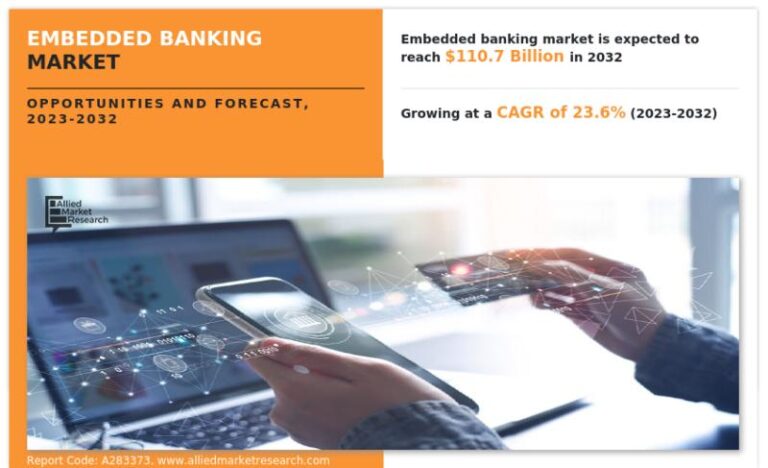

The global embedded banking market report published by Allied Market Research indicates that the industry is expected to showcase a noteworthy CAGR of 23.6% with a revenue of $110.7 billion by 2032.

โ๐๐๐ช๐ฎ๐๐ฌ๐ญ ๐๐๐ฌ๐๐๐ซ๐๐ก ๐๐๐ฉ๐จ๐ซ๐ญ ๐๐๐ฆ๐ฉ๐ฅ๐ & ๐๐๐ : https://www.alliedmarketresearch.com/request-sample/A283373

The market generated $13.6 billion in 2022. The study is a valuable resource for new entrants, shareholders, investors, and businesses, providing a detailed understanding of the landscape. It enables them to make informed decisions and educated business choices aligned with their goals.

The research covers a wide range of aspects, including insights into the overall market structure and size, accurate forecasts regarding production and sales volume, the market’s future potential, and the associated risks and hazards. Additionally, the study focuses on key market segments, highlighting both driving and restraining factors. The market is witnessing transformation due to improved customer experience, digitalization in the banking industry, and a surge in the trend of the BaaS platform.

However, the industry is facing a downturn due to a lack of data privacy, security, and awareness in emerging countries. Nevertheless, diversified revenue streams for non-banking entities are anticipated to offer lucrative opportunities for growth of the industry in the upcoming era.

Futuristic trends in the industry

Customization for enhanced customer experience

Embedded banking services focus on personalization and customer experience. By utilizing data analytics and artificial intelligence, providers offer customized financial recommendations, anticipate user needs, and deliver intuitive user interfaces, thereby enhancing engagement and satisfaction.

โ๐๐ง๐ช๐ฎ๐ข๐ซ๐ ๐๐๐๐จ๐ซ๐ ๐๐ฎ๐ฒ๐ข๐ง๐ : https://www.alliedmarketresearch.com/purchase-enquiry/A283373

BNPL model : BNPL is rapidly gaining popularity, allowing customers to split payments into interest-free installments at the point of sale. This enhances user experience and customer loyalty by encouraging repeat purchases. Integrating embedded finance with BNPL provides more payment options at checkout, reduces the risk of chargebacks, and offers payment methods that fit their budgets.

Industry highlights

In April 2024, Finzly, a provider of modern money movement systems to financial institutions, launched Account Galaxyโข, a solution aimed at equipping banks of all sizes with the tools and technology necessary to participate in the emerging embedded banking segment.

PNC partnered with the treasury platform Koxa in March 2024 to introduce an embedded banking offering. The integration targets PNC clients utilizing the Workday enterprise resource planning (ERP) system.

The payment processing segment…

Read More: An Overview of Key Aspects Influencing