price reached $368,667 (three-month

average) and the median total monthly payment (including principal,

interest, taxes, and insurance) rose to $2,350 per month. Both are record

levels. In…

Read More: Home Ownership Affordability Declines by Record Levels