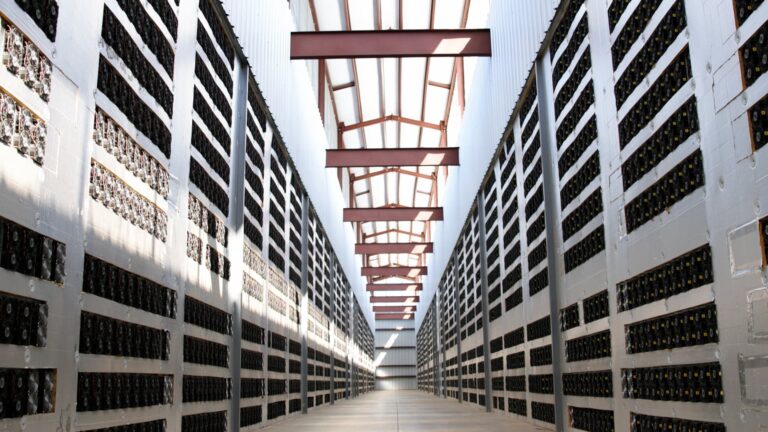

Core Scientific’s 104 megawatt Bitcoin mining data center in Marble, North Carolina

Carey McKelvey

AUSTIN — For five years, bitcoin miner Core Scientific has quietly been diversifying out of mining and into artificial intelligence, a market that will require immense amounts of power to handle the training of AI models and the massive workloads that follow.

The move is no longer a secret.

On Monday, Core Scientific announced a 12-year deal with cloud provider CoreWeave to provide infrastructure for use cases like machine learning. Core Scientific said the agreement, which expands upon an existing partnership between the two companies, will add revenue of more than $3.5 billion over the course of the contract.

CoreWeave, backed by Nvidia, rents out graphics processing units (GPUs), which are needed for training and running AI models. CoreWeave was valued at $19 billion in a funding round last month. Core Scientific will deliver about 200 megawatts of infrastructure to CoreWeave’s operations.

Core Scientific, which emerged from bankruptcy in January, has been mining a mix of digital assets since 2017. The company began to diversify into other services in 2019.

“The best way to think about bitcoin mining facilities is that we are essentially power shells to the data center industry,” Core Scientific CEO Adam Sullivan told CNBC.

Sullivan jumped into the role of CEO while the company was still in the throes of bankruptcy, which resulted from the collapse of bitcoin in 2022. Since then, the former investment banker has settled debts with angry lenders and further beefed up the company’s non-bitcoin business as it reentered the public market.

Though Core is up more than 40% since relisting earlier this year, its market capitalization of around $865 million is significantly lower than its valuation of $4.3 billion in July 2021.

Demand for AI compute and infrastructure surged after OpenAI unveiled ChatGPT in Nov. 2022, setting off a rush of investment in AI models and startups. Meanwhile, Core Scientific and other miners like Bit Digital, Hive, Hut 8, and TeraWulf have been looking to bolster their revenue streams after the so-called bitcoin halving in April cut rewards paid out to bitcoin miners by 50%.

Many have been retrofitting their massive facilities to meet the needs of the market.

“Bitcoin miners, often stationed in energy-secure and energy-intensive data centers, find these facilities ideal for AI operations as well,” said James Butterfill, head of research at digital asset firm CoinShares.

Butterfill said the the overlap is leading to a competition for rack space between bitcoin mining and AI activities. While AI operations require up to 20 times the capital expenditure of bitcoin mining, they’re more profitable, according to a report from CoinShares.

“The introduction of AI activities leads to increased depreciation and amortization, which can enhance gross profit margins,” Butterfill said.

According to CoinShares, Bit Digital derives 27% of its revenue…

Read More: Bitcoin miners sink millions into AI business, seek billions in return