It’s common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital – so investors should be cautious that they’re not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Tidewater (NYSE:TDW). While this doesn’t necessarily speak to whether it’s undervalued, the profitability of the business is enough to warrant some appreciation – especially if its growing.

View our latest analysis for Tidewater

How Fast Is Tidewater Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It’s an outstanding feat for Tidewater to have grown EPS from US$0.025 to US$2.53 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Tidewater shareholders can take confidence from the fact that EBIT margins are up from 6.9% to 20%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

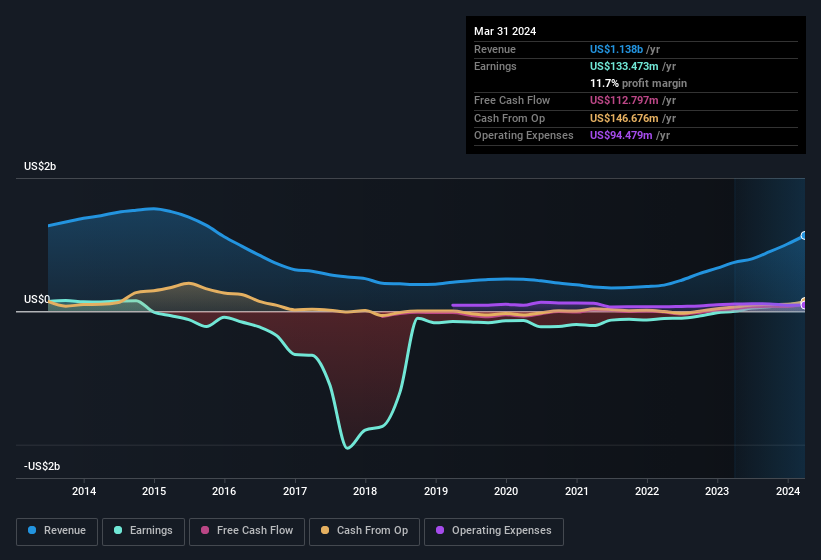

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there’s little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Tidewater?

Are Tidewater Insiders Aligned With All Shareholders?

Since Tidewater has a market capitalisation of US$5.1b, we wouldn’t expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it’s pleasing to see that there are still incentives to align their actions with the shareholders. Holding US$97m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. That’s certainly enough to let shareholders know that management will be very focussed on long term growth.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations between US$4.0b and US$12b, like Tidewater,…

Read More: Do Tidewater’s (NYSE:TDW) Earnings Warrant Your Attention?