The Swedish “buy now, pay later” pioneer said Tuesday that its new design would help users find the items they want by using more advanced AI recommendation algorithms, while merchants will be able to target customers more effectively.

Rafael Henrique | SOPA Images | LightRocket via Getty Images

Klarna on Wednesday announced a global partnership with Uber to power payments for the ride-hailing giant’s Uber and Uber Eats apps.

The partnership will see the Swedish financial technology firm added as a payment option in the U.S., Germany and Sweden, Klarna said in a statement.

In those countries, Klarna will roll out its “Pay Now” option in the two apps, which lets customers pay off an order instantly in one click. Users will be able to track all their Uber purchases in the Klarna app.

The company will also offer an additional payment option for Uber users in Sweden and Germany, allowing users to bundle purchases into a single, interest-free payment that gets removed from their monthly salary.

Interestingly, the company isn’t rolling out installment-based “buy now, pay later” plans, arguably Uber’s most popular service offering, on its platforms.

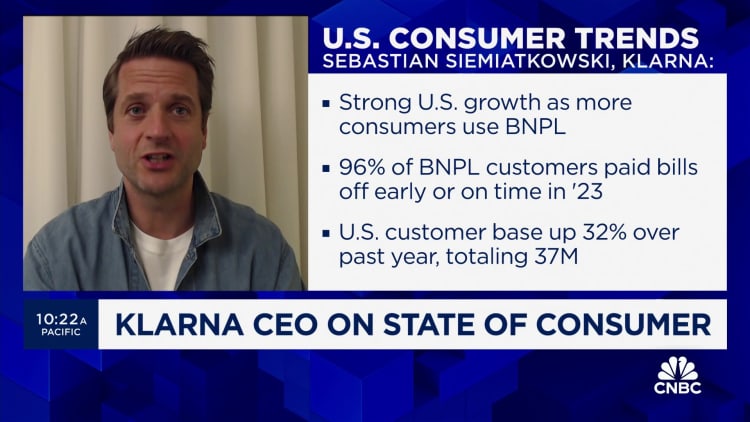

Sebastian Siemiatkowski, CEO and co-founder of Klarna, said in a statement Wednesday that the deal represented a “significant milestone” for the company.

“Consumers can Pay Now quickly and securely in full, which already accounts for over one third of Klarna’s global volumes, and more easily manage their finances in one place,” Siemiatkowski said.

Klarna declined to disclose the financial terms of its deal with Uber.

Big pre-IPO merchant win

The Uber deal marks one of the most significant merchant wins for Klarna as of late and comes as the European fintech giant is rumored to be gearing up for a blockbuster initial public offering that could value the firm at just north of $20 billion.

Klarna began having detailed discussions with investment banks to work on an IPO that could happen as early as the third quarter, Bloomberg News reported in February, citing unnamed sources familiar with the matter.

CNBC could not independently verify the accuracy of the report. Klarna has said that it doesn’t comment on market speculation.

Such a market flotation would mark a turnaround for a company that saw $38.9 billion erased from its valuation in 2022 when deteriorating macroeconomic conditions stoked by Russia’s invasion of Ukraine caused a reset of sky-high tech valuations.

Klarna reached an eye-watering $45.6 billion in a 2021 funding round led by SoftBank, before seeing its market value fall to $6.7 billion the following year in a so-called “down round.”

The firm recently launched a monthly subscription plan in the U.S. to lock in “power users” ahead of its anticipated IPO.

The product is called Klarna Plus and costs $7.99 per month. Klarna Plus enables users to get service fees waived, earn double rewards points and access curated discounts from partners, such as Nike and Instacart.

Last year, Klarna…

Read More: Klarna scores payment deal with Uber ahead of anticipated IPO