For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, you risk returning less than the market. We regret to report that long term Provident Financial Services, Inc. (NYSE:PFS) shareholders have had that experience, with the share price dropping 45% in three years, versus a market return of about 18%. More recently, the share price has dropped a further 13% in a month.

With the stock having lost 5.1% in the past week, it’s worth taking a look at business performance and seeing if there’s any red flags.

See our latest analysis for Provident Financial Services

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

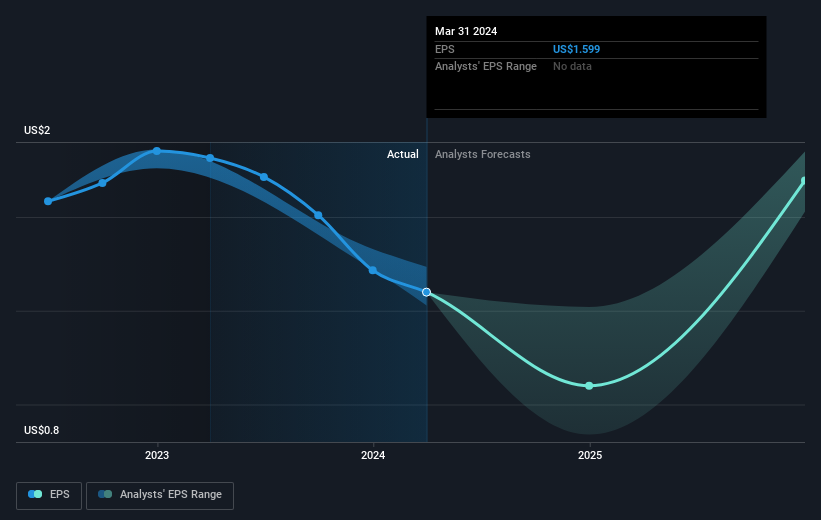

Provident Financial Services saw its EPS decline at a compound rate of 4.1% per year, over the last three years. This reduction in EPS is slower than the 18% annual reduction in the share price. So it seems the market was too confident about the business, in the past. The less favorable sentiment is reflected in its current P/E ratio of 8.63.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Provident Financial Services’ earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It’s fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Provident Financial Services’ TSR for the last 3 years was -36%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 24% in the last year, Provident Financial Services shareholders lost 20% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year’s performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should “buy when there is blood…

Read More: Provident Financial Services (NYSE:PFS) stock falls 5.1% in past week as