Comcast beat first-quarter earnings expectations on Thursday as broadband drove revenue even as the company and its peers have seen customer growth slow.

Here is how Comcast performed, compared with estimates from analysts surveyed by LSEG:

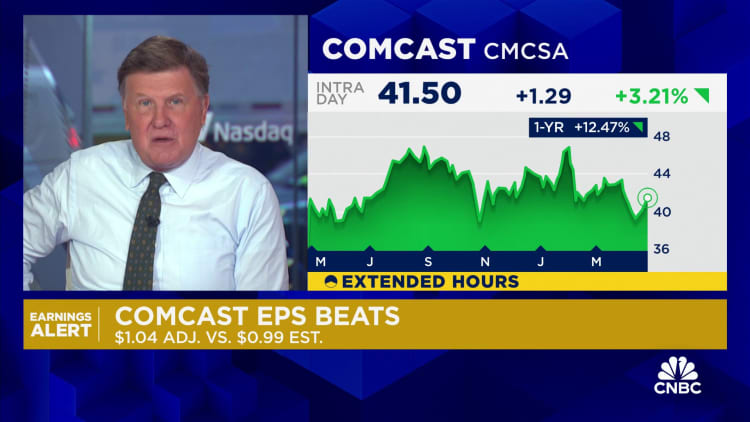

- Earnings per share: $1.04 adjusted vs. 99 cents expected

- Revenue: $30.06 billion vs. $29.81 billion expected

For the quarter that ended March 31, net income rose 0.6% to $3.86 billion, or 97 cents a share, compared with $3.83 billion, or 91 cents a share, a year earlier. Adjusted earnings before interest, taxes, depreciation and amortization, or EBITDA, slid 0.6% to roughly $9.4 billion.

The company’s revenue grew 1.2% to $30.06 billion compared to the same period last year. Revenue from the domestic broadband customers segment boosted that growth as rates increased, even as Comcast lost 65,000 customers during the quarter.

Comcast’s stock was trading down about 6% on Thursday.

Broadband struggles

Cable broadband companies’ customer additions have slumped in recent quarters and weighed on stock prices.

The slowdown in the buying and selling of houses due to high interest rates has led to a decline in new home internet connections. Cable providers have also been hit with heightened competition for home broadband from wireless companies such as T-Mobile and Verizon.

Mike Cavanagh, president of Comcast, said on Thursday’s earnings call that the market is “extremely competitive,” especially for “cost-conscious customers.”

Earlier this month, Comcast said it would launch NOW, a prepaid and month-to-month low-cost internet and phone plan program. The plan is designed to provide fixed wireless options at a low cost.

The plan supplements Comcast’s long-standing internet option for low-income customers, called Internet Essentials.

Company executives do not expect an improvement in the near term, particularly with the expected end of the federal government’s Affordable Connectivity Program, or ACP, which offers a $30 discount on broadband services to qualifying low-income households, in April.

Comcast’s wireless business saw a 21% increase in customers during the quarter to 6.9 million total lines. The company lost 487,000 cable TV customers during the quarter as consumers continued to cut the cord in favor of streaming.

Hot films, cooling theme parks

A billboard for the movie “Oppenheimer” in Times Square, New York City, on July 29, 2023.

Adam Jeffery | CNBC

The company’s theme parks adjusted EBITDA fell 3.9% to $632 million during the quarter, due to an increase in operating expenses such as higher marketing and promotion costs, as well as the negative effect of foreign currency.

On Thursday, Cavanagh noted attendance at the Orlando theme park “felt some pressure” in the most recent quarter, as the company is in between introducing new attractions. He added the company is confident about long-term growth and future opportunities for its parks.

Increased competition, particularly from cruises, also weighed on theme parks, Comcast…

Read More: Comcast (CMCSA) earnings Q1 2024